Demand for North American (NAM) land-drilling services has leveled off for the time being. A warm first half of winter and expectations for shoulder-month reductions in gas demand have given many producers pause regarding their drilling programs.

We believe a modest slowdown in activity could prove a blessing in disguise for many drillers, who could use the opportunity to regroup after a frenzied couple of years that, despite record earnings, have cost them in terms of customer satisfaction.

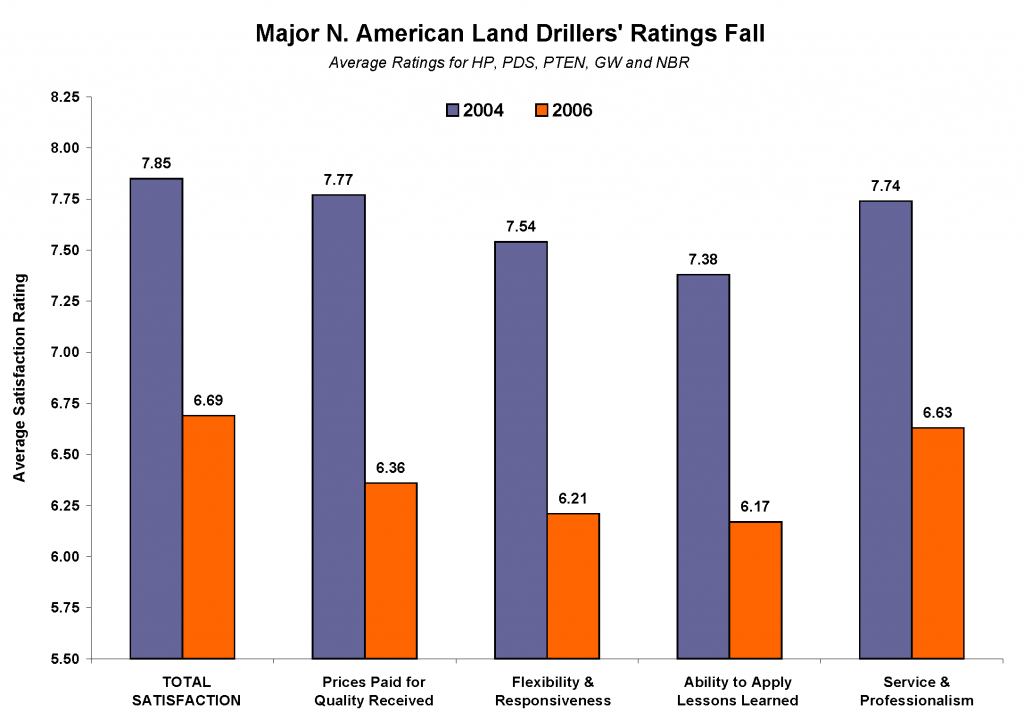

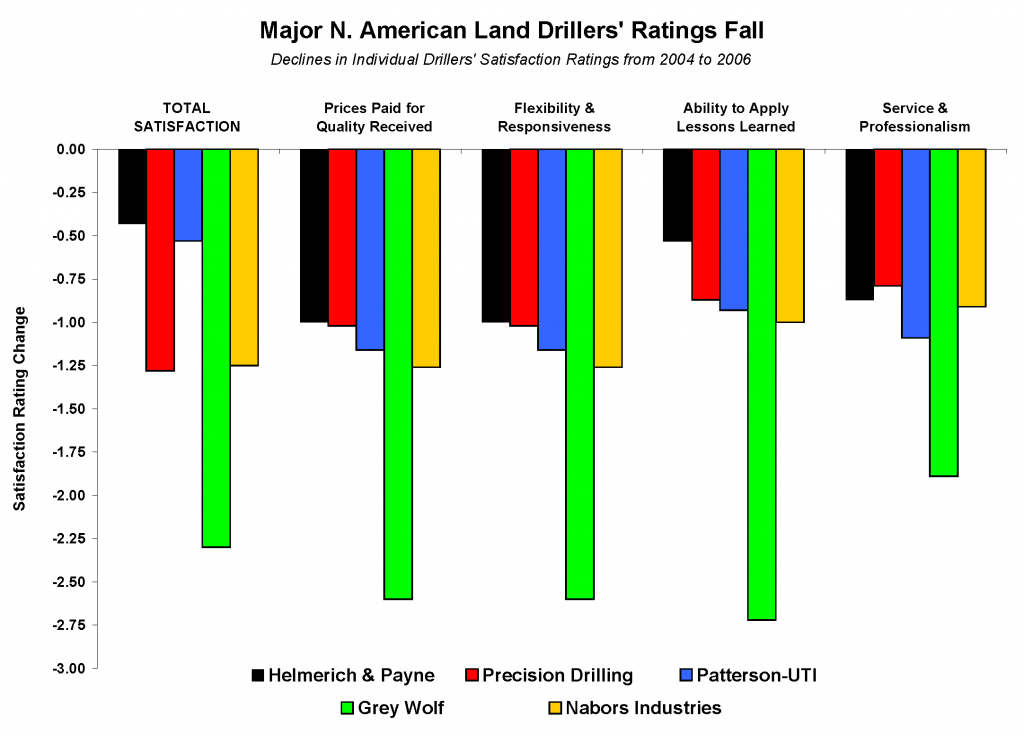

In EnergyPoint Research’s latest survey, the average customer satisfaction rating (on a 10-pt scale) of the five major NAM land drillers rated plummeted from 7.85 in 2004 to 6.69 in 2006. All five drillers saw their ratings fall over the period, with Grey Wolf experiencing the largest decline followed by Precision Drilling and Nabors. Even group leader Helmerich & Payne’s rating fell, though the company comfortably maintained its #1 ranking.

The largest ratings decline across all attributes was in pricing, for which the average price-for-quality rating fell to 6.36 from 7.77. Respondents expressed particular frustration with having to pay more as performance and service deteriorated. Grey Wolf registered the largest decline in the category, followed by Nabors and Patterson-UTI.

While it’s tempting to focus on the price component of the ratings decline, contradictory to what we suspect some contractors believe, analysis suggests price is not a primary driver of overall customer satisfaction. In fact, people and performance are much stronger determinants of how contractors rate in our surveys. Hence, declines in service and professionalism—led by deterioration in ratings for flexibility, responsiveness and accountability—are the more telling trend. Job quality was also a sore spot, including the extent to which contractors failed to convert lessons learned into performance improvements across jobs.

All drillers could stand to improve their focus on customers these days. Some more than others. Here’s our take on each NAM driller in terms of their current customer satisfaction.

Helmerich & Payne

H&P was the highest-rated land driller in EnergyPoint’s 2006 survey. While its much-ballyhooed FlexRig attracts the attention of customers and the envy of competitors, its standing as a driller-of-choice has to do with more than just its quality iron. In addition to top ratings in technology, the company rates first in reliability, job quality and corporate capabilities. In safety and environmental, H&P’s ratings actually climbed (a rarity in the survey) from already-high levels two years ago.

Precision Drilling

Like its peers, Precision suffered rating declines in various attributes since 2004, although none were drastic. During the period covered in the survey, Precision converted to a Canadian income trust. It also sold its energy services and international drilling operations to Weatherford, losing considerable management talent and some highly-regarded complimentary offerings. However, Precision still managed to maintain its top spot in service and professionalism and in price-for-quality. Time will tell whether this company is the same strong performer as prior to its transformation. So far, evidence seems to suggest so.

Patterson-UTI

Although the impact technology can have on satisfaction ratings is often overstated, Patterson-UTI’s markedly low ratings for technology in our 2006 survey is hard to overlook. Management’s preference for rebuilt rigs has purportedly resulted in impressive returns on assets over the years. But such a strategy could limit the list of operators for whom it can effectively work, especially in more competitive markets. Notwithstanding the company’s choices in terms of the rigs it operates, Patterson deserves credit for its increased satisfaction ratings in the area of safety and environmental.

Grey Wolf

Grey Wolf finished second in our inaugural 2004 survey. It’s ranking has fallen to fourth two years later. There’s no doubt the company can drill quality wells. But over the last couple of years it appears to have fallen victim to the “good times.” Respondent satisfaction with price, reliability, technology and job quality all declined as consistency waned. In fact, Grey Wolf’s pre- and post-job interactions with customers might need an overhaul given marks registered in these areas.

Nabors Industries

Being large and aggressive can certainly have its advantages. But when it comes to customer satisfaction, these traits can be problematic. Nabors finished last in total satisfaction among the 30 drilling suppliers (drilling contractors and oilfield service companies) rated in our 2006 survey. This is a decline from already weak showing in 2004. Especially low marks came from respondents at smaller operators, who appear to have had disproportionate exposure to the company’s lower quality rigs and crews. New rigs on order could help, although recently-announced delays in delivery for some units might be symptomatic of other underlying issues.

So, is there an “itch to switch” on the part of disappointed customers? If the following comments from a few disgruntled respondents are any indication, some customers appear poised to go to great lengths to find alternative contractors than those with whom they are currently working:

“We [have] used [this drilling contractor] where there are no alternatives; they are in it for the money only. Very little professionalism or care or respect for their personnel or their customers in my opinion. The corporate mentality is super-selfish.” — Drilling Engineer at Independent E&P

“[This driller’s] arrogance shown toward my company will not be forgotten when this boom slows down.” — Drilling Manager at Independent E&P

“I have experienced a take-it-or-leave-it attitude within [this drilling contractor]. Due to the current market conditions, they have displayed the attitude that they are doing the customer a favor to work for them. [In my opinion], times will change and [this drilling contractor] will be in trouble.” — Drilling Supervisor, Multinational E&P

[This drilling contractor’s] corporate strategy is [in my opinion] to go after a ‘10’ dayrate with a ‘4’ rig, and that won’t play well when things slow down.” —Drilling Manager, Independent E&P

Certainly, it’s right and fair that land drillers benefit in the up cycles, especially since they seem to bear so much of the pain in tough times. However, enjoying the fruits of one’s labors in good times is one thing; relishing them with insufficient regard for customers is another.

While increased dayrates may be an inevitable—even justified—byproduct of a healthy market, precipitous declines in customer satisfaction do not necessarily have to follow. In the end, drillers and other contractors that are not mindful of this fact run the risk of attracting and rewarding more capable competitors who are.