As the oil and gas sector stirs with a hopeful sense of purpose, several of its largest and most influential suppliers are pursuing distinctly different strategies. It’s not just about which products and services will propel the industry forward. To some extent, the balance of power between providers and customers is at stake.

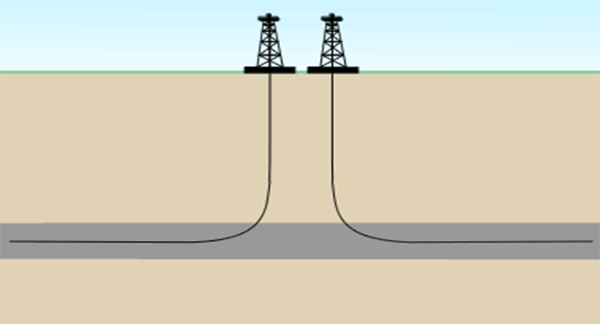

On one end of the strategic spectrum sit Schlumberger and GE Oil & Gas. With the help of recent acquisitions, both companies hope to meld oilfield equipment and services into a new seamless network, one capable of generating and interpreting streams of data for use in improving performance across all phases of a well. If successful, the impact could be far-reaching. Continue reading “Integrated Oilfield Suppliers Plot Divergent Paths”