A feature of EnergyPoint Research’s ratings is that they span numerous segments within the oil and gas industry. We currently publish ratings for contract drilling, oilfield services, oilfield products, and natural gas midstream services. Since our surveys are performed via a standardized process, the data enable fair comparison across segments. This reveals a balanced understanding of how segments and their participants are viewed by customers.

Below are the surveys conducted by EnergyPoint since 2003. The list is in descending order based on the average Total Satisfaction ratings of all suppliers rated in each respective survey:

| Industry Segment | Date | Rating |

| Contract Drilling | 2004 | 7.72 |

| Oilfield Services | 2004 | 7.53 |

| Oilfield Products | 2005 | 7.45 |

| Oilfield Services | 2006 | 7.31 |

| Contract Drilling | 2006 | 7.10 |

| Midstream Services | 2006 | 6.46 |

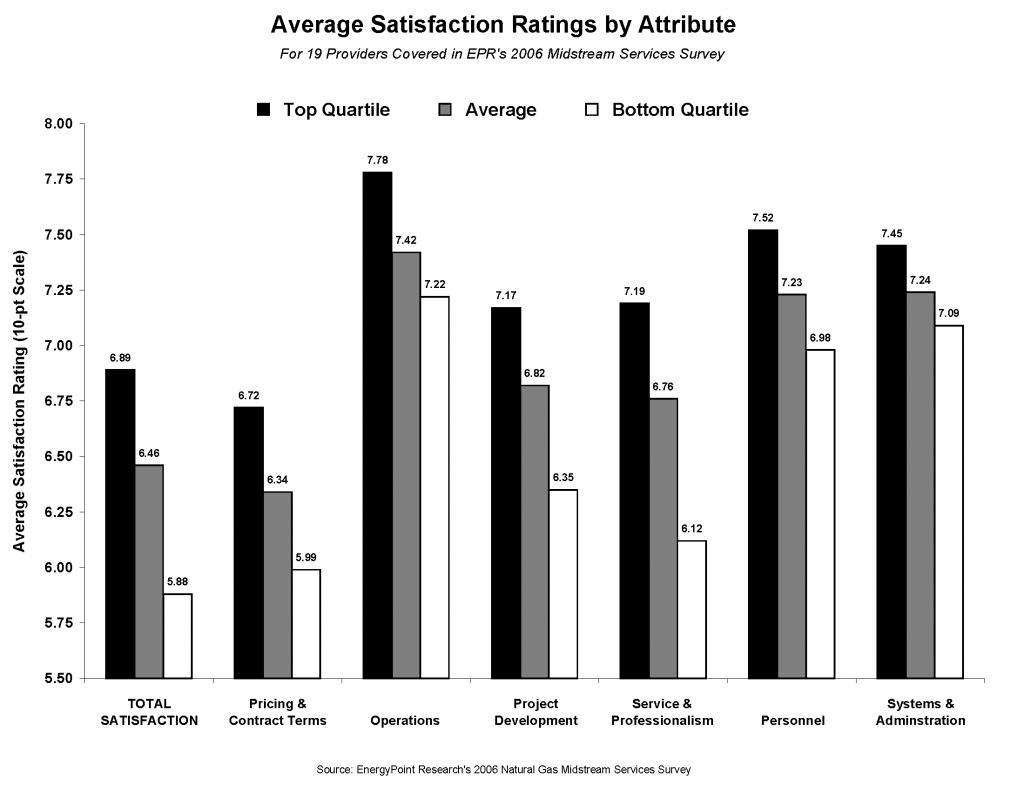

Conspicuously at the bottom of the list is U.S. gas midstream services, which registered a survey-wide average rating of 6.46 on a 10-pt scale in 2006. For context, this is near the rating received by the Internal Revenue Service in independent surveys. Within the midstream segment, ratings for gas processing and treating, gas transportation and storage, gas purchasing, and natural gas liquids (NGL) related services were particularly depressed.

We have our opinions as the why midstream ratings are so low. Chief among these is that customers (namely E&Ps) don’t view midstream providers as adding much in the way of value. Since many E&Ps perform midstream functions themselves (gathering, compression, etc) we believe, in many cases, they see less value in third parties’ services. This likely explains why customers are more sensitive to prices for midstream services.

We also suspect the significant amount of merger and acquisition activity in the sector—and the resulting lack of continuity in ownership of midstream assets—serves to frustrate midstream customers. This is exacerbated by the fact that a number of larger midstream providers are master-limited partnerships (MLPs), which often grow distributions by acquiring assets and competitors. Unfortunately, when the focus is on M&A, customers tend to pay a price.

While this “carving out” of midstream functions frees up capital for upstream opportunities, we suspect many E&Ps see few other benefits to their outsourcing. The risk to midstreamers is that these customers decide to seek greater ownership and control over the function over time.

Analysis suggests the average midstream provider needs to improve service and professionalism. Flexible and responsive companies—ones focused on resolving problems and disputes—clearly stand to gain. If they can keep their costs (and thus prices) down as well, all the better.