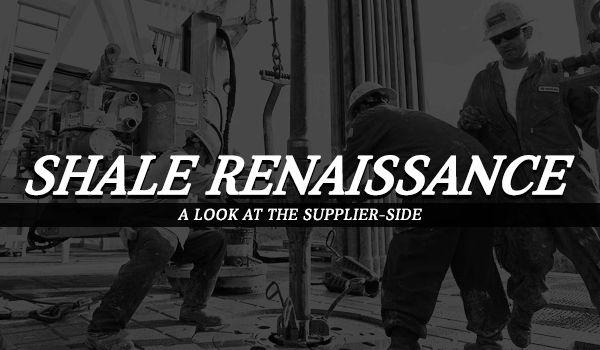

U.S. shale plays may be creating a novel way to measure the new breed of top oil companies. The standard yardstick of worldwide barrels produced per day still evokes names of familiar global players such as Exxon Mobil, Shell and BP, as well as state-owned entities like Saudi Aramco and Petrobras. When gauged by innovation on the frontier of enhanced oil recovery, however, a host of more narrowly focused companies enter the conversation.

The sheer volume of extractable petroleum, and the related economic potential, justifiably dominate shale discussions. The Bakken Shale helped reinvigorate domestic oil drilling, and the Eagle Ford Shale promises to make Texas the eighth largest producer of crude in the world by the end of this year. EOG Resources, a gas company turned top shale-oil producer, has plans to drill 425 wells this year in Eagle Ford. These shales are incubators where today’s new type of top oil company is changing the way we extract hydrocarbons. Continue reading “Top Oil Companies Increasingly Defined by Shale Innovation”