As a capable giant in the oilfield, Schlumberger’s tentacles of services, manpower and ingenuity stretch into just about every major facet of exploration and production. Yet from the purview of customer satisfaction, the company can, in certain ways, appear surprisingly unremarkable.

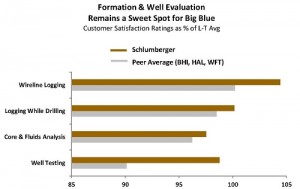

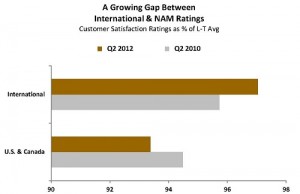

Schlumberger’s customer satisfaction ratings remain strong in the area of formation and well evaluation, a demonstration of strength at its core. Its acoustics-while-drilling and related wireline suite of products and services make some operators’ must-have list these days. It also scores well in drill bits, drilling fluids, well testing, rotary steerable systems, deepwater applications and international markets.

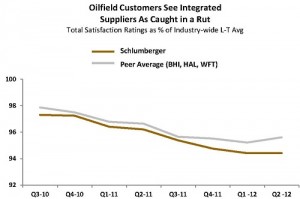

But in other important ways, the company appears more also-ran than conquering champion. In fact, its customer satisfaction ratings have ebbed in numerous dimensions in EnergyPoint Research surveys over the last 24 months. But why?

Schlumberger’s diversity of skills and capabilities arguably protects the oilfield supplier from downturns in certain markets or industry segments. The recent reduction of rigs in North America following a buildup that began in 2011 is a good example. However, that same diversity may also be the most difficult part of steering the ship.

Over the years, Schlumberger has earned its position and reputation within the industry by leveraging its ever-growing skill set of services and technologies.But as broad as its capabilities may seem, it can’t realistically expect to lead in every segment of the oil and gas industry. As a group, integrated oilfield service providers — Schlumberger, Halliburton, Baker Hughes and Weatherford — lag farther behind certain less well-heeled oilfield suppliers, even as the sector stabilizes in this post-economic downturn, post-Macondo world.

OneSubsea, the company’s JV with Cameron International announced in November, may reflect a recognition within Schlumberger that certain specialty jobs are for the specialists. By combining Schlumberger’s expertise in subsea processing and platform integration with Cameron’s position in subsea flow and pressure control, the JV seems an intelligent way for Schlumberger to compete both more effectively and efficiently in the space.

We also note an interesting development in the company’s approach to working with its customers. Paal Kibsgaard, Schlumberger’s CEO, mentioned recently that the company has been successful with smaller producers by taking a fresh approach to its value-add proposition.

For example, its SPARK* technology delivery platform allows certain customers the flexibility to apply Schlumberger’s technology using their own pressure pumping crews and equipment. The capital-efficient tact allows Schlumberger to share its expertise and technology with smaller customers without big-footing their projects. In effect, the larger company gains advantage by imitating the niche firm.

Bottom Line

It’s our opinion, Schlumberger is looking for ways to boost its return on capital employed, a metric the company has targeted successfully in the past. To the extent the strategy leads to ideas and innovations that seek greater capital and operating efficiencies (and higher levels of customer satisfaction), we believe the company ends up a more focused and potent competitor.