Listening to earnings calls of today’s publicly traded oilfield suppliers, it’s easy to come away with the impression that within certain original equipment manufacturers’ post-sale support function has little to do with ensuring customers get the most and best use of the products they purchase. Rather, the function seems more about collecting outsize incremental revenues designed to juice margins.

A number of suppliers openly boast to their investors (but we suspect not to customers) that the increasingly high-tech features embedded in many of today’s oilfield products are good for business expressly because of the future maintenance income attached to the products.

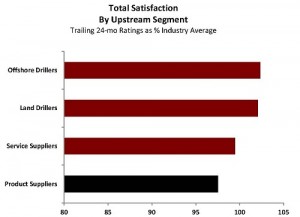

Much less common is the supplier that points to its low after-market revenues as evidence its products are so doggedly rugged and reliable. This might help explain why oilfield product suppliers’ overall satisfaction marks are currently the lowest of the four upstream segments we track.

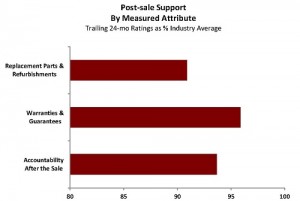

For most capital equipment sold in the oil and gas industry these days, warranties typically run 18 months from delivery or 12 months from in-service date, whichever comes first. Beyond this abridged period, customers looking to control costs generally have the option to service mechanical equipment themselves or use a third party.

Options are more limited, however, when it comes to more sophisticated and technologically oriented products, such as those incorporating proprietary micro chips or software. Some purchasers do apply risk-adjusted or cost-of-ownership approaches to their vendor-selection processes in efforts to cope. Yet there’s still a desire among many for longer-term and more robust warranties. We smell competitive advantage for oilfield suppliers that might accommodate.

Understandably, customers always expect a degree of service after the sale. Dissatisfaction arises when suppliers fail to acknowledge that expectation or fulfill the obligation.

Understandably, customers always expect a degree of service after the sale. Dissatisfaction arises when suppliers fail to acknowledge that expectation or fulfill the obligation.

One area of particular consternation is the availability, cost and quality of replacement parts and refurbishments. The attribute currently rates lowest of the three we measure as part of our post-sale support customer satisfaction index. Oilfield suppliers without standalone parts and service organizations, including dedicated inventory and personnel, seem particularly prone to disappoint.

On the design side, problems arise when products have too many mission-critical components that, should they fail, can compromise a customer’s ability to complete their objective on time. Buyers also tend to cast a skeptical eye toward equipment whose primary attribute is that it’s “high-tech.”

Customers do acknowledge the promise of certain emerging technologies, however. For example, sensors that alert operators and suppliers in real time of excessive wear and tear, or impending failure, of a part or entire piece of equipment seem particularly promising, especially for remote locations with longer delivery times.

Interested in EnergyPoint speaking to your organization?

Click here to find out more.

Bottom Line

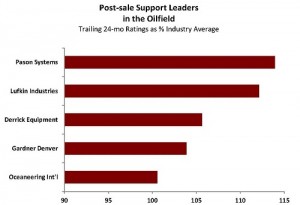

Something’s askew if the objective of any function within a company is more about engendering customer dependency than customer satisfaction. The former seeks to effectively force customer retention by limiting buyers’ future options; the latter seeks to earn customer loyalty over time through superior performance.

As the oil and gas industry moves toward a more advanced and networked existence, the need for adjustments to the current model of aftermarket support seems apparent. Clearly, oilfield suppliers deserve to be paid for the value and capabilities they bring to the table. But customers also deserve good-faith assurances of the lasting quality and integrity of the products they purchase.

As a financial professional for public companies, EPR’s comments in “Off Target” are spot on. It is very difficult, and frankly uncomfortable for public companies to discuss customer weaknesses in an open forum, when satisfied customers are what should drive happy investors.

If companies and their managements would view customer satisfaction deficits more as opportunities, rather than simply as liabilities, I believe the sensitivity to the issue in the public realm would lessen.