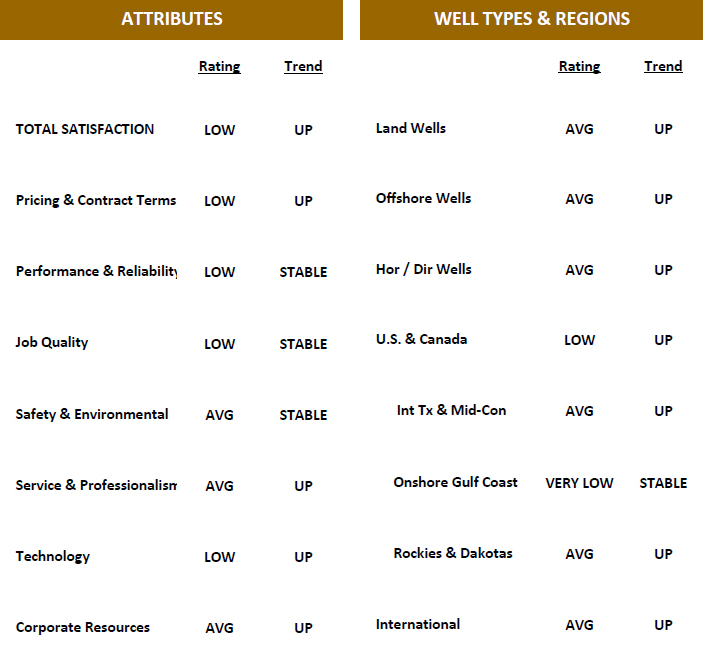

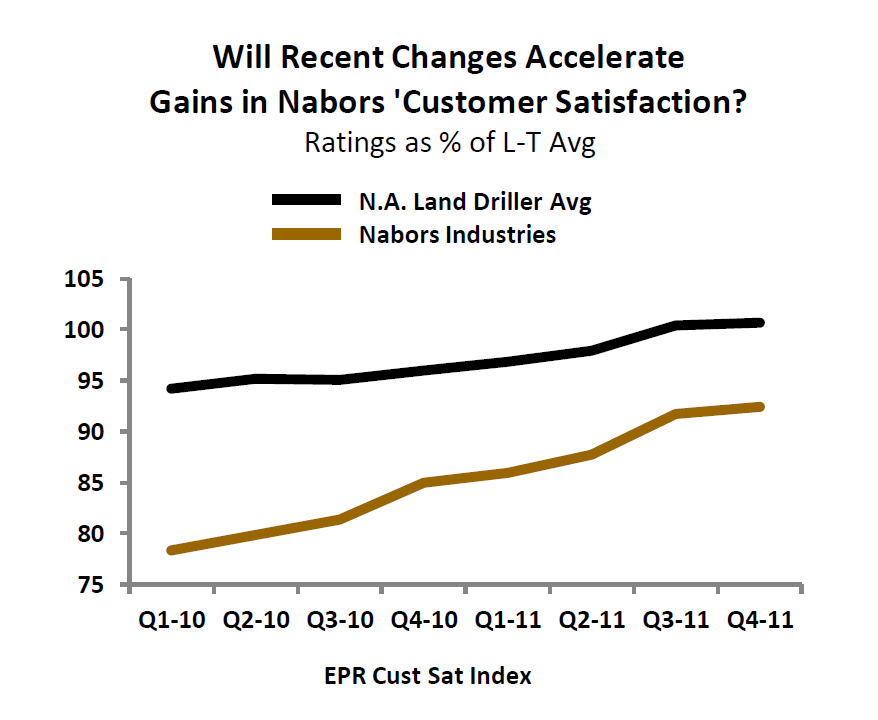

Are positive changes are underway at Nabors Industries? The company, which currently rates Low overall but is trending Upward in EnergyPoint’s oilfield customer satisfaction ratings, seems to be undergoing a cultural and strategic transformation under the leadership of Tony Petrello, who recently replaced Gene Isenberg as CEO.

As COO, Petrello was seen by many as complicit in the strategies and ways of Isenberg. So, were not sure if these transformational steps Petrello’s own initiative, or if they stem from specific directives from an increasingly proactive board.

Either way, if carried out the changes portend a better future for the company and its clients. We particularly view the decision to jettison certain non-core businesses as a crucial step. The previously announced sale of E&P investments and its JV seems especially appropriate, as oilfield suppliers that partake in the E&P side of the business can be viewed (and treated) as potential competitors by some clients. In fact, it’s our feeling such a quasi-competitor status has impeded Nabor’s ability to gain work from certain operators.

Note – For a guide to EnergyPoint’s ratings and trends designations, click here.

Other announced areas of rationalization include: the sale of the company’s Gulf of Mexico offshore jackup barge rig business and potentially its international jackup rigs; the completed sale of its oilfield hauling business in parts of Texas; and the sale of its Canadian aircraft and well-servicing businesses.

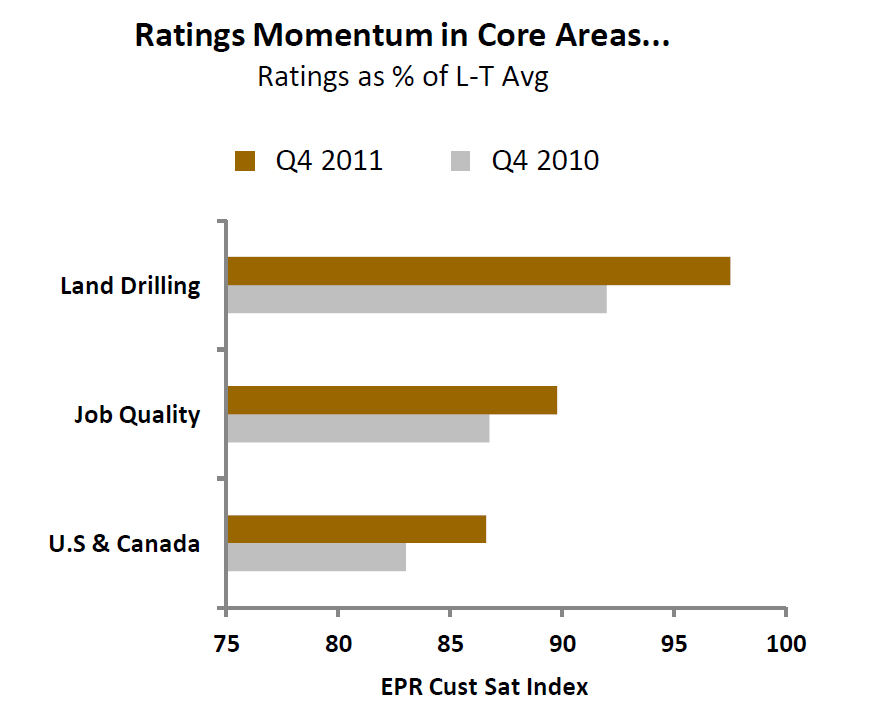

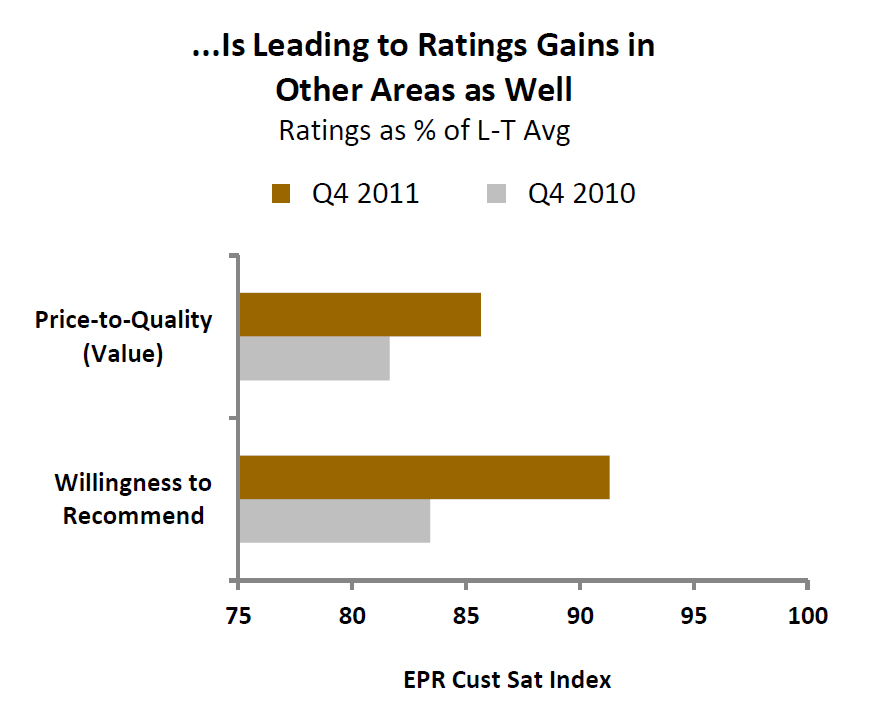

On balance, driven by widespread efficiency and productivity gains, customer satisfaction scores for N. American land drilling contractors continue to show improvement in our surveys. With ratings for four of the five major drillers we track on the rise, adjusted scores for the group are up measurable compared to only a year ago.

Helmerich & Payne is the only domestic land driller that currently enjoys a Very High level of total satisfaction. To be sure, H&P’s performance has benefited from a more singular focus on the land-drilling activities and investments, especially as compared to more acquisitive and transactional competitors like Nabors and Patterson-UTI.

We were also encouraged by Petrello’s recent comments on the value of long-term contracts to both Nabors and its customers. The growing incidence of term contracts in the onshore drilling market, and the greater levels of visibility provided suppliers and customers, allows for more confident and consistent investment in the assets, people and operations needed to continually improve performance.

Nabors continues to believe additional growth opportunities exist in international markets. Our data suggest that N. American land drillers can bring much to the table in the international arena, especially when it comes to development of shale and tight-gas reserves. If robust international markets do in fact develop, we would not be surprised to see the company refocus further. This means eventually separating itself from other non-drilling related businesses, including pressure pumping operations it purchased in 2010.

In short, if history is any indication, Nabors’ best prospects lie in swapping its Jack-of-all-trades mindset for a greater focus on a smaller, but potentially more powerful, set of core drilling activities.