EnergyPoint conducts its independent surveys annually. This schedule allows rated upstream, midstream and downstream energy companies to track their performance over time. The goal is encourage continual improvement and a “race-to-the-top” mentality.

Pricing and contract terms, service and professionalism, engineering and design, operations, and others attributes are measured in our surveys. Results are detailed in published reports. These include 1-to-10 point ratings, top-to-bottom rankings, evaluation counts, ratings means and medians.

But ratings are just the first step. To properly manage customer satisfaction, companies also need to know which attributes are most important to customers. This helps in setting priorities and allocating resources to achieve goals.

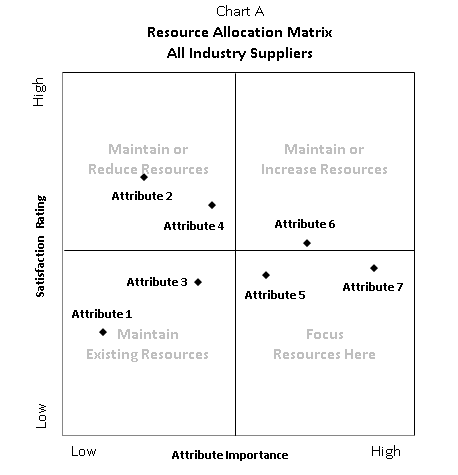

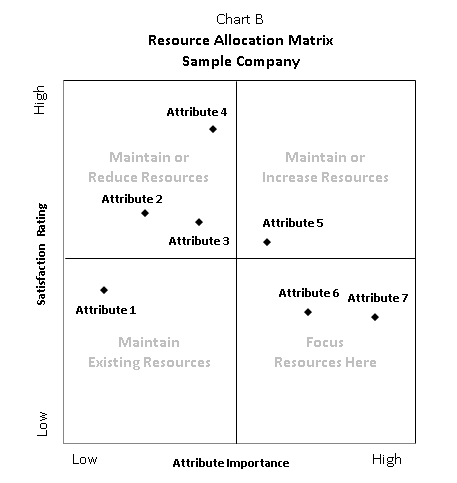

Resource Allocations Matrices (RAMs) help rated enterprises identify and develop smarter strategies by comparing performance in an attribute to its importance. Chart A below is a RAM for a sample industry while Chart B is a RAM for a sample company:

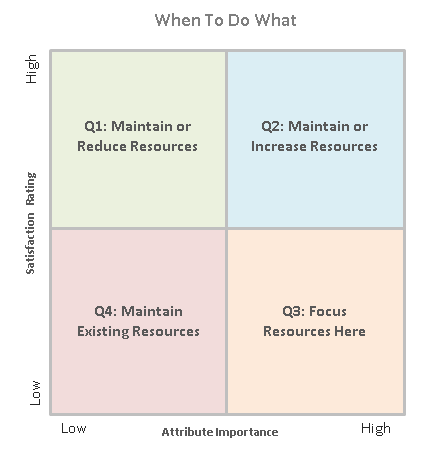

As you can see, RAMs compare the importance of a survey attribute (the X-axis) with the attribute rating (the Y-axis) in an easy-to-understand way. Attributes fall into one of four quadrants:

Q1: Low Importance & High Rating

Attributes in this quadrant have limited impact on customer satisfaction. Hence, the logical strategy is to maintain or reduce resources allocated to these attributes. This is especially true for outfits that spend material resources supporting an attribute.

Q2: High Importance & High Rating

This quadrant connotes a company’s competitive advantage. So it’s vital that resources be maintained or increased for these attributes. Even small gains can have big impacts, so incremental improvement is the goal. And since informed competitors also allot resources here, resting on one’s laurels isn’t recommended.

Q3: High Importance & Low Rating

Attributes needing the most attention reside in this quadrant. While rising scores lead to pricing power and other advantages, static scores can lead to customer defections. This is also where companies are most vulnerable to competitors. For these reasons, focus resources here.

Q4: Low Importance & Low Rating

Companies should maintain existing resources for these low-importance and low-rated traits. Efforts to improve should be smartly targeted since only modest gains in satisfaction tend to result from efforts to improve in this area.

At their core, RAMs reveal strengths and weaknesses. They can also predict where competitors will enter new markets or attempt to steal market share.

Yet, managers shouldn’t act on RAMs in isolation. Since most companies focus on the customers believed to match an organization’s skills, management must determine if priorities identified in RAMs are plausible fits with their current capabilities. If so, moving forward with initiatives supported by RAMs makes sense.

Companies that meet the needs that drive customer satisfaction enjoy greater customer loyalty, retention, and positive word-of-mouth. These lead to higher revenues, lower costs, and greater growth—driving profitability and investor returns. Businesses that fail to take note are likely to underperform over the long run.

Portions of this post are based on concepts described in Michael D. Johnson’s book, “Customer Orientation and Market Action, ” Prentice Hall publisher.