By some estimates, national oil companies (NOCs) control an estimated 90% of the world’s proven petroleum reserves. One need look no further than Statoil’s recent announcement to purchase Norsk Hydro’s offshore oil and gas assets, Royal Dutch Shell’s sale of interest in the Sakhalin II project to Gazprom, or the creeping nationalization in Latin America to understand that state-controlled oil and gas companies are poised to grow in size and influence in coming years.

In the past, NOCs sought established international oil companies (IOCs) like ExxonMobil, Chevron, BP, ConocoPhillips and Shell to develop their reserves. Under these arrangements, the IOCs typically handled much of the selection and management of oilfield vendors on behalf of their NOC partners. However, NOCs now appear to be asserting themselves in the process to a greater degree .

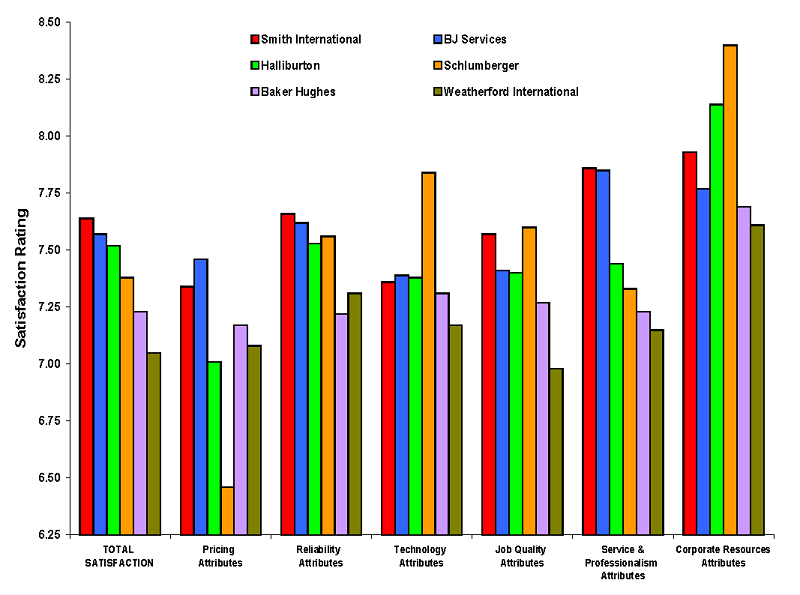

Few will be more impacted by the developing influence of NOCs than the industry’s “Big Six” oilfield suppliers—Schlumberger, Halliburton, Baker Hughes, Weatherford, BJ Services and Smith International. Hundreds of evaluations in EnergyPoint’s 2006 survey were by respondents at NOCs. Of these, almost 70% were of one of these vendors.

In reviewing these evaluations, we examined how each of the Big Six is currently rated by NOC respondents. Below is a summary of our findings, listed in order of each company’s total satisfaction rank:

Smith International: Ranked 1st

Followers of EnergyPoint’s ratings know Smith historically rates very well with our survey participants. The same holds true for its ratings from respondents at NOCs. The company ranked first in total satisfaction, reliability, price-for-value, and service and professionalism. It rated second in job quality, and third in corporate resources. Smith fared particularly well with NOCs in the Asia Pacific. The only potential chink in Smith’s armor is technology, where Smith finished toward the middle of the pack—and well behind group leader Schlumberger.

Smith’s NOC evaluation count was also the lowest of the six providers. This is in part due to the fact that two of Smith’s largest business lines—drill bits and drilling fluids (Smith-operated M-I SWACO)—are covered in EnergyPoint’s products survey (due out in mid-2007). The current survey mostly rates Smith’s downhole tool-retrieval and hole-remediation (i.e., “fishing”) services.

BJ Services: Ranked 2nd

In many respects, BJ Services’ position and potential with NOCs might be the envy of the group. The company was evaluated—and, thus, likely viewed as a key vendor—by a number of leading NOCs, despite lacking the size and scope of its larger competitors. BJ ranked well across virtually every satisfaction attribute, except corporate resources. NOCs rated BJ’s cementing services, completion services, and workovers and well services first among the Big Six.

If a remedy can be found for BJ’s below-average ratings in its nascent casing and tubing running services group, accompanied by ratings improvements from key NOCs in Middle East and N.Africa, BJ should benefit as much as any supplier from the shift to a more NOC-centric world.

Halliburton: Ranked 3rd

Overall, Halliburton appears to be a contender in terms of NOC satisfaction but not quite a leader. The company rated toward average in many dimensions of satisfaction. One strength appears to be corporate resources, although this category is not shown to be a particularly strong driver of customer satisfaction with NOCs. Respondents also showed enthusiasm for its performance in the categories of cementing and completion services.

Ratings for directional drilling, and workovers and well servicing, were slightly less encouraging. Geographically, its ratings were respectable—and in some cases quite strong. Halliburton also had the highest number of evaluations from respondents at NOCs of any vendor in the survey. This, at least anecdotally, suggests high penetration with NOCs.

Schlumberger: Ranked 4th

As with most other customer types in our survey, respondents from NOCs appreciate Schlumberger’s industry leadership. The company rated first in all three of the survey’s technology-related sub-attributes: i) responsiveness to requests for new technologies, ii) the ability to develop value-creating technologies, and iii) the ability to apply both in-house and third-party technologies. It also rated first in corporate resources, and safety and environmental. Directional drilling, and formation and evaluation, services were standouts.

Yet the company rated 4th among the Big Six in terms of total satisfaction. Why?First, respondents seemingly grate at its culture and “we-know-best” attitude. Part of the problem lies in assertive pricing practices, which pushed its price-for-value ranking to last place. Its completions, and workovers services, ratings were also laggards.

Baker Hughes: Ranked 5th

Baker Hughes’ weak showing with NOCs is one of the more salient findings of our analysis. Its low standing is notable given that the company rated first with NOCs in our, admittedly smaller, survey two years ago. BHI rated last in reliability, fishing, and formation and well evaluation services. It also finished at the bottom in technology, job quality, and service and professionalism. Low ratings in the Middle East and N. Africa likely played a role.

If not for relatively strong ratings by NOCs in other regions of the world—along with respectable ratings in completion services and workovers and well servicing—we might be tempted to suggest the company’s latest reorganization has hurt its performance with customers internationally. We’ll be keeping a close eye on BHI’s performance with all types of customers.

Weatherford International: Ranked 6th

Based on the combination of its relatively low evaluation count and last-placed ranking, Weatherford’s position with NOCs seems the weakest. Only 12.4% of its evaluations in 2006 came from respondents at NOCs. The average for the other five vendors was 17.3%. The company rated last among NOC respondents in total satisfaction, technology, job quality, service and professionalism, corporate capabilities, completion services, and workovers and well servicing.

Past ratings present a similar story, as Weatherford also finished last in total satisfaction with NOCs in 2004. The silver lining? It rated relatively well with NOCs in the Middle East & N. Africa.

Drivers of NOC Satisfaction

Analysis suggests vendors scoring well in the area of service and professionalism have the best chance of satisfying NOCs. Not surprisingly, both Smith and BJ Services stand out in this metric. Within service and professionalism, the sub-attributes of flexibility and responsiveness are the single largest drivers of NOC satisfaction. This is followed by accountability in resolving problems and disputes.

Job quality was also shown to be a strong determinant of NOC customer satisfaction, attributes in which Smith and Schlumberger share in abundance. Job quality’s influence appears primarily driven by the ability to apply lessons learned to demonstrate continual improvement. The quality of pre-job planning and design processes were also influential.