In May of last year, we published an article discussing certain constructive developments we saw underway at Nabors Industries. The relatively sanguine tone of the report, which was met with a certain degree of skepticism by some readers, reflected our analysis of changes in both the executive suite and in the company’s stated strategy and plan for execution.

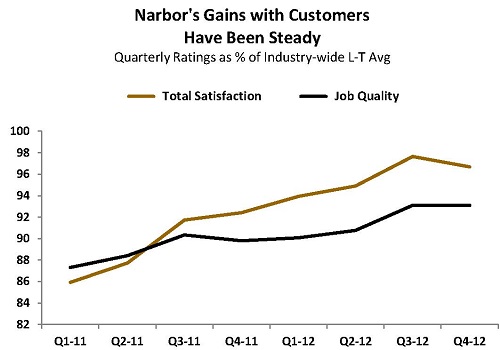

After reviewing the company’s fourth quarter 2012 earnings report, listening to the associated conference call, and examining updated customer satisfaction results, we continue to see Nabors as making strides. Granted, progress has been slower than expected. But EnergyPoint’s customer satisfaction ratings suggest both change and improvement are the overall trend at the company.

Below are what we view as some of the key takeaways from the company’s recent earnings release and conference call:

- Progress continues in splitting the company’s operations into two separate units: Drilling & Rig Services and Completion & Production Services. Management’s emphasis in the second half of 2012 was on “right-sizing” the C&P segment as pressure pumping demand fell sharply. The realignment could position the company to eventually spin off or sell the C&P unit should it desire. In the meantime, operational focus and effectiveness should improve as both customers and employees respond to greater delineation between segments.

- The company added 25 newbuild drilling rigs to its domestic fleet under long-term take-or-pay contracts in 2012. Its new Pace-X rig, designed to offer the mobility/flexibility of a walking/pad-capable rig combined with the efficiency of an AC power system, is central to its newbuild program. The company signed contracts for nine new Pace-X rigs in the fourth quarter of 2012, and is slated to deploy about twice this number of the rigs in 2013.

- The company retired a total of 43 land rigs and five offshore rigs during the quarter. As a result, 55% of the company’s domestic drilling fleet now consists of new-generation AC rigs, up from virtually none in 2005. Less-capable and lower-demand mechanical rigs have fallen from 55% of the fleet to approximately 10%. Both trends support the contention that, at least on paper, the quality of Nabors’ active drilling-rig fleet continues to improve.

- As of the close of 2012, the company had 122 rigs operating internationally. This compares to 168 rigs domestically. Overall, international operations continue to build more slowly than expected. According to management, the slow progress has resulted from tender processes that can take as long as 12 months to get rigs in place once an operator identifies a need. We note that we believe in the long-term prospects for global shale activity and that early entrance and experience in international markets could lead to first-mover advantages down the road.

- Management continues to pursue the disposition of various non-core assets. Our sense is that the sale of its remaining oil and gas properties will occur by year end, with proceeds used to further reduce long-term debt. We’re less clear on the timing of other asset sales, including its Gulf of Mexico jackup with barges, various Canadian and Alaskan well-servicing units, etc.

- By its own admission, Nabors has missed some past opportunities in North America as a result of less-than-optimal management of its capital allocation process and balance sheet. Its new CEO now seems intent on avoiding a repeat of these mistakes. Accordingly, outstanding debt is now lower by $700 million from its peak in early 2012. An additional reduction of $400 million, before asset sales, is expected in 2013.

Interested in EnergyPoint speaking to your organization?

Click here to find out more.

Below are our thoughts and observations on what we’re hearing from the company and the market place:

- As a general rule, we view a strong balance sheet as a foundation for operational excellence in the oilfield. It affords contractors greater flexibility and means to invest in equipment, training, people and facilities across the cycle. Nabors management’s contention that lower leverage could open up other “strategic options”, which we read as M&A, therefore gives us pause. We would view any stepped-up M&A activity at this point as a step backwards, and disruptive to management’s efforts to, as it says, “reduce the noise” in the business.

- Nabors’ ability to regain lost market share in the domestic land-drilling market will require more consistent performance for customers. Our data indicate the company’s best rigs and crews are up to the task. However, in the past, the company (along with many of its peers) has also been reputed to deploy rigs and crews whose capabilities were seen as sub-par. The retirement of older equipment and the general downsizing of its fleet suggests Nabors is now better positioned, and management is more fully committed, to providing a higher-quality experience across its flagship domestic drilling operations.

- In order to fully realize its potential, Nabors will need to create a culture and organization enduring in its ability to continually improve. While we believe management is committed to streamlining costs and divesting of what it sees as its non-core operations, the question still remains as to what it views as the company’s core competency going forward. Absent sufficient clarity regarding this question, the improvements currently materializing at the company, while real, will likely boost performance by only so much.

Bottom Line

The next twelve months will be important for Nabors as they will go a long way in determining the longer-term direction of the company. In addition, they will help set customers’ and other stakeholders’ perceptions regarding the company’s ability to transform itself into a more purposeful and effective competitor.