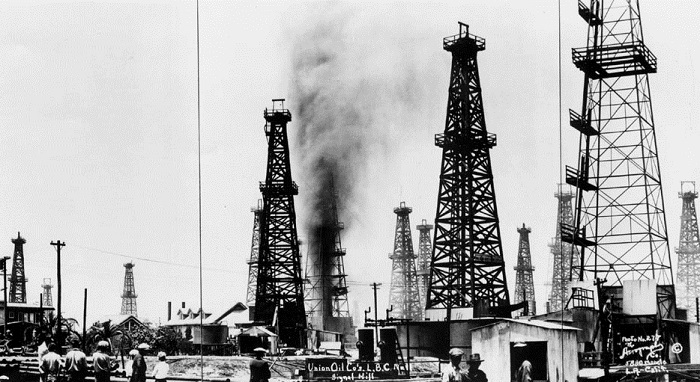

If the devil lies in the details when it comes to Halliburton making its acquisition of Baker Hughes work for stakeholders, so might the opportunity.

We’ve pointed out in the past the convergence of performance as seen by customers among the industry’s largest suppliers. We see elements of this same effect in the latest customer satisfaction scores for Halliburton, Baker Hughes and Schlumberger. With the exception of Schlumberger’s marks in engineering and technology, there’s generally little difference in the three companies’ ratings across several key performance and organizational attributes. Continue reading “Halliburton & Baker Hughes: The Devil’s in the Details”