The father of modern scientific method, Sir Francis Bacon, believed consistency to be “the foundation of virtue.” Dramatist and poet Oscar Wilde, on the other hand, saw consistency as the “last refuge of the unimaginative.”

While we do not wish in any way to diminish Wilde’s esteemed position in literary circles, we do suppose it’s a good thing he made his living with a pen and not with the drill bit. Why? Because this much we know: consistency matters in the oil and gas industry. In fact, it matters a lot.

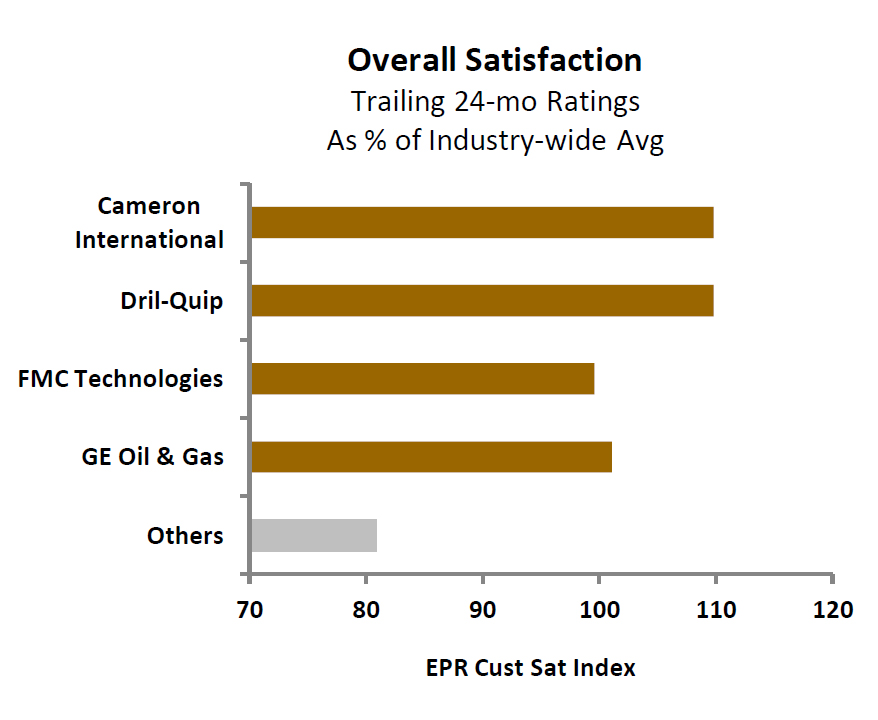

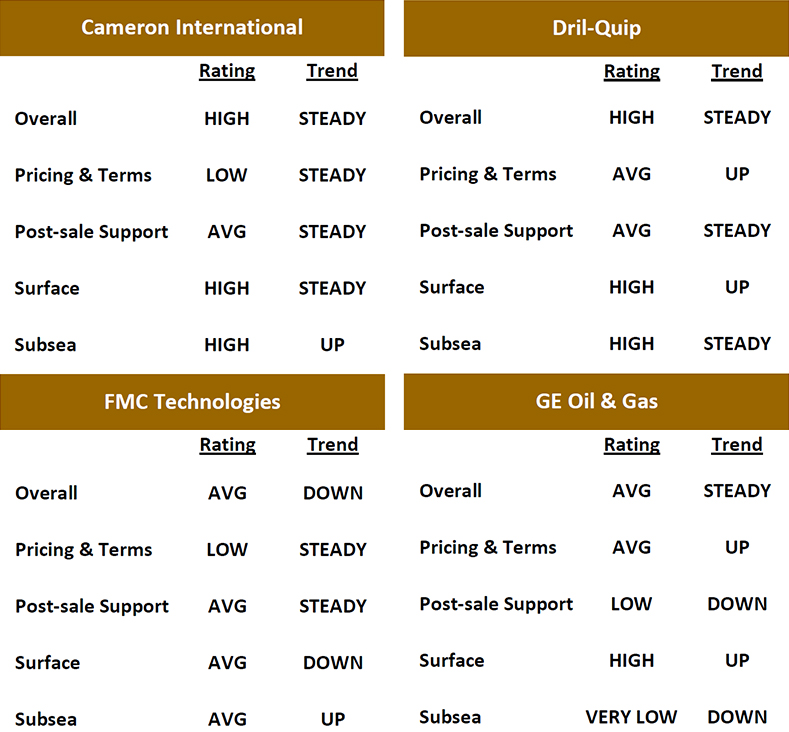

Oilfield equipment suppliers possessing Bacon’s most favorite of traits tend to fare well with customers in EnergyPoint Research’s independent customer satisfaction surveys. This is certainly the case when it comes to Dril-Quip and Cameron International, both of which our surveys suggest are long-held darlings in the market place—at least when it comes to their wellheads and trees.

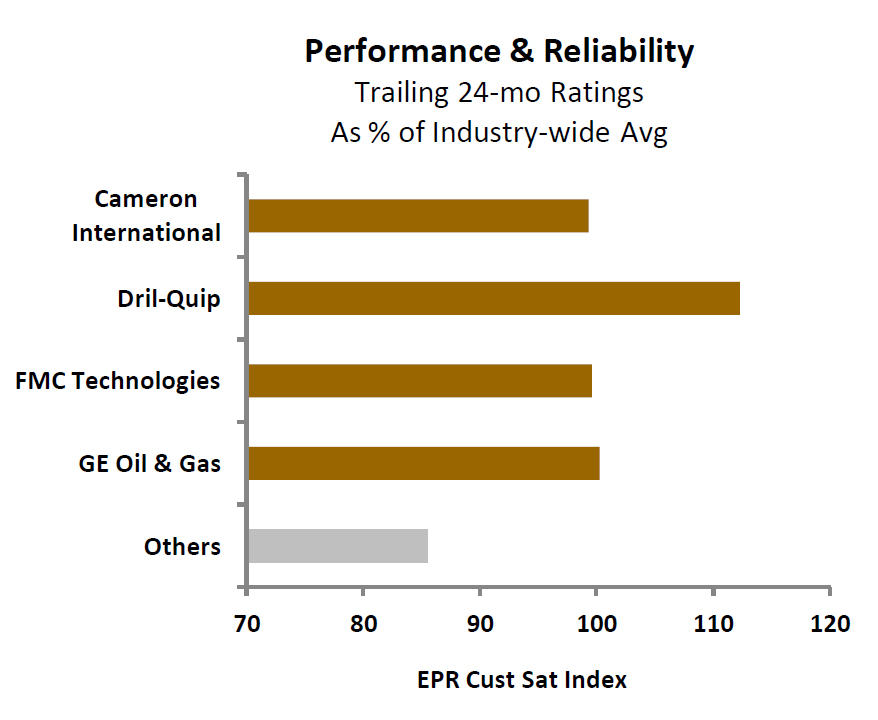

Not only do the data show the two companies as outpacing industry heavyweights FMC Technologies and GE Oil & Gas in terms of overall satisfaction in the segment, but both also tend to upstage the competition in many of the key attributes that drive such satisfaction. Moreover, this has been the case for the last few years. Granted, it is true that Dril-Quip enjoys somewhat higher marks from customers for its pricing and contract terms, but it’s the performance and reliability of its heavy iron that stands out most with survey respondents. Post-sale support, on the other hand, is one area in which all major suppliers within the segment could stand some improvement.

Granted, it is true that Dril-Quip enjoys somewhat higher marks from customers for its pricing and contract terms, but it’s the performance and reliability of its heavy iron that stands out most with survey respondents. Post-sale support, on the other hand, is one area in which all major suppliers within the segment could stand some improvement. Buoyed by the rise in offshore drilling activity, subsea installations of wellheads and trees continue to grow in importance for both suppliers and customers. Not surprisingly, most major subsea equipment suppliers have pointed to various respective contract wins as evidence of their capabilities and dexterity down below.

Buoyed by the rise in offshore drilling activity, subsea installations of wellheads and trees continue to grow in importance for both suppliers and customers. Not surprisingly, most major subsea equipment suppliers have pointed to various respective contract wins as evidence of their capabilities and dexterity down below.

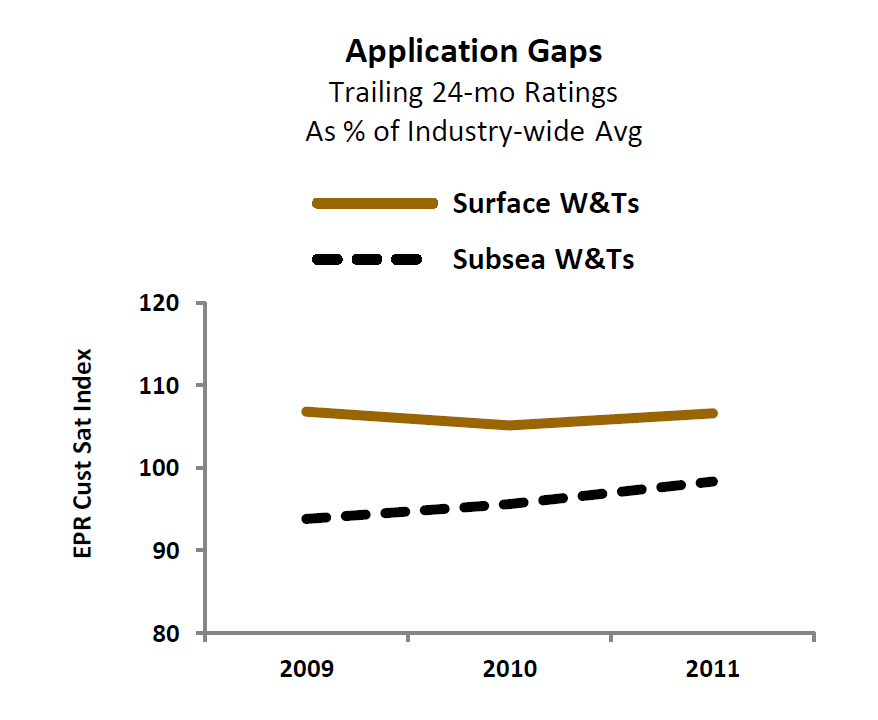

However, as we have noted in past reports, on a comparative basis, customer satisfaction scores for subsea wellheads and trees materially trail those of similar surface-based equipment. Recent entrant GE Oil & Gas in particular has struggled with lower satisfaction levels for subsea applications, including its line of wellhead and trees acquired from Vetco Gray.

We acknowledge that subsea and surface-based applications are arguably related more in name than function given the different environments in which they must perform. Nonetheless, the gap between the two is conspicuous. Suppliers in the subsea segment will almost certainly need to further improve product performance and reliability. Otherwise, they run the risk of losing the confidence of customers, some of whom face an increasingly crowded set of investment opportunities and regulatory pressures.

Suppliers in the subsea segment will almost certainly need to further improve product performance and reliability. Otherwise, they run the risk of losing the confidence of customers, some of whom face an increasingly crowded set of investment opportunities and regulatory pressures.

Unlike for subsea applications, ratings for surface-based wellheads and trees have remained more buoyant. Strong ratings for GE Oil & Gas—in part reflecting scores for the highly regarded Wood Group pressure control unit the company purchased last year—are certainly contributing factors. Still, it’s Cameron that continues to enjoy the segment’s most enviable combination of customer satisfaction and ratings consistency for surface-based wellheads and related equipment.

Note – For a guide to EnergyPoint’s ratings and trends categories, click here.