Transitions are hard, especially big ones. They’re even more challenging when they take a company from a well-plotted, successful path to an more uncertain one. Such is the story with Baker Hughes.

It’s been over three years since Baker Hughes embarked on its high-profile effort to transform from a relatively decentralized oilfield products and services provider to one determined to compete more widely and deftly via an expanded and deepened global footprint, along with a more integrated suite of products and services. To date, the promise of the strategy has yet to fully materialize.

We were skeptical at the time that it was the right decision to move away from the Baker Hughes as it then existed, if only because its customer satisfaction ratings in EnergyPoint’s independent surveys were very competitive with those of the peers it was apparently targeting with the new strategy — namely Schlumberger and Halliburton, and to a lesser extent Weatherford International.

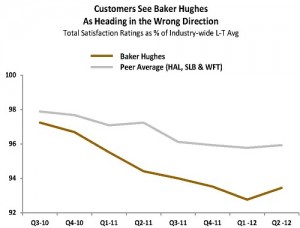

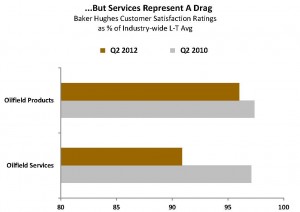

Since the strategy was announced in 2009, Baker Hughes’ overall customer satisfaction has fallen 8.9% on an adjusted basis. This compares to an average decline of 2.5% for its major peers. Job quality, post-sale support, and pricing and contract terms all currently rate as Low. We note its Low customer satisfaction rating in international markets as well.

However, the company still posts Average customer satisfaction ratings in the majority of the attributes and categories we track. The multi-year downward drift lower in customer satisfaction has shown signs of bottoming as of late, with the trend for most categories now flashing Stable.

One headwind for Baker Hughes has been the reaction to the change in its culture over the last several years. Many customers and employees bemoan the loss of performance at the individual level. Claims of too much analysis and too little execution linger. A plethora of competing initiatives, along with inconsistent implementation, haven’t helped. New and old employees alike seem confused as to Baker Hughes’ priorities.

Strategic miscalculations are also apparent. Emphasis on market share seems to have led to a push into new international markets without clear signals from customers, at least that we could see, of impending reward for doing so. And it’s acquisition of BJ Services has probably not added as much to either its competitiveness or financial results as was originally hoped.

The company also reorganized around geographic markets, away from a product- and service-line orientation. The change seemed to encourage more extensive bundling and packaging of offerings, an approach studies by EnergyPoint and others suggest often leads to diminished customer experiences.

Interested in EnergyPoint presenting to your organization?

Click here to find out more.

As we have reported before, the strategies, offerings and capabilities of the oil and gas industry’s larger suppliers, including Baker Hughes, now are so strikingly similar that their customer ratings have effectively converged. And not for the better.

Oilfield suppliers’ efforts to emulate the same far-reaching integrated model have, in effect, made it substantially more difficult, maybe even impossible, for them to stand out from one another. The upshot is that customers are now able to more effectively push pricing as the final differentiator.

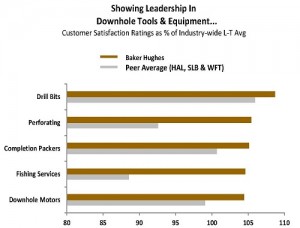

So, is a return to Baker Hughes’ roots in order? Maybe. Our customer satisfaction surveys show its greatest competitive advantages still lie in products such as drill bits, packers and downhole motors. Likewise, its strong ratings in perforating and fishing services stem, at least in part, from the quality of in-house products used in providing the services.

To the extent Baker Hughes seeks more firm footing on what has proven a slippery slope, it would likely do well to re-emphasize what it does best in the eyes of customers. The company unquestionably has a long-held reputation for quality downhole tools and equipment to build upon. And history has shown that when companies focus on providing products and services that customers are fond of, things tend to fall in to place for all stakeholders.

As a Baker Hughes employee, I can say this is pretty much spot on.

Thanks for your comment.

Yes, this piece has really struck a chord with a lot of current and ex- Baker Hughes employees.