The wisdom of the masses is a concept that contends information gathered from a group is generally more reliable than information gathered from any single individual within that group. If so, what is the industry saying en masse about the products used to develop offshore wells—particularly those at greater depths—in light of the Deepwater Horizon incident?

In short, EnergyPoint’s data suggest customers are significantly less satisfied with the equipment and materials available for subsea and deepwater projects than for land- and surface-based applications. In fact, since 2005, subsea products received the lowest overall customer ratings of all product segments tracked in our surveys.

Going forward, as the industry seeks to avoid future catastrophes, a more thorough appreciation of what drives these lower scores might prove helpful. So, let’s take a look.

First, to a large degree, customer satisfaction is a matter of meeting expectations. Unfortunately, customer evaluations suggest subsea suppliers and their products have fallen short almost across the board compared to their surface-based counterparts. The shortfall is most acute in the areas of in-house quality control, post-sale support, and product availability and delivery.

One frustrated survey respondent summed things up as a “lack of adequately trained personnel, long delivery times for even routine spares, arrogant responses to technical inquiries, and exorbitant cost[s]…”

Customers’ dissatisfaction is exacerbated by the rapid growth of the sector over the last several years. Too many suppliers have spread their organizations thin as they attempt to service a larger number of projects globally. At the same time, they’ve pushed their organizations to develop ever-more sophisticated and expanded offerings.

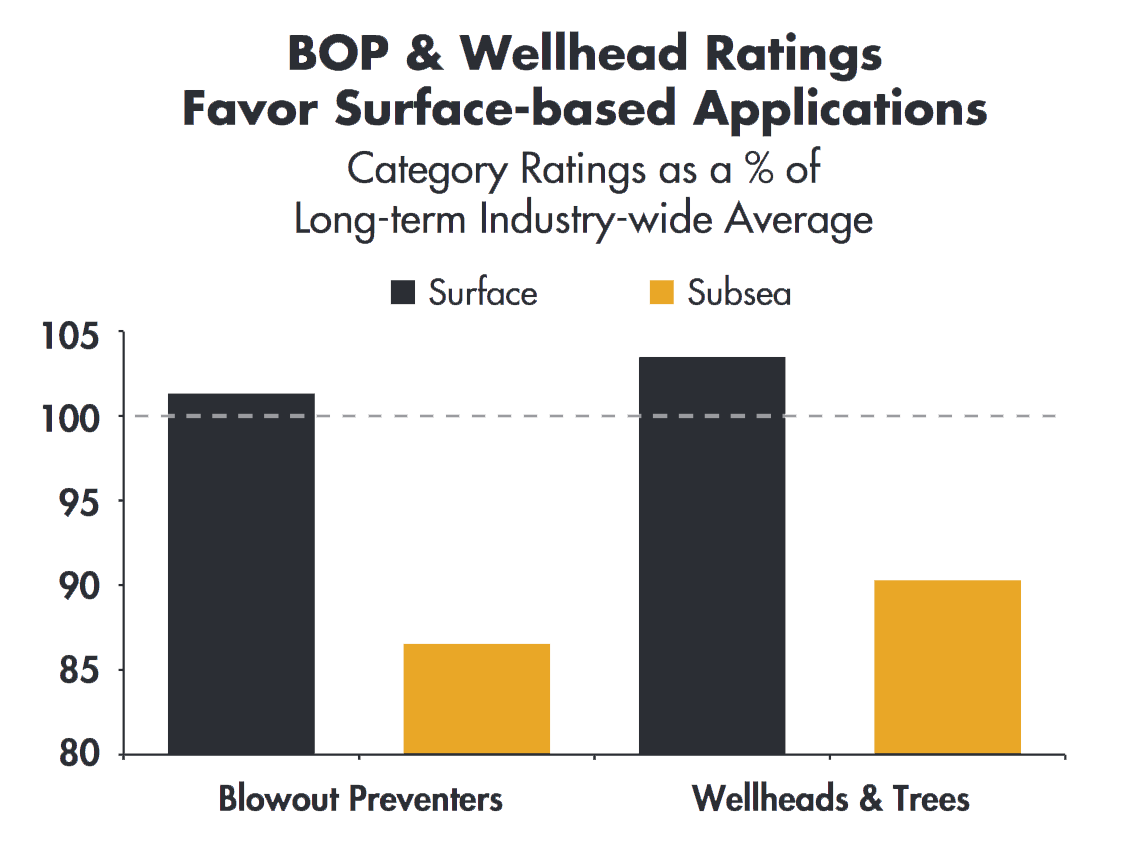

So where are the problems? The data indicate customers view subsea BOPs, risers and flexible joints, and wellheads and trees as particularly lacking. This is followed by umbilicals, controls, manifolds and flowlines.

On the other hand, remotely operated vehicles (ROVs), the robotic submarines responsible for taming the Macondo well, enjoy the highest long-term ratings of any subsea category. That’s right, the industry holds the equipment used to deal with problems on the seafloor in higher regard than the products used to prevent such troubles in the first place.

When it comes to suppliers, ROV manufacturer Oceaneering and Dril-Quip, are the only two suppliers with subsea ratings that exceed the segment average. Below are ratings leaders by category.