Changes in the outlook for the upstream oil and gas industry have led Schlumberger to launch a convincing bid for Houston-based oilfield equipment supplier and current joint-venture partner Cameron Int’l. The richly valued deal implies a price for Cameron’s stock of just over $66 per share, a 56% premium over its pre-announcement close. With the assumption of $1.1 billion of Cameron debt, the deal’s total price approaches $15 billion.

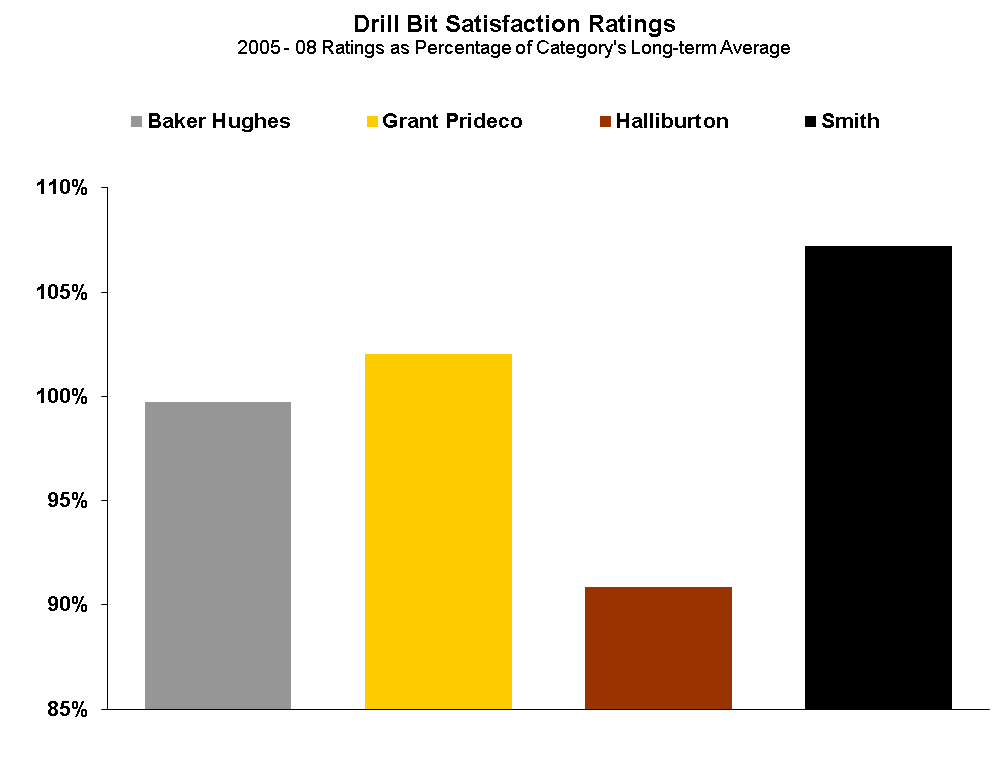

This is not the first time in recent memory Schlumberger has sought to acquire an existing partner. In 2010, it purchased Smith Int’l to gain needed Continue reading “Schlumberger Angles for Growth with Bid for Cameron”