When EnergyPoint published its first-ever survey results in 2004, Halliburton was in the midst of a high-profile juggling act of sorts. The company was grappling with asbestos-related legal issues inherited via its ill-fated Dresser Industries acquisition, even as its now-jettisoned KBR subsidiary was taking flak—both in the media and in political circles—over a series of inutile U.S. military contracts.

At the time, we weren’t sure if these distractions were contributing to the company’s lackluster oilfield customer satisfaction scores. In retrospect, it appears they were. Halliburton’s ratings improved appreciably once the issues were resolved, as management concentrated on its mainstay energy-services business.

The company smartly swore off major acquisitions, focusing on organic growth. As domestic shale began to take off, Halliburton’s hydraulic fracturing expertise was increasingly in demand. By mid 2009, after managing through the prerupt decline in global rig count in late 2008 and early 2009, customer surveys indicated Halliburton was effectively hitting on all cylinders.

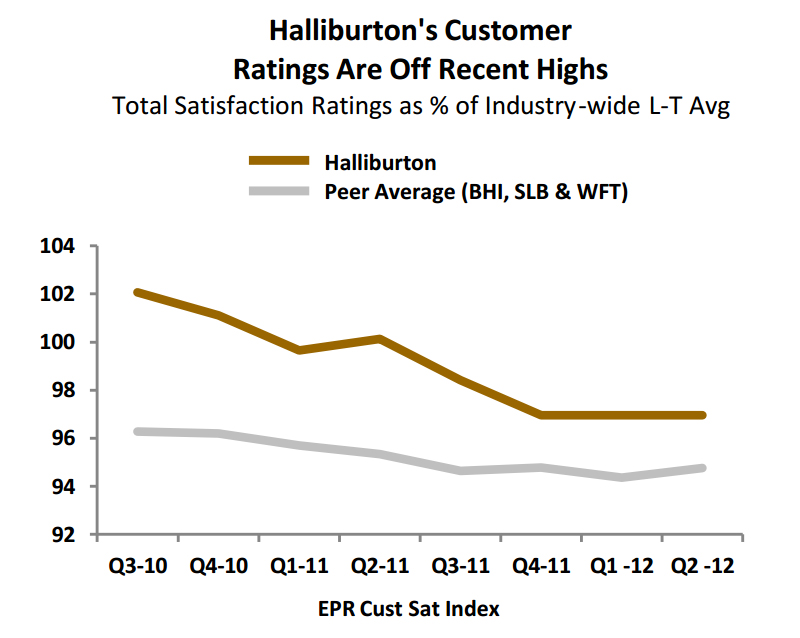

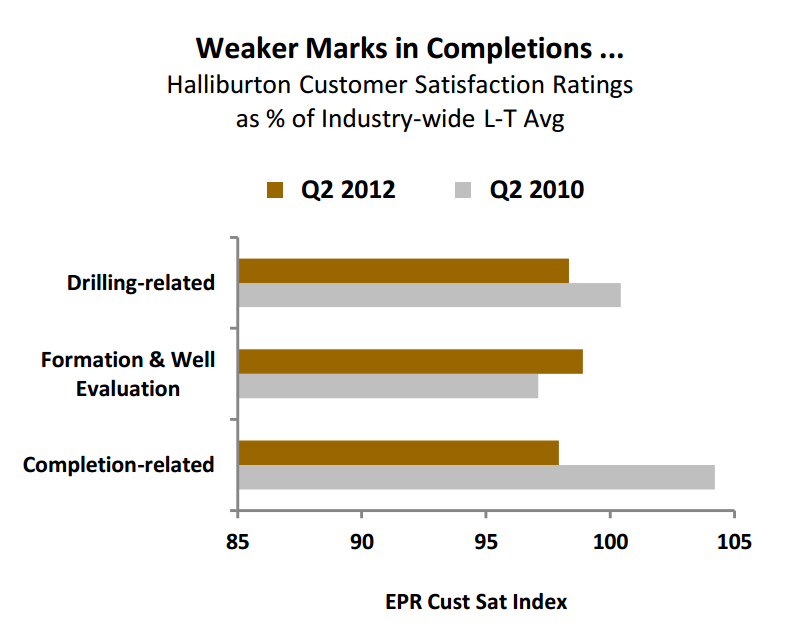

Unfortunately, nothing lasts forever. As both demand and expectations grew, customer satisfaction began to decline in 2010. Everything from equipment wear and tear to soaring prices for guar gum played a part. A trend of more subdued ratings for Halliburton has resulted, including for domestic hydraulic fracturing services and deepwater applications.

As we’ve previously noted, today’s largest oilfield suppliers appear increasingly lookalike in terms of offerings, reach and strategy. But appearance is one thing, performance is another. While our data point to Halliburton having lost some of its ratings vigor over the last 18 months, the company might have an ace up its sleeve with its new Frac of the Future (FOF) initiative.

FOF is an ambitious multi-faceted, multi-year effort to reduce the maintenance costs, downtime, horsepower, physical and environmental footprint, and onsite headcount required for frac jobs. Two of FOF’s major components—Sand Castle proppant storage units and Q10 pumps—are in the early phases of implementation. Initial interviews with customers suggest high levels of interest in the concept. While competitors have introduced twists of their own in the space, none are as joined in their approach or design as FOF. For example, while Schlumberger’s HiWay offering has its devotees, many customers see it as limited in its application. FOF’s appeal lies in its applicability across a larger swath of well types.

While competitors have introduced twists of their own in the space, none are as joined in their approach or design as FOF. For example, while Schlumberger’s HiWay offering has its devotees, many customers see it as limited in its application. FOF’s appeal lies in its applicability across a larger swath of well types.

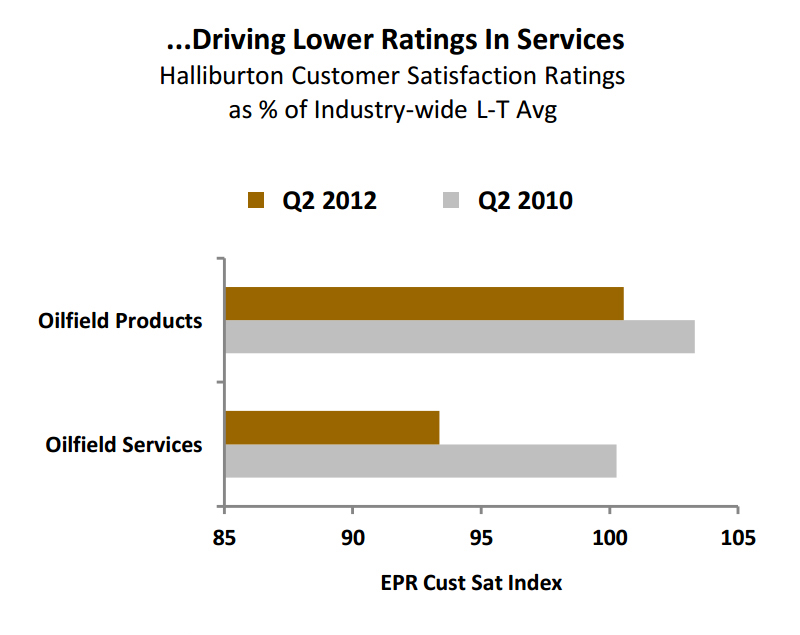

The last couple of years have seen a modest erosion in Halliburton’s ratings in EnergyPoint surveys. The decline has been especially noticeable in the U.S. & Canada, and its oilfield service lines have suffered more than its product lines.  That said, the company’s long-term leadership and recognized reputation in hydraulic fracturing offers plenty of opportunity to regain its standing. If successful, FOF has the potential to effect a paradigm shift in terms of what customers expect from pressure pumping suppliers. We’re certain competitors will be watching—the bigger question is will what they see compel them to emulate.

That said, the company’s long-term leadership and recognized reputation in hydraulic fracturing offers plenty of opportunity to regain its standing. If successful, FOF has the potential to effect a paradigm shift in terms of what customers expect from pressure pumping suppliers. We’re certain competitors will be watching—the bigger question is will what they see compel them to emulate.