Global oilfield activity remains buoyed by high long-term commodity prices. But a first look at customer satisfaction in 2008 suggests industry suppliers still struggle to serve ravenous customers.

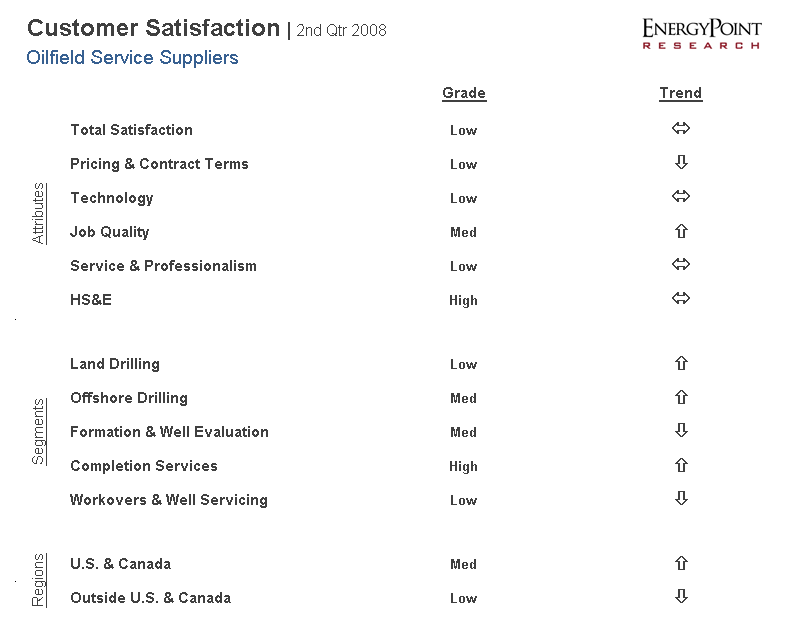

Ratings in the natural gas-driven U.S. & Canadian markets, though low, are stable for the time being. Weaker natural gas prices in the second half of 2007 have helped.

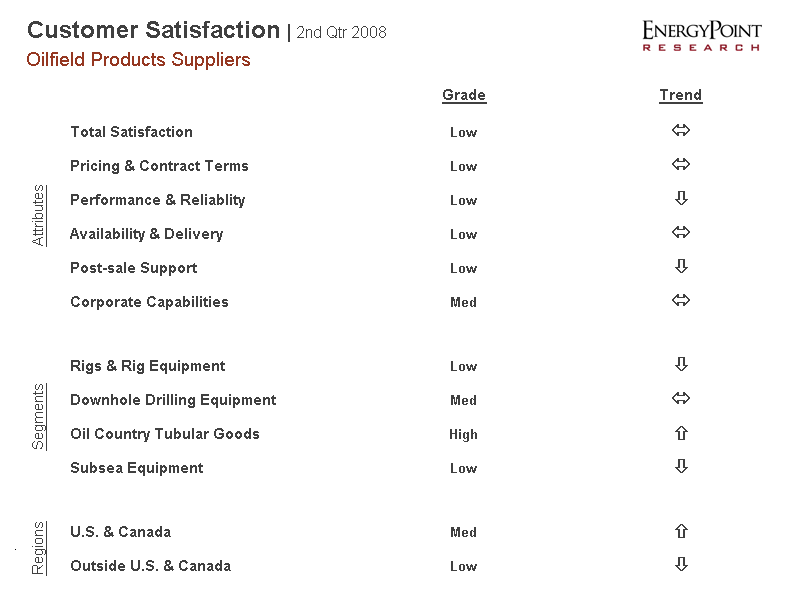

It’s oil-driven international markets that are eroding. Ratings in this segment are down significantly, according to EnergyPoint Research’s 2Q 2008 survey.

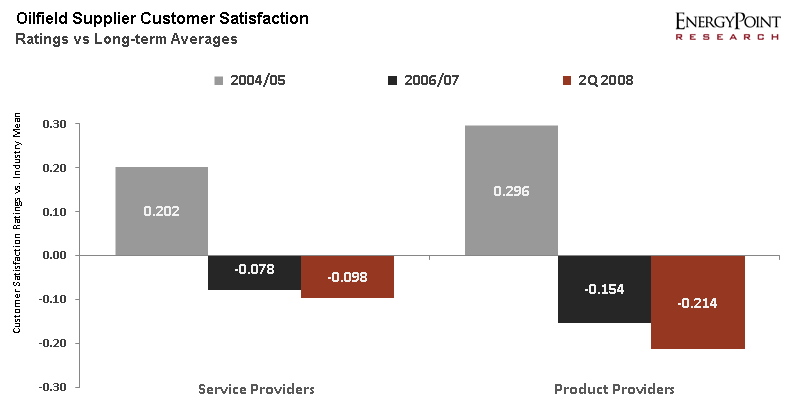

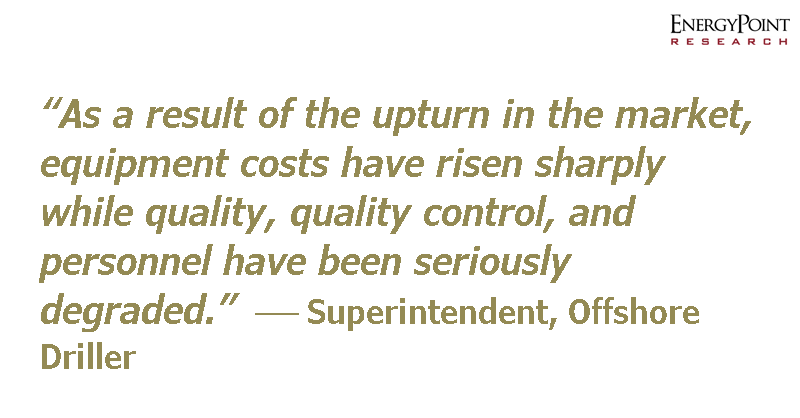

Both oilfield product and service providers showed small ratings drops versus prior surveys. Pricing remains the lowest-rated attribute–although, not the largest driver of satisfaction.

So, what’s on the horizon? We’re not forecasting a significant reversal in customer satisfaction scores anytime soon. But we are watching for an uptick. A small but growing number of suppliers are successfully expanding their capabilities. Some are also gaining greater control over operations.

Drilling contractors, whose ratings rose meaningfully in the most recent period, might take the lead. A looser market for GOM jackups likely contributed to improved scores. Deepwater drilling also recorded healthy ratings increases, despite a tight global market.

North American land drillers also showed improvements. Whether these gains hold in the face of stronger natural gas prices and higher rig demand isn’t clear.

Ratings for integrated service providers also stabilized. In short, Halliburton’s improved marks offset an erosion at Baker Hughes.

On the products side, the picture is less sanguine. Ratings fell in performance, reliability, and post-sale support. NOV’s ratings show little improvement from last year.

One notable exception to the poor performance of product providers is OCTG. Tubulars continue to enjoy high satisfaction despite challenging conditions. Ratings may not fully reflect the impact of exploding raw materials costs, but OTCG manufacturers and their distributors deserve credit.

Of course, one-step-forward, one-step-back is a tough way to make up ground. To register real improvement, suppliers need to address poor fundamentals in supplier-client relationships.

Today’s customers spend hundreds of billions each year with suppliers. Yet, suppliers often focus their energies on internal priorities over client needs.