With shrinking E&P budgets, weak commodity prices, the rise of environmental, social and governance (ESG) investing, the need for greater emphasis on customer satisfaction in the oil and gas industry has never been stronger. Providers of midstream services, and their stakeholders, ignore the evidence at their own peril.

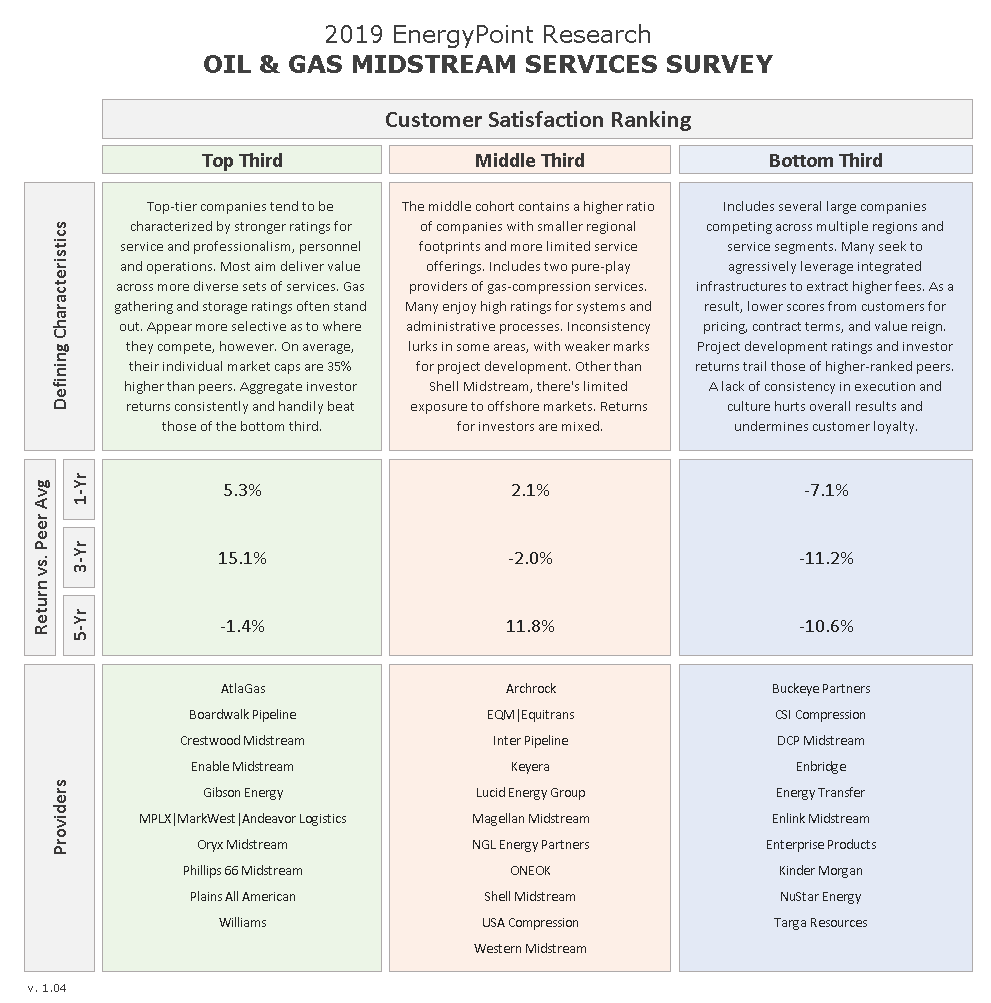

Results from EnergyPoint Research’s 2019 Oil & Gas Midstream Services Survey make the case, as companies rating in the top third of the survey register investor returns well in excess of the bottom third.

The top group consists of eight publicly traded companies: AltaGas, Crestwood Midstream, Enable Midstream, Gibson Energy, MPLX, Phillips 66 Midstream, Plains All American and Williams. Two private firms—Boardwalk Pipeline and Oryx Midstream—also rank in this cohort.

View Chart in PDF

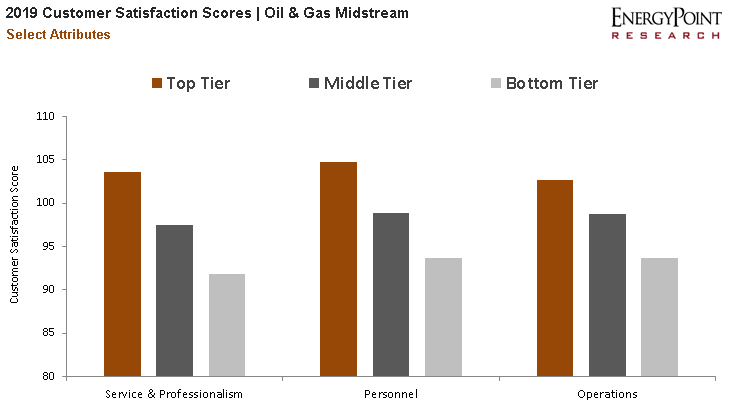

Average investor returns for the top tier outpaced the bottom tier by 12.4 percentage points over the last year. Returns for Gibson Energy, Phillips 66 Partners and Crestwood Midstream stood out. Each company garnered strong ratings in service and professionalism, personnel, and operations—all material drivers of satisfaction.

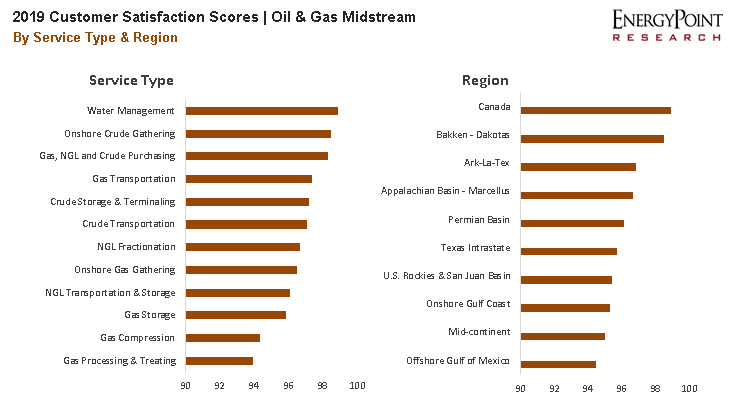

Higher-rated providers offer their fair share of midstream services. But they tend to be more selective as to where they compete, emphasizing depth over breadth. It has its rewards. The market valuations for this group are 35% higher than peers on average.

Contrast this with the vast footprints and “iron-in-every-fire” style of certain competitors. Energy Transfer, Enterprise Products and EnLink Midstream can be found in almost every corner of the oil patch. Yet their size and scope fosters an unwieldiness that hurts consistency and undermines customer loyalty.

Arrayed between the two groups are companies like ONEOK, Inter Pipeline and Magellan Midstream. While these mid-tier companies tend to tout higher systems and administration marks, project development remains a weakness. Still, the group’s returns beat those of the lower-tier.

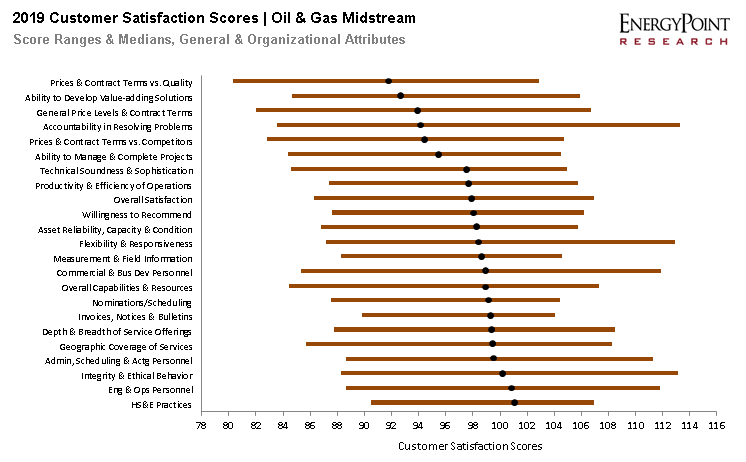

Customers are most satisfied with the personnel, and systems and administration, of midstream providers followed by operations. Engineering and operations personnel rate well, verall. Scheduling, accounting and adminstrative functions also rate well. HSE practices are well received.

Customers are least satisfied with midstream providers’ pricing and contract terms. This extends most deeply to prices and contract terms vs. quality received.

Respondents also rated providers low for project development. Scores for value-adding projects and solutions were particularly moribund.

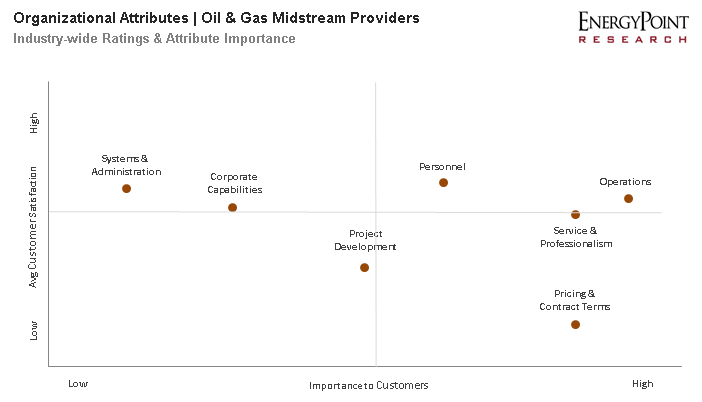

While ratings tell a rich story, the ultimate allocation of resources to address customer satisfaction does rest with whether a company outperforms or underperforms in a particular area. Rather, the importance of attribute in determining overall satisfaction should also be considered.

As the chart below shows operations, pricing and contract terms, and service and professionalism are primary drivers of customer satisfaction in the midstream. Top-rated companies focus these attributes to extract higher fees and better terms, placing priority on value over price.

The upshot? As priorities like sustainability and environmental stewardship move center stage, customer satisfaction will increasingly be tied to corporate reputation, employee satisfaction, earnings and other key performance indicators. Companies that master the right things will see their opportunities expand and financial results improve. Other aspects of their businesses may fall in line as well.