As the oil and gas sector stirs with a hopeful sense of purpose, several of its largest and most influential suppliers are pursuing distinctly different strategies. It’s not just about which products and services will propel the industry forward. To some extent, the balance of power between providers and customers is at stake.

On one end of the strategic spectrum sit Schlumberger and GE Oil & Gas. With the help of recent acquisitions, both companies hope to meld oilfield equipment and services into a new seamless network, one capable of generating and interpreting streams of data for use in improving performance across all phases of a well. If successful, the impact could be far-reaching.

Of the two, Schlumberger’s plan appears the more ambitious. Catalyzed by the purchase of Cameron, it’s also farther along. At the heart of the strategy is a drilling and production system designed to link and optimize previously disparate products and services via a proprietary operating system and platform. It’s innovative stuff—think Apple iOS for the oilfield.

For GE, its direction reflects opportunities afforded by its pending merger with Baker Hughes. The vision is less about software than about The Internet of Things. The company plans to link its products and services—from downhole motors to field production equipment—via reams of data generated by always-on chips and sensors. The linchpin will be GE’s Predix system, which, among other capabilities, purports to better detect and predict wear and tear on equipment.

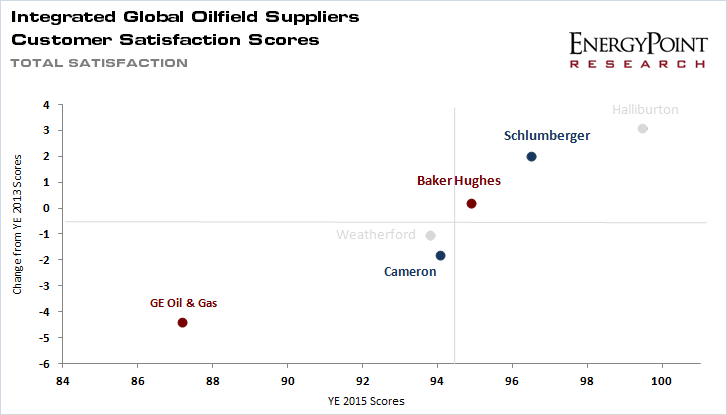

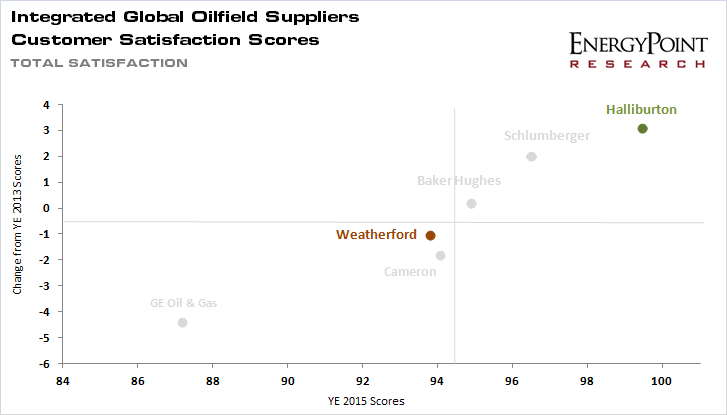

It’s an open question whether either strategy will succeed. But knowing how customers view the companies’ current efforts might offer some hints. To this end, EnergyPoint’s data suggest Schlumberger+Cameron holds the advantage—in satisfaction ratings, trends and gaps. What isn’t clear is if this reflects the past or the future—or if it’s enough to overcome customer resistance to its closed protocol.

If Schlumberger and GE are pushing for more transformational change, Halliburton and Weatherford seem comfortable sticking with what brought them—and the industry—to this point. This is not to say either views automation and connectivity as irrelevant. But neither seems to see them as central to their near-term success.

Not too long ago, Halliburton was arguing that a combination with Baker Hughes was the answer. Today, the company appears content with what it has. This makes sense. It’s products and services are popular with customers, and the industry seems primed for eventual upturn. Moreover, with a new asset-light strategy, a more nimble and adept competitor is emerging. Performance should follow.

In the end, events at Weatherford might prove the most consequential, at least in the near term. The resignation of Bernard Duroc-Danner—the company’s longtime and perennially snake bit CEO—offers opportunity for a needed reboot. Weatherford as an a-la-carte provider in the vein of the late-great Smith International has always made sense to us. Either way, improvement seems in the cards.

For the foreseeable future, oilfield customers will likely be drawn to supplier models that incorporate less automation and connectivity than envisioned by those at the vanguard. The improvements in efficiency and productivity made possible by today’s technology are just too compelling.

That said, markets benefit when suppliers compete based on a mix of visions. It spurs innovation and provides greater choice. In this sense, maybe it’s the industry as a whole that comes away the winner.

Excellent post. The arrival of divergent thinking is exciting but it introduces new risks for the Big 4 too. GE and SLB are backing their vision with large capital investments. Will the ROI be there? While HAL and WFT may seem a bit behind the curve, perhaps they end up creating more value by simply playing the next cycle with conventional gearings. Never a dull moment…

Joseph, you took the words right out of my mouth.

What I find so interesting is how Schlumberger has been more willing to use it’s balance sheet at the expense of its industry-leading margins/ROI. The company’s last two major acquisitions (Smith International and Cameron) not only put it in more capital-intensive segments, the deals had the effect (from an accounting perspective) of consolidating large equity investments (M-I SWACO and OneSubsea) that had helped boost its vaunted ROI. It’s hard to know is these shifts in strategy are a result of the change in market conditions or the change in the corner office.

Either way, Schlumberger and GE Oil & Gas appear to be going all-in– a remarkable development that deserves watching.