Despite its relatively small size and narrow focus, Lufkin Industries‘ products are iconic within the petroleum industry. Glance at virtually any photo of a West Texas oilfield, and you’ll likely see at least one gracefully oscillating Lufkin pump jack. The oilfield’s a pretty practical place, but there’s always been something sublime about that particular image.

With its announcement earlier this week that it will purchase Lufkin Industries for $3.3 billion — a rich 38% premium over the previous trading-day’s closing price — GE Oil & Gas obviously sees something inspiring in the shot as well. The industrial giant clearly believes there are strong secular growth prospects in artificial lift applications.

Lufkin Industries’ stock, one of the stronger performers in the sector over the last five years, underperformed its broader peer group in 2012. Management’s uncharacteristic stumble in executing expansion plans, combined with an unwelcome slowdown in North America, led to the disappointment in investor ranks.

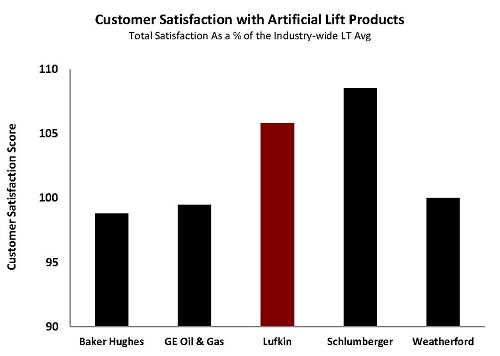

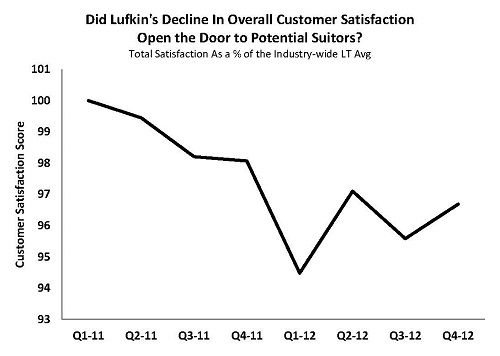

The company also had lost a little of its luster with customers beginning in 2011. This was evidenced by a noticeable decline in EnergyPoint’s ratings for the company, which we reported in our April 2012 report focusing on the artificial lift segment. We noted then that Lufkin’s ratings were not only down in terms of overall satisfaction, they were also down in other areas as well.

To some extent, GE’s bid was aided by an overly ambitious agenda within Lufkin. At the same time the company was acquiring and integrating multiple modest-sized acquisitions, it also was attempting to bring additional capacity online with a new production facility in Romania. Financial results suffered during this period, as did the company’s stock price. Both arguably opened the door to potential suitors.

So, what might be expected from a combined GE- Lufkin?

So, what might be expected from a combined GE- Lufkin?

GE already has a presence in the artificial lift space via its 2011 acquisition of Wood Group’s ESP unit, which manufactures downhole electrical submersible pumps (ESP’s). So, with its purchase of Lufkin, the company essentially closes the loop in its portfolio in the artificial lift space.

Interested in EnergyPoint speaking to your organization?

Click here to find out more.

Although Lufkin has an array of artificial lift offerings — including gas lift, plunger lift, hydraulic lift and progressive cavity pumps — it’s the company’s position in rod-lift systems, which are in high demand for their application in oil shale fields, that likely represents much of the romance for GE.

The shale oil story is just getting underway in North America, and most projections suggest Lufkin still has plenty of room to grow despite the fact that rod-lift systems’ share of all artificial lift sales has increased handsomely in the last few years. GE’s balance sheet and manufacturing know-how should certainly provide increased resources to respond to any outsized demand growth.

Lufkin’s growing portfolio of automation-related products and services also holds potential. In fact, productivity gains from emerging automation technologies and applications across the entire upstream spectrum is a major EnergyPoint theme these days. The company has purchased three automation-related companies within the last couple of years. It is also developing capabilities organically, with plans to roll out new intelligent-well and measurement systems in the near term.

In Part 2 of this report, we take a look at what a GE – Lufkin combination might mean for customers and how the two companies’ cultures might mesh (or not).