One would think E&P companies would be cheering. Nominal hydraulic fracturing capacity looks on pace to rise 25 percent or more this year. And advances in technology promise to bolster both the potency and cleanliness of the increasingly relied-upon service.

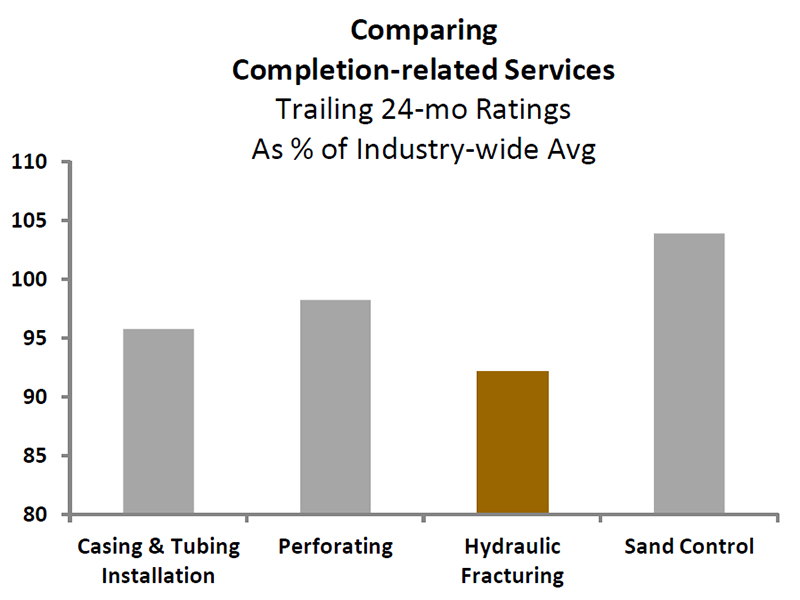

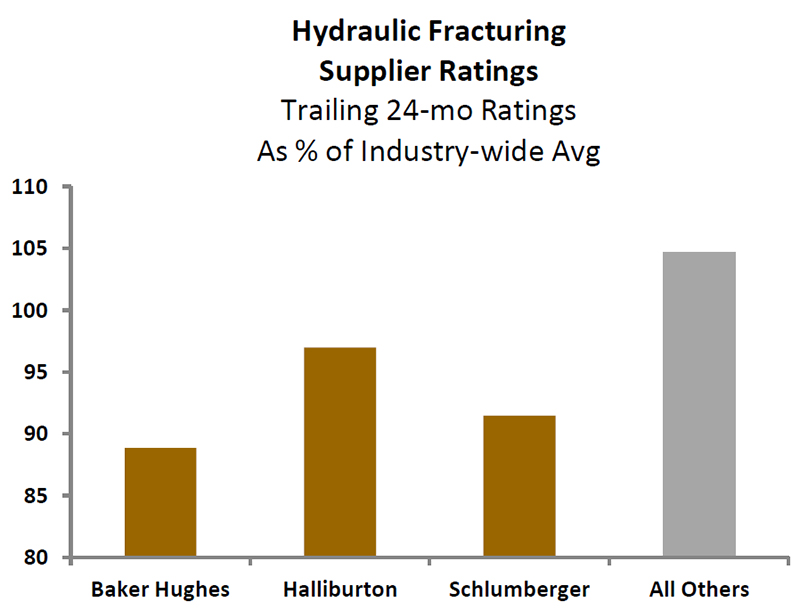

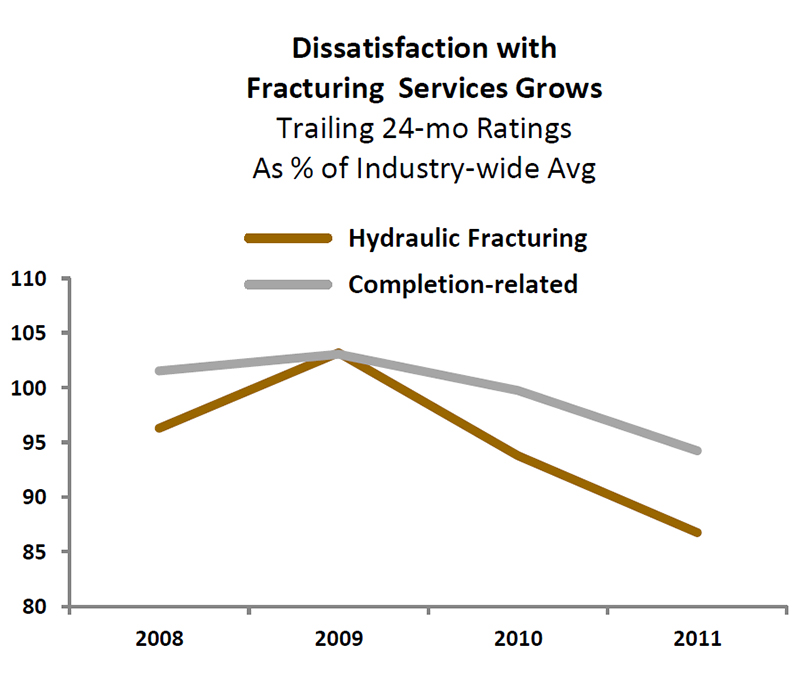

Yet, against the backdrop of capacity growth and technological advances, suppliers of frac services are earning relatively low marks in EnergyPoint customer satisfaction surveys. In fact, as demand for frac services increases, the less content customers seem—especially compared to other completion-related services. This is certainly the case for perennial segment leader Halliburton (although the company’s ratings still continue to lead those of its major peers). It appears the case for Schlumberger and Baker Hughes as well.

To be fair, hydraulic fracturing is not as perfunctory a procedure as the hullabaloo surrounding the Shale Revolution would suggest. It takes the right people, materials and equipment—all of which are in short enough supply that oilfield providers have been heavily backlogged.

To get ahead of the game in the current environmental and political climate, suppliers have invested heavily in new fracturing technology and equipment. This adds to costs at a time when many domestic customers are already nervous about low natural gas prices. The ramification? In the highly frac-intensive North American land market, the industry’s “Big Three” have seen customer satisfaction ratings fall over the last 24 months.

Clearly, market leaders in the space are working hard to differentiate their services. Centralization of crews and resources, packaging of proppant technologies, use of proprietary materials to redirect hydrocarbons around proppants, and deeper blasts into rock formations are all part of today’s next-generation approach to the high-profile service. However, even with all the “super fracking” going on, domestic customers still seem relatively disenchanted with supplier performance.

Internationally, Baker Hughes and Halliburton fare better with customers, but Schlumberger lags in multiple regions. Halliburton, which holds the largest share of the U.S. market, announced in its recent earnings conference call plans to hold 2012 capacity additions steady with 2011 levels—even as Schlumberger and Baker Hughes seek to step up domestic capacity and extend their footprints internationally.

The shortage in frac capacity has also encouraged some integrated providers to require bundled purchases from customers in exchange for the right to access their in-demand frac crews. Previous EnergyPoint analyses suggests this only serves to rankle customers further.

The capacity-strapped situation has left room for independent suppliers like FTS International (formerly Frac Tech), Trican and Weatherford to wedge their way deeper into unconventional shales. In fact, if past levels are any indication, oilfield customers may be happy to know that just under half of domestic frac activity remains with smaller firms.

Though limited, customer evaluations EnergyPoint has collected related to smaller providers suggests the door remains open for these second-tier players given the group’s relatively healthy satisfaction scores and past market acceptance.

Note – For a guide to EnergyPoint’s ratings and trends categories, click here.