Weatherford International recently reported 1st Quarter 2013 earnings after adjustments that were generally in line with consensus estimates. The following day, the company’s stock price rose more than seven percent. Investors seemed relieved that no additional shoes dropped in the earnings release or conference call. The fact that such rise in stock price occurred on a report of no unexpected bad news says a lot about how Weatherford is currently viewed in the investor community.

Below are our thoughts on what we’ve read and heard from Weatherford recently, both positive and negative, as well as some updated data regarding the company’s customer satisfaction ratings and what they suggest for its new strategic tact:

- In a strictly objective sense, Weatherford’s financial results were mediocre. In a more subjective sense, however, they indicate the company is beginning to make constructive changes to its strategy, operations and culture beyond just lip service.

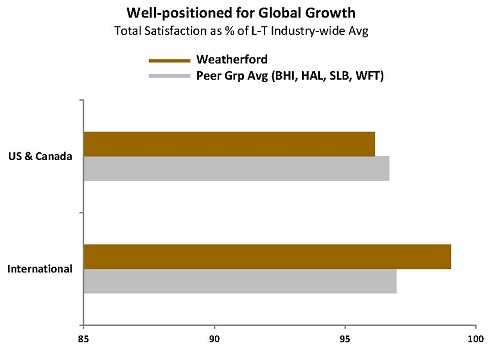

- We were encouraged to hear management endorse and articulate a more focused, returns-oriented strategy centered around what it sees as Weatherford’s core competencies — well construction, artificial lift, and formation and well evaluation. Our customer satisfaction data have long indicated customers are more loyal to suppliers that offer a superior customer experience in a handful of products and/or services (e.g., Helmerich & Payne, Core Lab, Newpark Resources, etc.) as opposed to those juggling offerings so broad they can’t be managed effectively (e.g., legacy Weatherford, Aker Solutions.)

Interested in EnergyPoint speaking to your organization?

Click here to find out more.

- The good news is that the strategy identified by management jibes well with findings from EnergyPoint’s most recent annual customer satisfaction survey, which show Weatherford rated No. 1 in some of the survey’s product and service categories related to its strategic areas of focus. These include sand control, casing and tubing handling equipment, casing installation services, and logging-while-drilling (LWD) services.

- Given GE Oil & Gas’ pending purchase of Lufkin Industries, Weatherford should be poised to add to its already strong market position in artificial lift should GE pursue a more heavy-handed integration that hurts Lufkin’s customer satisfaction.

- We note the presence of Dharmesh Mehta (EVP & Chief Administrative Officer) and John Briscoe (CFO) on the conference call. Mehta, who previously served as the Weatherford’s SVP of Completion & Production Systems, spoke on subjects ranging from back-office process changes to prospects for the company’s high-profile artificial lift segment. For his part, Briscoe spoke with a good level of confidence and detail about the company’s financial results and standing.

- Management dynamics can be harder to read than tea leaves, but we’d guess Mehta’s and Briscoe’s higher profile on the call illustrates a re-distribution of responsibilities — and a hopefully a stronger system of checks and balances — in the executive suite.

- The company has also instituted a set of “capital efficiency” initiatives involving, in part, how it invoices customers and collects its cash. The objective regarding working capital is to reduce receivables DOH to the industry average. Since some customers likely utilize Weatherford for its historically favorable purchase terms, we imagine these efforts will result in some customer churn. However, should operational service and quality remain in tact, Weatherford’s efforts around more accurate and timely invoices will likely be viewed as a step forward by most customers.

- Lastly, we must admit, we are perplexed by management’s claim that the recent quarterly financial report had “no noise.” In fact, the quarter had enough noise to reduce its “adjusted” net income of $117 million down to $22 million on a “non-adjusted” basis. To someone who has followed Weatherford over the years, the dismissive characterization of one-time events of this magnitude is a bit too familiar. But just a bit.