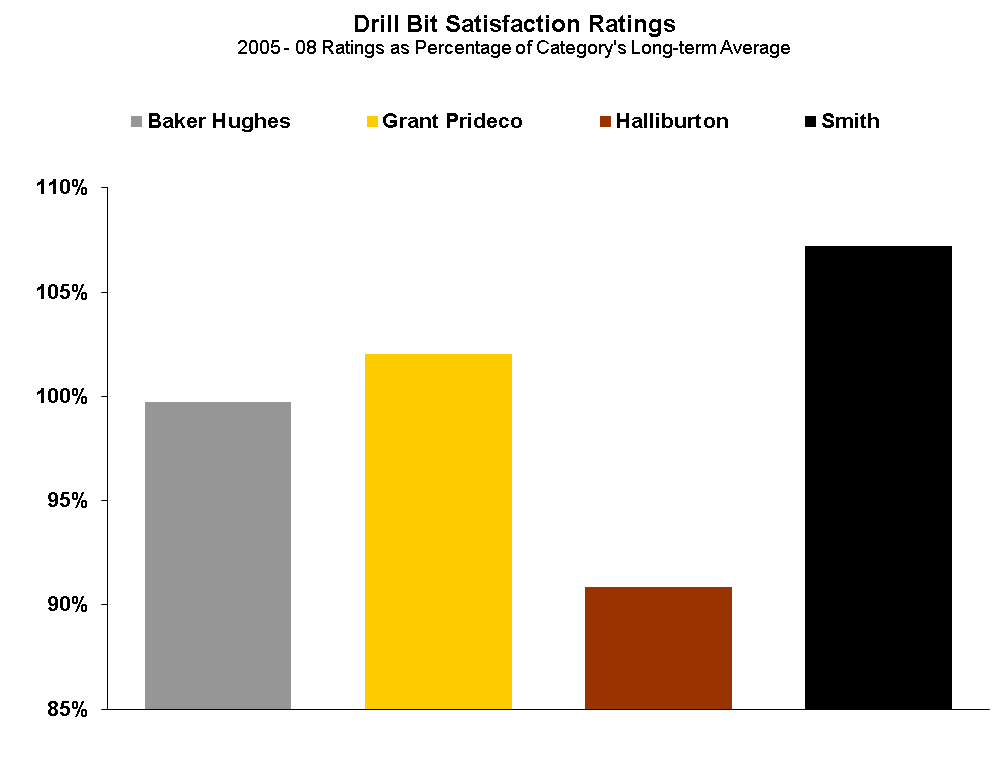

Within the upstream oil and gas industry, there’s a limited number of oilfield suppliers possessing the size and scope to be considered fully integrated and/or global in nature. On the services side, the roll (listed alphabetically) includes Baker Hughes, Halliburton, Schlumberger and Weatherford International. For capital equipment, it’s Aker Solutions, Cameron International, FMC Technologies, GE Oil & Gas and National Oilwell Varco.

On a combined basis, these nine super suppliers (did we just coin a new term?) currently represent about a quarter of all supplier-segment sales to the global upstream. Yet, none of these companies currently enjoy above-average ratings in EnergyPoint Research’s independent customer satisfaction surveys. And the latest trends don’t suggest the situation will significantly change anytime soon.

Continue reading “Suppliers’ Lockstep Strategies Not the Answer”