It would not be surprising if last month’s announcement that General Electric will purchase oilfield equipment maker Vetco Gray sent a collective shiver down the spines of Vetco competitors.

For years, competitors watched Vetco more or less tread water under the ownership of ABB. Private-equity bought the company in 2004 and seemed to hold to the traditional private-equity model of limiting investments to initiatives offering the highest returns and quickest payback. We suspect to see changes at the company now that it is in the hands of a longer-term, more growth-oriented owner.

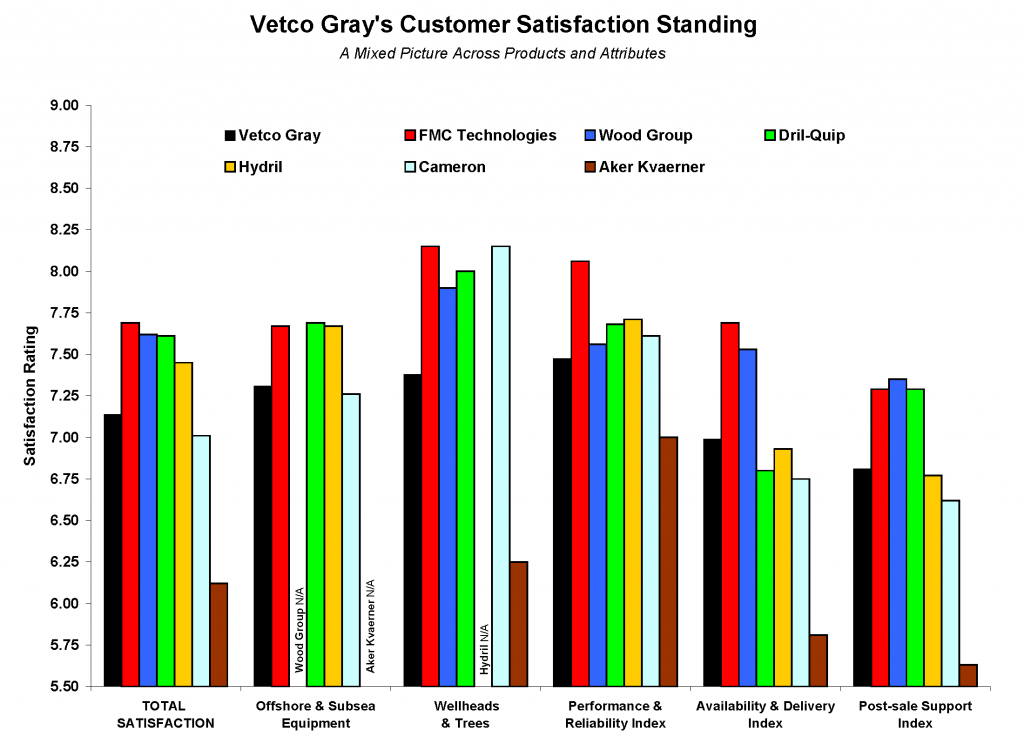

Despite its history, Vetco’s market share remains respectable. However, its customer satisfaction as measured by EnergyPoint surveys is a mixed picture. In 2005, the company ranked in the third quartile in terms of total satisfaction, ahead of Cameron and Aker, but behind FMC, Wood Group, Dril-Quip and Hydril.

In the high-profile category of offshore and subsea, Vetco ranked slightly ahead of Cameron, but below Dril-Quip, FMC and Hydril. Likewise, it trailed Cameron, FMC, Dril-Quip and Wood Group in wellheads and trees, and but above Aker. As we said, it’s a mixed picture that maybe more easily communicated via the charts below.

We foresee Vetco becoming a more effective supplier under GE. We also see GE raising standards on a number of fronts, including customer satisfaction. As a global leader in the manufacturing, sales and servicing of an array of high-profile heavy-industry products, GE brings substantial experience and success to bear on the task of managing and growing businesses like Vetco.

Nor is GE a novice when it comes to the energy industry, having successfully developed and sold products and services to the industry for years. It already offers a relatively well-regarded line of directional drilling-related products to the upstream, while its gas turbines are heavily used in both field and plant applications throughout the industry.

GE gains valuable foundational market share with room to grow in a fragmented space. In our survey, Vetco received 21% of all evaluations in the category of wellheads and trees. This compares to 27% for Cameron, 22% for FMC, 17% for Wood Group, 10% for Dril-Quip, and 6% for Aker. Vetco received 20% of evaluations in the category of offshore and subsea, compared to 18% for Cameron, 12% for Dril-Quip, 9% for FMC, and 7% for Hydril.

GE’s six-sigma program and approach to process improvement should benefit product and service quality. Based on survey results, GE will likely find opportunities for improvement in quality controls and inspection, product delivery and inventory management, and post-sale support.

Vetco’s customer satisfaction in pricing also ranks below most of its competitors. Should GE prove to be more assertive in pricing, it could erode market share. Still, on balance, we see a potential for Vetco’s price-for-value proposition to improve. And that, of course, would be good news for customers.