Advances in the E&P space coming fast these days. And industry suppliers that fail to stand equipped and fleet-of-foot run the risk of falling behind.

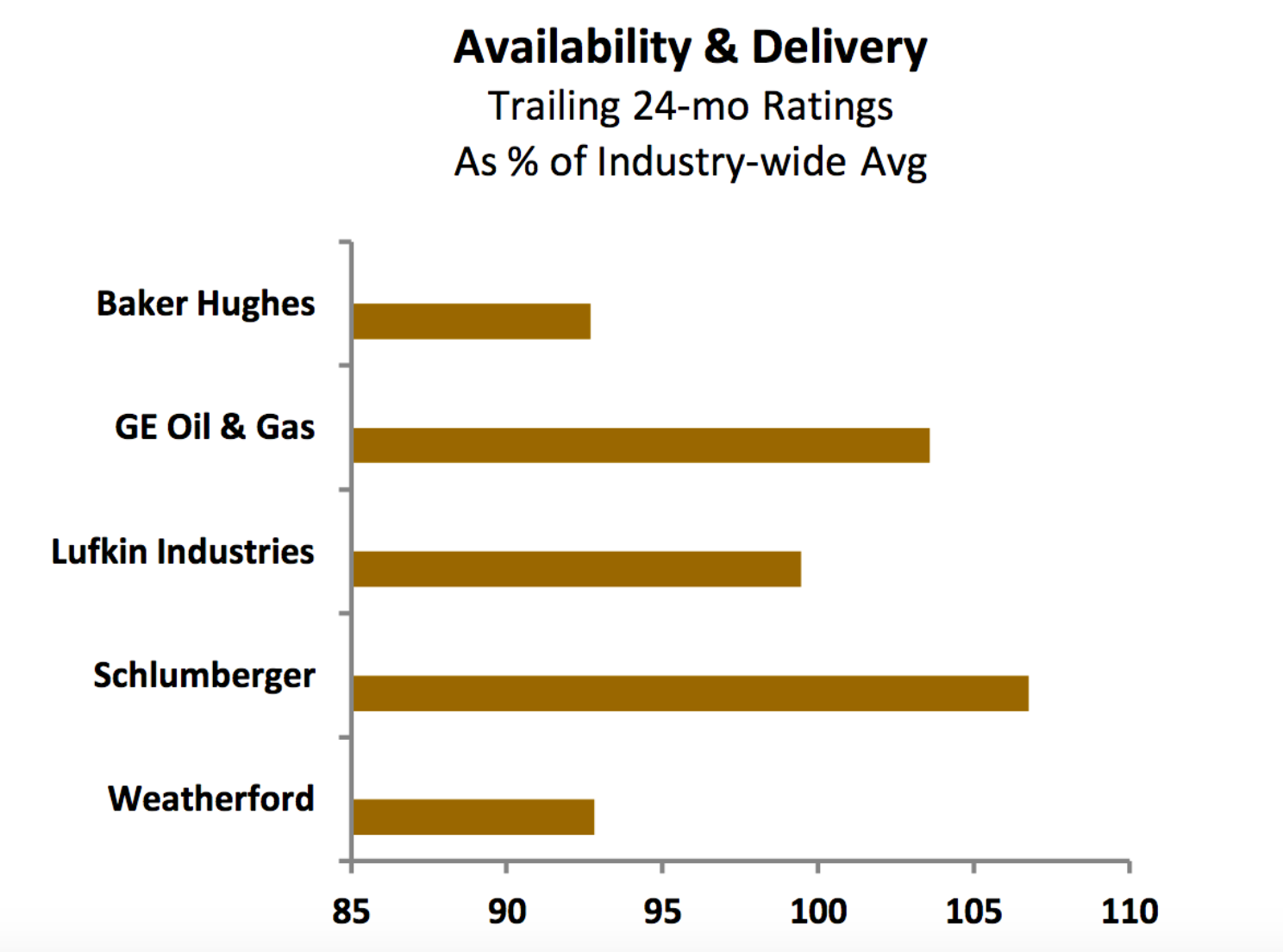

Results from EnergyPoint Research’s latest customer satisfaction survey indicate that product availability and efficient delivery are ways suppliers of artificial lift equipment might distinguish themselves going forward. Quality control, engineering and other factors will certainly continue to matter to customers, but so will actually having the desired equipment at the time it’s needed.

With over a million oil and gas wells currently producing across the globe, it is understandable that today’s customers want to know that suppliers have the resources—and willingness—to meet their needs as demand both grows and shifts. As a result, flexibility and responsiveness will continue to be of prime importance.

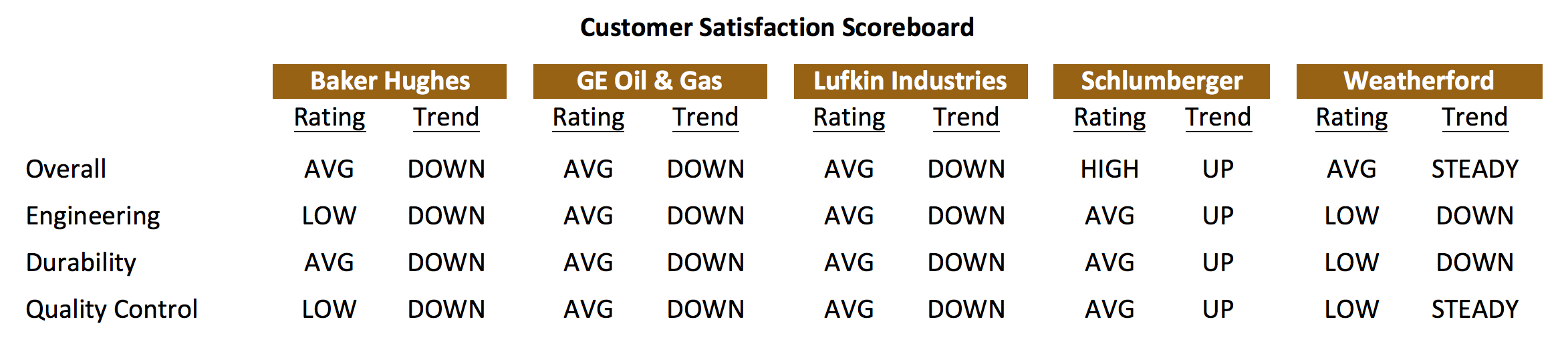

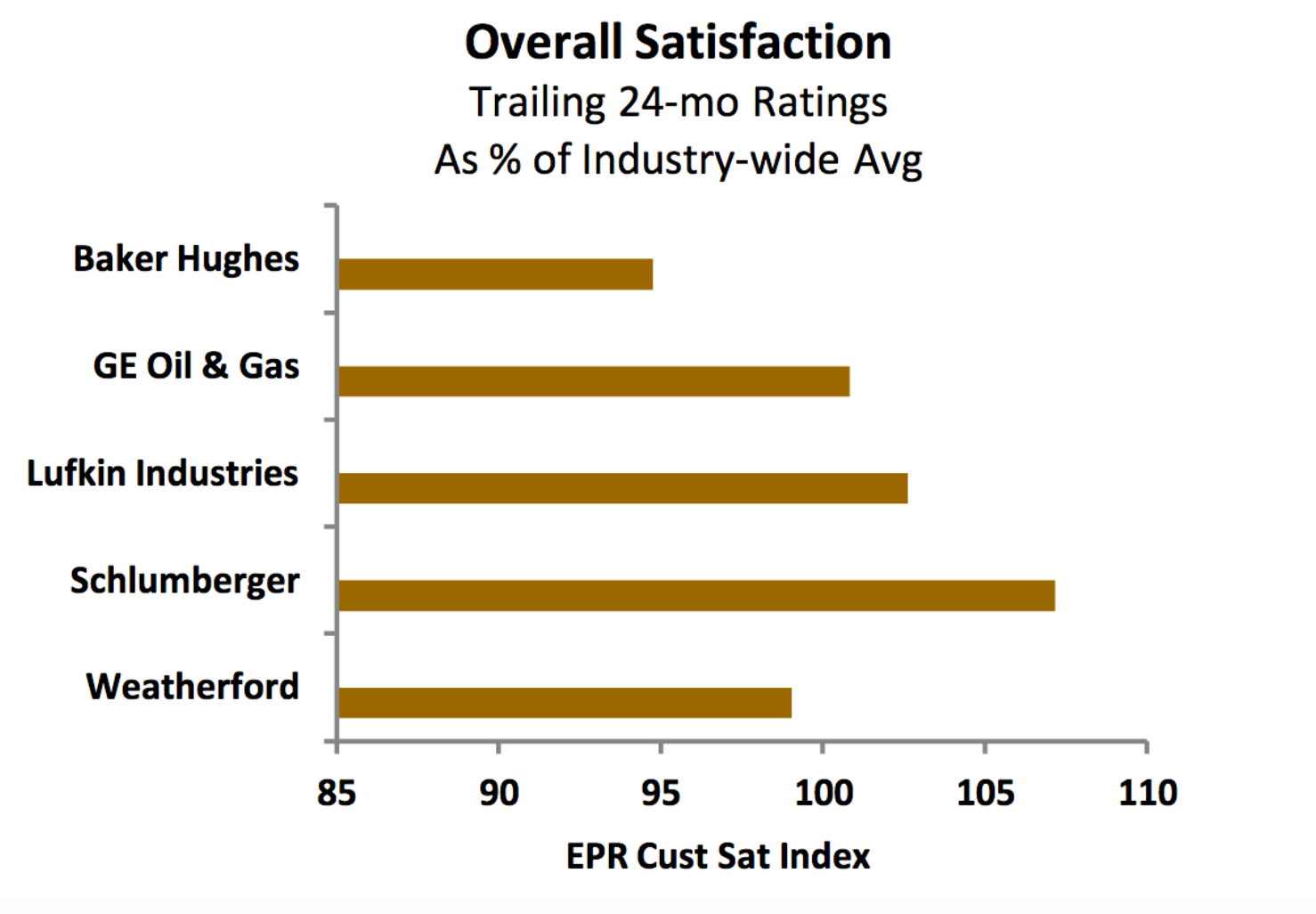

We believe availability and delivery of capacity and equipment are contributing factors as to why Schlumberger, despite average ratings in other areas, currently leads the pack in terms of satisfaction among suppliers of artificial lift equipment.

Followers of our ratings know Schlumberger’s current high ratings in the artificial lift segment run counter to past results. Yet Schlumberger has clearly caught the attention of respondents (in a good way), even as competitors’ ratings have dropped.

Despite Big Blue’s curve-busting performance, artificial lift suppliers as a whole do not appear to have greatly exceeded customers’ expectations over the last 24 months. Many have incurred supply-chain challenges over the period as they and their customers grappled with production increases, especially in crude-related applications.

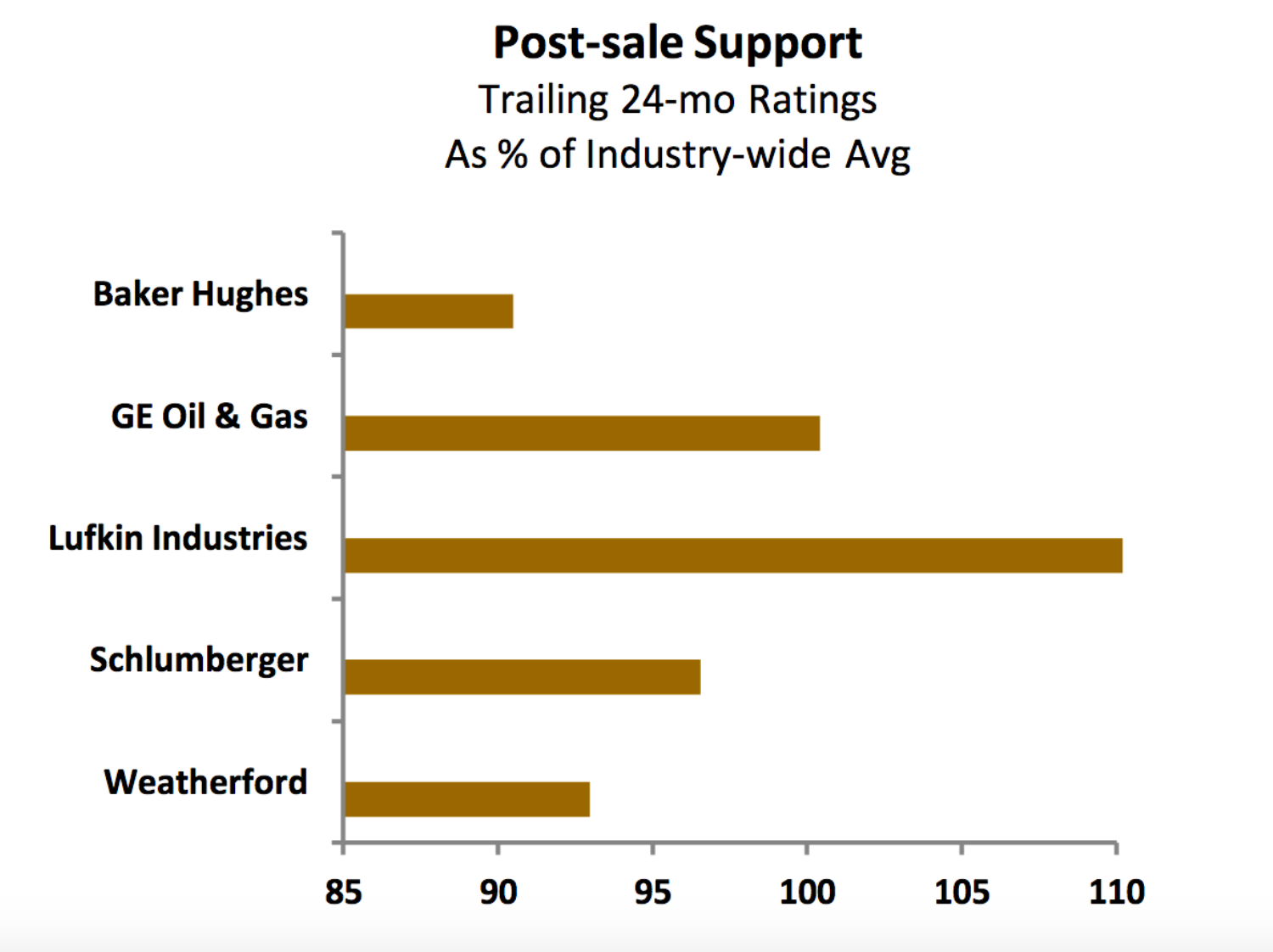

Of course, oftentimes leads to backlog—a circumstance that holds contrasting connotations for provider and supplier. Lufkin Industries, Baker Hughes, GE Oil & Gas (which owns Wood Group ESP) and Weatherford International currently enjoy hundreds of millions in future bookings for artificial lift equipment. Ergo, customers will endure increased lag times between their orders and deliveries. This may help explain the dip in artificial lift suppliers’ ratings.

We note that the two suppliers with the lowest ratings for availability and delivery—Weatherford and Baker Hughes—also posted low marks in engineering and quality control. This is likely more than coincidence, since high levels of backlog can lead suppliers to rush product out the door.

Lufkin is the most focused play in artificial lift, while Weatherford claims hefty market share. Both currently report significant backlogs. However, by outpacing competitors in after-sale support, Lufkin arguably sits in a more enviable position for the long-term. GE Oil & Gas’ ratings also fared well, although they too appear to lag in getting resources to the field.

The outlook for artificial lift tends to follow that of the oil and gas industry at large. So, it should be an adventurous game. Still, as customer satisfaction is usually a precursor to customer loyalty, current tepid scores for the segment suggest customers might be looking around.

Moreover, the space appears to have attracted new entrants, as both Cameron and Halliburton recently announced acquisitions. This casts them as emerging competitors in a race that looks to favor the stacked and swift.