Customer satisfaction can be a valuable tool for energy industry suppliers, as it provides providers and customers with both qualitative and quantitative insight.

Continue reading “Customer Ratings — Global Energy Industry Suppliers”Opportunity Looms in the Midstream

Consisting mostly of publicly traded master limited partnerships (MLPs), oil and gas midstream suppliers, for better or worse, are beholden to a breed of investor as interested in the return of capital (i.e., distribution yield) as in the return on capital (i.e., unit-price appreciation and/or distribution growth).

With oil and gas prices currently weak, the attractiveness of MLPs as income and growth investments is waning. Midstream customers, made up mostly of upstream entities, are hunkered down. Drilling and development budgets have been slashed, and suppliers of all stripes are being asked to lower costs till it hurts. Continue reading “Opportunity Looms in the Midstream”

Top Oil Companies Increasingly Defined by Shale Innovation

U.S. shale plays may be creating a novel way to measure the new breed of top oil companies. The standard yardstick of worldwide barrels produced per day still evokes names of familiar global players such as Exxon Mobil, Shell and BP, as well as state-owned entities like Saudi Aramco and Petrobras. When gauged by innovation on the frontier of enhanced oil recovery, however, a host of more narrowly focused companies enter the conversation.

The sheer volume of extractable petroleum, and the related economic potential, justifiably dominate shale discussions. The Bakken Shale helped reinvigorate domestic oil drilling, and the Eagle Ford Shale promises to make Texas the eighth largest producer of crude in the world by the end of this year. EOG Resources, a gas company turned top shale-oil producer, has plans to drill 425 wells this year in Eagle Ford. These shales are incubators where today’s new type of top oil company is changing the way we extract hydrocarbons. Continue reading “Top Oil Companies Increasingly Defined by Shale Innovation”

Ditch the Price-centric Mindset

Bottom-line pricing may matter to some customers, but misconceptions abound in terms of the specific relationship between pricing and customer satisfaction in the oilfield. Most organizations overestimate the impact pricing has on customer satisfaction.

A company’s customer satisfaction relative to peers — what customers and suppliers should both be focused on — is a function of completed acts. That is, how did the supplier and its offerings perform compared to expectations? Continue reading “Ditch the Price-centric Mindset”

MarkWest, Williams & Sunoco Logistics Garner Midstream Kudos

As customers in the hotly contested midstream services segment have demanded more reliable operations and deeper product-development capabilities from their suppliers, MarkWest Energy once again has emerged as best-in-class as it captured top honors in EnergyPoint Research’s 2013 Midstream Services Customer Satisfaction Survey.

The recently announced results cinches back-to-back customer satisfaction victories for MarkWest, which also took first-place overall in EnergyPoint’s midstream survey conducted in 2011. The biennial study, which dates back to 2006, is the leading independently conducted benchmark customer satisfaction study focusing on U.S. midstream service providers.

Continue reading “MarkWest, Williams & Sunoco Logistics Garner Midstream Kudos”

Sizing Up GE + Lufkin Industries – Part 2

Part 1 of this article discussed background issues at play for the companies in GE Oil & Gas‘ purchase of Lufkin Industries, including the uncharacteristic decline in Lufkin’s customer satisfaction ratings in 2011 and early 2012. It also took a look at the strategic rationale behind the deal.

This second part focuses on what the GE-Lufkin combination prospectively means for customers, with particular attention paid to the perceived cultural fit between the two companies. Continue reading “Sizing Up GE + Lufkin Industries – Part 2”

Sizing Up GE + Lufkin Industries – Part 1

Despite its relatively small size and narrow focus, Lufkin Industries‘ products are iconic within the petroleum industry. Glance at virtually any photo of a West Texas oilfield, and you’ll likely see at least one gracefully oscillating Lufkin pump jack. The oilfield’s a pretty practical place, but there’s always been something sublime about that particular image.

With its announcement earlier this week that it will purchase Lufkin Industries for $3.3 billion — a rich 38% premium over the previous trading-day’s closing price — GE Oil & Gas obviously sees something inspiring in the shot as well. The industrial giant clearly believes there are strong secular growth prospects in artificial lift applications. Continue reading “Sizing Up GE + Lufkin Industries – Part 1”

The “Bad Apple” Scenario (Revisited)

The Wall Street Journal recently published an article pointing out that fewer environmental incidents are being recorded now that larger, more experienced operators have begun to supplant smaller ones in Pennsylvania’s Marcellus Shale. While this is certainly welcome news, the industry has reason to remain vigilant in greenfield regions that lack installed infrastructure and/or a pool of trained and experienced personnel.

With this in mind, we thought we’d share an updated version of the “Bad Apple” post we published back in the Fall of 2012. We hope it will serve as a reminder of the potential pitfalls that exist as the industry moves into new regions to develop an ever-expanding set of resources. Continue reading “The “Bad Apple” Scenario (Revisited)”

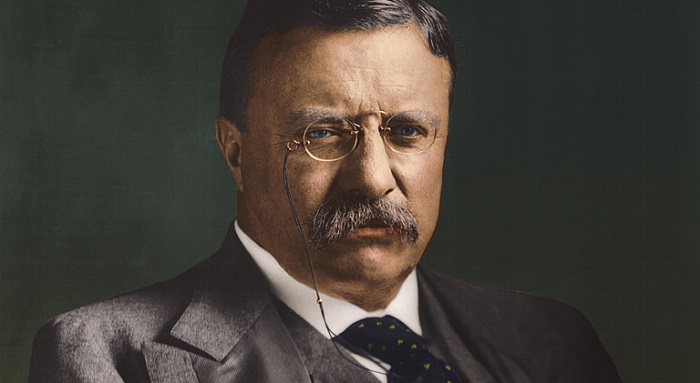

Theodore Roosevelt: Industry Standard-bearer

For decades, it has been popular for politicians and the media to portray the energy sector as a begrimed example of what needs to change in America. All the while, the industry continues to provide low-cost energy and well-paying jobs at times when the country needs both.

Faced with a public and political class that has little appreciation—and in some cases outright scorn—for its contributions, it would be understandable if industry participants felt like throwing in the towel. However, those who give their best everyday would do well to remember the words of Theodore Roosevelt. Continue reading “Theodore Roosevelt: Industry Standard-bearer”