As a capable giant in the oilfield, Schlumberger’s tentacles of services, manpower and ingenuity stretch into just about every major facet of exploration and production. Yet from the purview of customer satisfaction, the company can, in certain ways, appear surprisingly unremarkable.

Continue reading “Schlumberger Adjusts Its Aim”New Tests Challenge Schlumberger

As a capable giant in the oilfield, Schlumberger’s tentacles of services, manpower and ingenuity stretch into almost every major facet of exploration and production. Yet, from the purview of overall customer satisfaction, the company can appear more like a straw in a haystack.

To be sure, Schlumberger’s customer satisfaction ratings remain quite strong in the area of formation and well evaluation, a demonstration of strength at its core. In fact, its acoustics-while-drilling and related wireline suite of products and services are considered by some to be must-haves these days. Its scores are also strong in drill bits, drilling fluids, well testing, rotary steerable systems, deep water applications and international markets. Continue reading “New Tests Challenge Schlumberger”

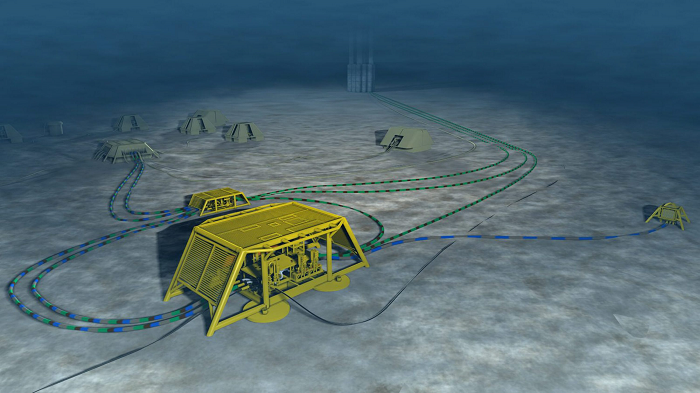

Cameron – Schlumberger JV Shifts Subsea Currents

Cameron and Schlumberger announced this morning the formation of OneSubsea, a 60/40 joint venture partnership that will focus on manufacturing and developing subsea products and services worldwide.

Cameron will contribute its existing subsea division and receive $600 million from Schlumberger. It will also act as operator. For its part, Schlumberger will contribute its Framo, Surveillance, Flow Assurance and Power and Controls businesses. Continue reading “Cameron – Schlumberger JV Shifts Subsea Currents”

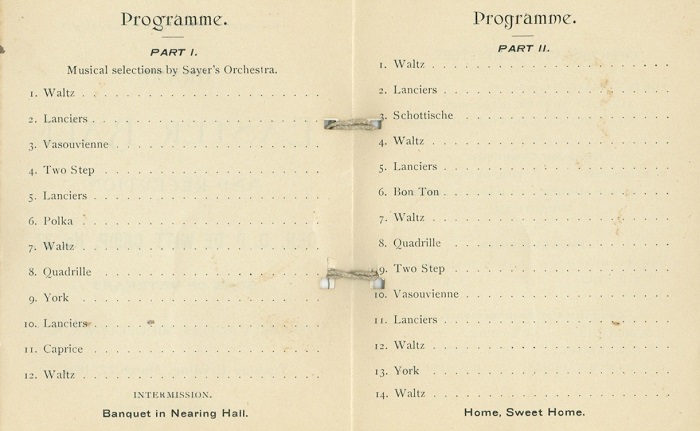

Gardner Denver’s Dance Card to Fill Up Fast

Late last week, Gardner Denver acknowledged it has engaged investment bankers at Goldman Sachs to help evaluate potential strategic alternatives, including sale of the company.

The company’s stock price jumped with the news. However, there’s reason to believe an eventual sale of Gardner Denver could be done at a price materially above current stock-price levels, especially since its shares seem to have been trading at a discount prior to the run-up. Continue reading “Gardner Denver’s Dance Card to Fill Up Fast”

What Does NOV Get in Robbins & Myers?

In retrospect, the recent announcement by National Oilwell Varco that it will acquire Robbins & Myers really shouldn’t come as much of a surprise. The surprise, rather, might be that the deal didn’t come any sooner than it did. Maybe NOV decided it would have been poor form to have moved earlier given that R&M only completed its transformational acquisition of T3 Energy Services a little more than 18 months ago.

Regardless of the factors behind the deal’s timing, NOV picks up in R&M a number of products and services that fit well with NOV’s already expansive set of offerings. But it’s R&M’s BOPs (and related pressure control products and services), along its artificial-lift/tubulars line up, that seem to us at the heart of the deal. Continue reading “What Does NOV Get in Robbins & Myers?”

Suppliers’ Lockstep Strategies Not the Answer

Within the upstream oil and gas industry, there’s a limited number of oilfield suppliers possessing the size and scope to be considered fully integrated and/or global in nature. On the services side, the roll (listed alphabetically) includes Baker Hughes, Halliburton, Schlumberger and Weatherford International. For capital equipment, it’s Aker Solutions, Cameron International, FMC Technologies, GE Oil & Gas and National Oilwell Varco.

On a combined basis, these nine super suppliers (did we just coin a new term?) currently represent about a quarter of all supplier-segment sales to the global upstream. Yet, none of these companies currently enjoy above-average ratings in EnergyPoint Research’s independent customer satisfaction surveys. And the latest trends don’t suggest the situation will significantly change anytime soon.

Continue reading “Suppliers’ Lockstep Strategies Not the Answer”

Availability & Delivery Help Drive Satisfaction in Artificial Lift

Advances in the E&P space coming fast these days. And industry suppliers that fail to stand equipped and fleet-of-foot run the risk of falling behind.

Results from EnergyPoint Research’s latest customer satisfaction survey indicate that product availability and efficient delivery are ways suppliers of artificial lift equipment might distinguish themselves going forward. Quality control, engineering and other factors will certainly continue to matter to customers, but so will actually having the desired equipment at the time it’s needed. Continue reading “Availability & Delivery Help Drive Satisfaction in Artificial Lift”

Wellheads & Trees: Consistency a Virtue, Reliability a Requirement

The father of modern scientific method, Sir Francis Bacon, believed consistency to be “the foundation of virtue.” Dramatist and poet Oscar Wilde, on the other hand, saw consistency as the “last refuge of the unimaginative.”

While we do not wish in any way to diminish Wilde’s esteemed position in literary circles, we do suppose it’s a good thing he made his living with a pen and not with the drill bit. Why? Because this much we know: consistency matters in the oil and gas industry. In fact, it matters a lot. Continue reading “Wellheads & Trees: Consistency a Virtue, Reliability a Requirement”

A Sea of Discontent

The wisdom of the masses is a concept that contends information gathered from a group is generally more reliable than information gathered from any single individual within that group. If so, what is the industry saying en masse about the products used to develop offshore wells—particularly those at greater depths—in light of the Deepwater Horizon incident?

In short, EnergyPoint’s data suggest customers are significantly less satisfied with the equipment and materials available for subsea and deepwater projects than for land- and surface-based applications. In fact, since 2005, subsea products received the lowest overall customer ratings of all product segments tracked in our surveys. Continue reading “A Sea of Discontent”

The Rig Equipment Blues

To limit downtime, the equipment on rigs receives close attention. However, EnergyPoint Research surveys show many equipment providers are missing the mark. There’s room to improve in post-sale support, availability and delivery, and pricing. Without improvements, the status quo will only entice new entrants.