This post was updated on June 24, 2019.

Fulfilling the Promise of Weatherford

It is said what CEOs most enjoy is a challenge with outsize reward. If so, Mark McCollum should be ecstatic. As the incoming CEO of Weatherford International, he is tasked with resurrecting one of the more perennially promising, yet frustratingly underachieving, companies in the oil patch.

McCollum’s predecessor, long-time CEO Bernard Duroc-Danner, built an organization with a global presence and broad portfolio. However, the company found itself adrift in recent years as a string of financial losses and shifting strategies undermined employee morale and depleted investor confidence. Continue reading “Fulfilling the Promise of Weatherford”

Integrated Oilfield Suppliers Plot Divergent Paths

As the oil and gas sector stirs with a hopeful sense of purpose, several of its largest and most influential suppliers are pursuing distinctly different strategies. It’s not just about which products and services will propel the industry forward. To some extent, the balance of power between providers and customers is at stake.

On one end of the strategic spectrum sit Schlumberger and GE Oil & Gas. With the help of recent acquisitions, both companies hope to meld oilfield equipment and services into a new seamless network, one capable of generating and interpreting streams of data for use in improving performance across all phases of a well. If successful, the impact could be far-reaching. Continue reading “Integrated Oilfield Suppliers Plot Divergent Paths”

The Grapevine – Weatherford Int’l

Weatherford International recently reported 1st Quarter 2013 earnings after adjustments that were generally in line with consensus estimates. The following day, the company’s stock price rose more than seven percent. Investors seemed relieved that no additional shoes dropped in the earnings release or conference call. The fact that such rise in stock price occurred on a report of no unexpected bad news says a lot about how Weatherford is currently viewed in the investor community.

Below are our thoughts on what we’ve read and heard from Weatherford recently, both positive and negative, as well as some updated data regarding the company’s customer satisfaction ratings and what they suggest for its new strategic tact: Continue reading “The Grapevine – Weatherford Int’l”

Sizing Up GE + Lufkin Industries – Part 2

Part 1 of this article discussed background issues at play for the companies in GE Oil & Gas‘ purchase of Lufkin Industries, including the uncharacteristic decline in Lufkin’s customer satisfaction ratings in 2011 and early 2012. It also took a look at the strategic rationale behind the deal.

This second part focuses on what the GE-Lufkin combination prospectively means for customers, with particular attention paid to the perceived cultural fit between the two companies. Continue reading “Sizing Up GE + Lufkin Industries – Part 2”

Sizing Up GE + Lufkin Industries – Part 1

Despite its relatively small size and narrow focus, Lufkin Industries‘ products are iconic within the petroleum industry. Glance at virtually any photo of a West Texas oilfield, and you’ll likely see at least one gracefully oscillating Lufkin pump jack. The oilfield’s a pretty practical place, but there’s always been something sublime about that particular image.

With its announcement earlier this week that it will purchase Lufkin Industries for $3.3 billion — a rich 38% premium over the previous trading-day’s closing price — GE Oil & Gas obviously sees something inspiring in the shot as well. The industrial giant clearly believes there are strong secular growth prospects in artificial lift applications. Continue reading “Sizing Up GE + Lufkin Industries – Part 1”

Availability & Delivery Help Drive Satisfaction in Artificial Lift

Advances in the E&P space coming fast these days. And industry suppliers that fail to stand equipped and fleet-of-foot run the risk of falling behind.

Results from EnergyPoint Research’s latest customer satisfaction survey indicate that product availability and efficient delivery are ways suppliers of artificial lift equipment might distinguish themselves going forward. Quality control, engineering and other factors will certainly continue to matter to customers, but so will actually having the desired equipment at the time it’s needed. Continue reading “Availability & Delivery Help Drive Satisfaction in Artificial Lift”

Opportunities Stack Up, As Fracs Back Up

One would think E&P companies would be cheering. Nominal hydraulic fracturing capacity looks on pace to rise 25 percent or more this year. And advances in technology promise to bolster both the potency and cleanliness of the increasingly relied-upon service.

Yet, against the backdrop of capacity growth and technological advances, suppliers of frac services are earning relatively low marks in EnergyPoint customer satisfaction surveys. In fact, as demand for frac services increases, the less content customers seem—especially compared to other completion-related services. This is certainly the case for perennial segment leader Halliburton (although the company’s ratings still continue to lead those of its major peers). It appears the case for Schlumberger and Baker Hughes as well. Continue reading “Opportunities Stack Up, As Fracs Back Up”

The Other Drilling Guys

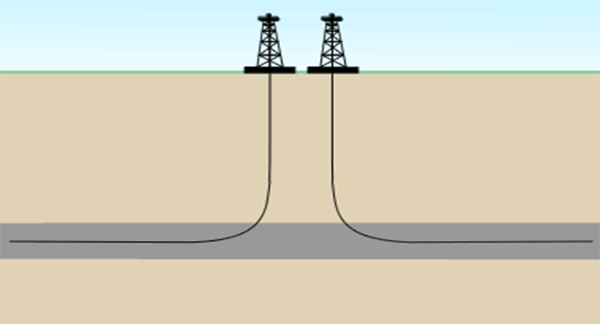

The increasing complexity of today’s drilling process places considerable attention on the role of drilling contractors. However, there are drilling-related services not traditionally provided by drillers that play an equally important role in determining the quality and profitability of a well.

For the purposes of EnergyPoint’s independent surveys, these other services fall into five segments: drilling fluids, fishing, cementing, directional drilling and measurement-while-drilling (MWD). Generally speaking, survey results suggest customers have high regard for the drilling-related services they provide. In fact, the category’s customer satisfaction scores have outperformed EnergyPoint’s broader index of oilfield products and services since 2004. Continue reading “The Other Drilling Guys”

Getting More of What’s Down There

No doubt the ability to maximize well potential is crucial to the oil and gas industry’s future. Companies must complete wells damage-free and seek new ways to enhance them in order to stand apart. Continued progress in well-completions is vital to the industry’s ability to develop its reserves.

This post examines the state of customer satisfaction across various completion-related products and services in our surveys. And generally speaking, survey respondents are pleased. In fact, the data show the category’s ratings have outperformed since 2006. Continue reading “Getting More of What’s Down There”