No doubt the ability to maximize well potential is crucial to the oil and gas industry’s future. Companies must complete wells damage-free and seek new ways to enhance them in order to stand apart. Continued progress in well-completions is vital to the industry’s ability to develop its reserves.

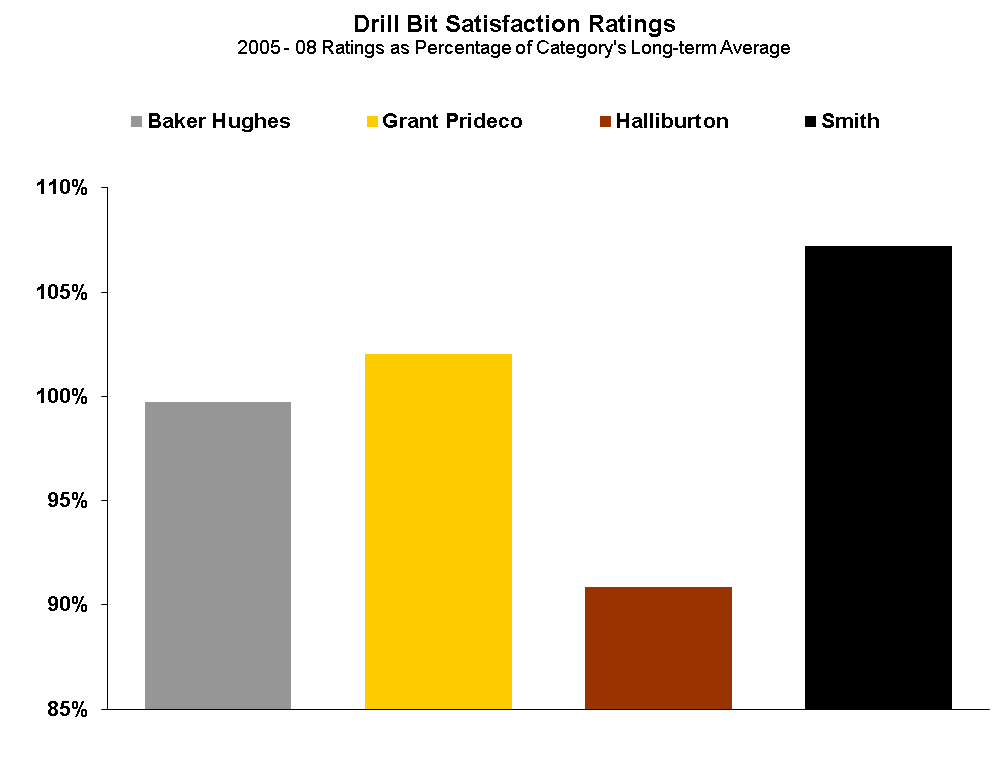

This post examines the state of customer satisfaction across various completion-related products and services in our surveys. And generally speaking, survey respondents are pleased. In fact, the data show the category’s ratings have outperformed since 2006. Continue reading “Getting More of What’s Down There”