If there’s one truth that data from EnergyPoint Research’s independent studies reveals, it is that upstream oil and gas customers respond to steady quality and reliable support from suppliers.

Despite these customer entreats, our latest survey suggests many high-profile equipment and material suppliers continue to repeat performance-killing mistakes: design flaws, lack of quality controls, poor commissioning practices, and a disproportionate focus on acquisitions.

These missteps continue to frustrate oilfield customers as much as they did when we conducted our first survey six years ago . All the same, the entry of new sophisticated players offers hope. Take GE Oil & Gas. The company’s focus on quality, along with its management acumen, offers a potential new formula.

It also offers incentive. GE’s actions will, through the forces of competition, cause others like Cameron International, FMC Technologies, National Oilwell Varco (NOV), Aker Solutions to step up their quality—or run the risk of losing market share. To be sure, this kind of interplay among competitors is an interesting dynamic; one worth monitoring.

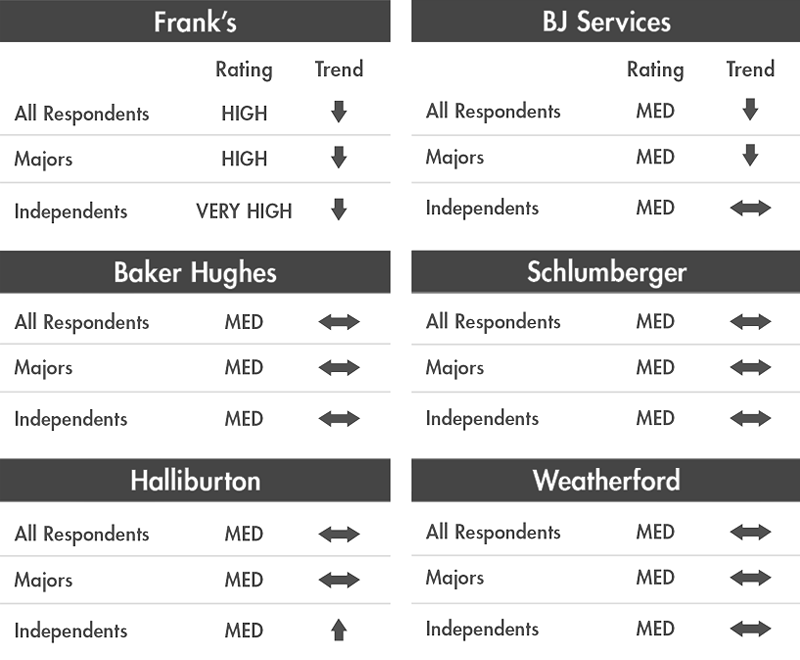

Yet pressure from new entrants is not the only means of improving performance. Incumbent suppliers—some listed in the table below—are already working to find new and better ways of meeting customers’ needs.

So, how to get there? For starts, culture plays a central role. And the more cohesive an organization’s culture, the greater the chance of success. Along these lines, artificial-lift supplier Lufkin Industries sees teamwork as important to its efforts. According to CEO Jay Glick, Lufkin focuses on persons who “…want to be part of a team and who are willing to go beyond the conventional eight-hour workday when needed. Prima donnas will not survive here.”

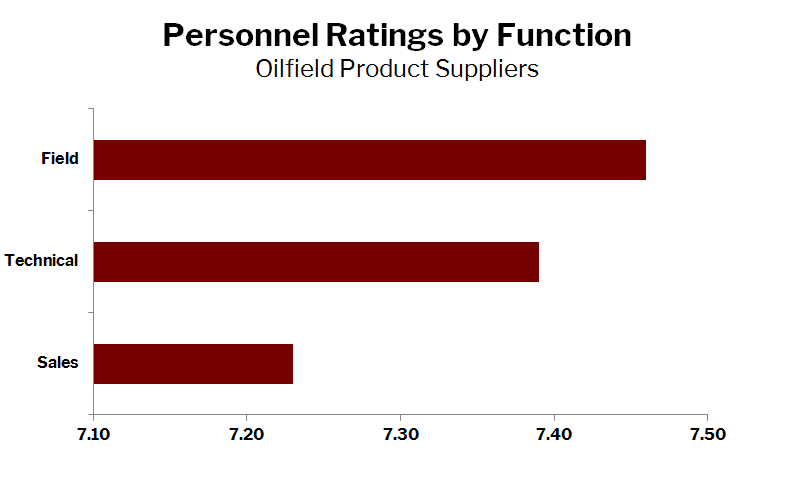

Employee training is also central to success. “In many cases, our customers have lost their in-house knowledge with regards to artificial lift. So we need our personnel to be as knowledgeable about our products and solutions as possible,” notes Glick. “Because we lead with our service, the ability of our employees to listen, learn and communicate is very important.”

Lufkin uses development programs that focus on building skills and immersing employees in the culture of the organization. For this reason, new hires from around the globe can find themselves training for several weeks at a time at the company’s East Texas headquarters during their first year of employment.

Lufkin uses development programs that focus on building skills and immersing employees in the culture of the organization. For this reason, new hires from around the globe can find themselves training for several weeks at a time at the company’s East Texas headquarters during their first year of employment.

Lufkin also emphasizes first-hand learning and fostering relationships with more experienced colleagues. The upshot is new hires to feel comfortable reaching out for assistance when issues arise. This provides Lufkin with an advantage over many oilfield suppliers, whose training can be disjointed, or even ad hoc, in nature.

Focus also matters. Many industry onlookers suggest independent players like Lufkin are ultimately disadvantaged in the market place because they do not offer a larger range of products. But Glick sees it otherwise: “We don’t think there’s really much in the way of economies associated with integrated suppliers locking non-complementary services together in a package-discount scheme. Most customers recognize such packages are designed to maximize suppliers’ overall bottom lines, not the customer’s long-term objectives.”

Glick’s assertions are difficult to dismiss. For one, customers clearly hold concerns over the industry’s shrinking supplier base. Yet, many suppliers are still attracted to mergers and acquisitions as an irresistible tonic—a quick way to grow market share, diversify revenues, gain scale, or enter new markets or segments.

Customers, however, consistently bemoan such transactions, noting product and service quality deterioration, cuts in personnel and investment, and steep price hikes. Client satisfaction and retention also suffer—particularly concerning since independent providers tend do a better job at meeting customers needs.

So, what, then, is the right course of action for suppliers? Evidence suggests it’s vital to have a clear mission—one that includes a focus on both quality and after-sale support. But until suppliers prioritize the tracking and managing of these dimensions as seen through the eyes of customers, most will continue to fall short.