Changes in the outlook for the upstream oil and gas industry have led Schlumberger to launch a convincing bid for Houston-based oilfield equipment supplier and current joint-venture partner Cameron Int’l. The richly valued deal implies a price for Cameron’s stock of just over $66 per share, a 56% premium over its pre-announcement close. With the assumption of $1.1 billion of Cameron debt, the deal’s total price approaches $15 billion.

This is not the first time in recent memory Schlumberger has sought to acquire an existing partner. In 2010, it purchased Smith Int’l to gain needed exposure to North American shale. At the time, Smith owned a 60% interest in the two companies’ M-I Swaco JV.

If the Smith deal was about playing catch up in shale, Cameron is about stimulating Schlumberger’s lower growth prospects. The company already holds a presence in essentially every service and product line where traditional integrated suppliers compete. And because of its global footprint, it has few remaining opportunities to expand geographically.

With the purchase of Cameron, Schlumberger gains a crucial new avenue for growth. The two companies originally partnered in 2012 to create OneSubsea, an innovative JV that combined Cameron’s subsea equipment business with complementary units from Schlumberger. For Cameron, the venture promised greater credibility and a more prominent seat at the table with customers. For Schlumberger, it armed the company with the breadth of hardware and expertise to efficiently compete with competitors such as GE Oil & Gas, FMC Technologies, Aker Solutions and National Oilwell Varco by having the more focused partner operate the venture. The arrangement also boosted Schlumberger’s margins, while maintaining its exposure to a high-profile segment.

At the time, OneSubsea seemed for Schlumberger a move away from long-lead capital-equipment businesses. In retrospect, it represented an opportunity to look over Cameron’s shoulder and gain insight into its operations and products. Liking what it saw — especially as industry prospects weakened for its existing businesses — Schlumberger eventually fixed its sights on the entirety of Cameron.

Whatever the lead-up, the purchase price implies Schlumberger has lofty ambitions for Cameron. Specifically, Schlumberger believes its software and automation expertise provide a logical bridge between its reservoir and well technologies and Cameron’s wellhead and surface products. Step-change improvements in performance are the goal.

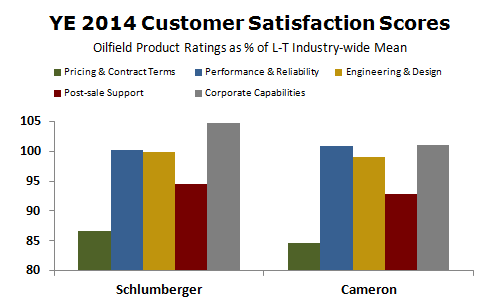

Interestingly, the two companies possess strikingly similar standing in EnergyPoint’s oilfield product customer satisfaction surveys. This is the case despite the fact Schlumberger’s scores reflect ratings for downhole equipment and materials (i.e., mostly consumables), while Cameron’s reflect ratings for capital drilling and surface equipment.

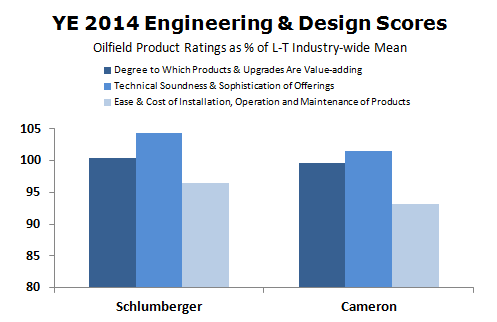

Within engineering and design, Schlumberger’s marks in technical soundness and sophistication certainly stand out. This technical prowess could represent an opportunity to add value to where Cameron’s offerings trail. In a coming post, we’ll look at the challenges and questions facing the combined company (and its customers) as it seeks to do so.