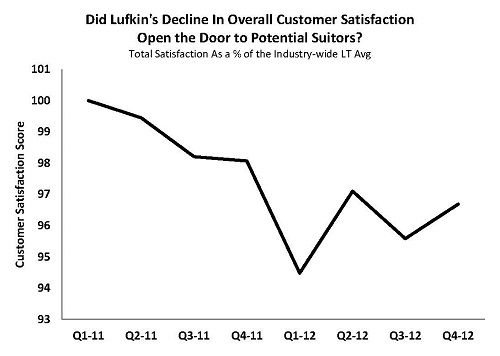

Part 1 of this article discussed background issues at play for the companies in GE Oil & Gas‘ purchase of Lufkin Industries, including the uncharacteristic decline in Lufkin’s customer satisfaction ratings in 2011 and early 2012. It also took a look at the strategic rationale behind the deal.

This second part focuses on what the GE-Lufkin combination prospectively means for customers, with particular attention paid to the perceived cultural fit between the two companies.

As we have written about previously, M&A in the oilfield always has its risks. We believe the biggest risk to the success of the GE-Lufkin merger will be in how Lufkin’s customers respond.

Although a number of factors have contributed to Lufkin’s traditionally strong customer satisfaction and success in the market place, its small-company feel and attention to customer needs and service has driven much of the company’s success over the years. The challenge for GE, with its approach to running its immense spread of businesses, will be in maintaining the Lufkin touch.

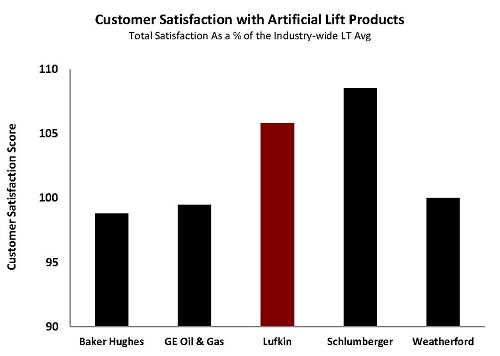

Unfortunately, should customers get the impression Lufkin has moved from being a responsive, nimble specialty supplier to just another division of a lumbering industrial conglomerate, we’d expect some customers to cast an eye toward Lufkin’s competitors. While it’s difficult to say which supplier(s) would gain the most in such a scenario, the short list includes Weatherford and Dover, and to a lesser degree Baker Hughes and Schlumberger. With their recent entry into the space, Halliburton and Cameron International could benefit as well.

Interested in EnergyPoint speaking to your organization?

Click here to find out more.

It will also be interesting to see the extent to which GE seeks to integrate Lufkin with its Wood Group ESP. The two companies certainly know each other as competitors, but there are distinct differences in their product lines and target applications.

Lufkin’s pump/rod-oriented systems lie in a particularly nice sweet spot. Its systems offer relatively low installation and operating costs, excellent total-system efficiencies, high run-times, limited sensitivity to downhole temperatures, and compelling ROIs for low-volume wells. They also are easily monitored and lend themselves to automation. Pump speed can also be adjusted easily over the life of a well, reducing the need for on-site intervention. All of this adds up to strong customer appeal for Lufkin’s flagship product line.

ESPs are generally more effective for wells with higher flow rates and for deeper applications. Unfortunately, ESPs, despite their increased costs, carry a reputation for higher fail rates, both mechanical and electrical, and higher intervention costs. They also require proper sizing on the front end and include the risk of sub-optimal performance in those cases when sizing is off. ESPs, Wood Group’s main offering, therefore fit with a more narrow set of well applications.

Bottom Line

The case for GE moving toward greater integration between Lufkin and Wood Group ESP is straight forward. In combination, their product lines cover a broad swath of what customers might need in the way of artificial lift. By creating an organization in which the two units collaborate rather than compete, GE could capture greater customer mind share. As we see it, the opportunity in a combined GE-Lufkin will not be as much about cross-selling as it will be about offering a greater selection of artificial lift products.

For GE, the culture challenge and risks may be more daunting than the operational. Notwithstanding the decline in the company’s overall customer satisfaction ratings in EnergyPoint’s surveys, ratings for Lufkin’s products remain strong (the decline in its overall customer satisfaction was driven more by availability- and delivery-related issues than product quality.) In short, Lufkin’s traditional customer base clearly values the company’s single-minded focus and expertise.

Should GE move forward with a heavy-handed integration of Lufkin (as, in time, we expect it will,) we believe it runs the risk of disappointing Lufkin’s loyal customer base and hurting customer satisfaction. In this case, the deal’s success will hinge more on growth in artificial lift applications in general, along with the realization of cost savings captured from integration.