National Oilwell Varco (NOV) operates just about everywhere oil and gas is extracted, enjoying a hearty share of the market for integrated oilfield equipment. Yet global reach and a wide-ranging portfolio of products do not necessarily translate to a better customer experience—for NOV or its competitors.

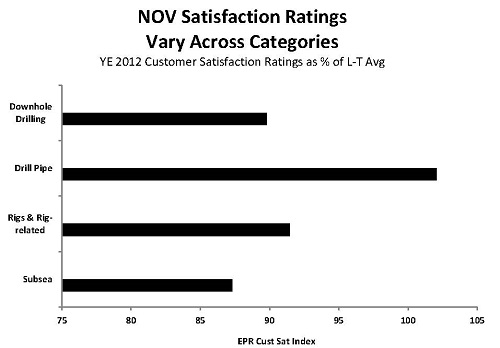

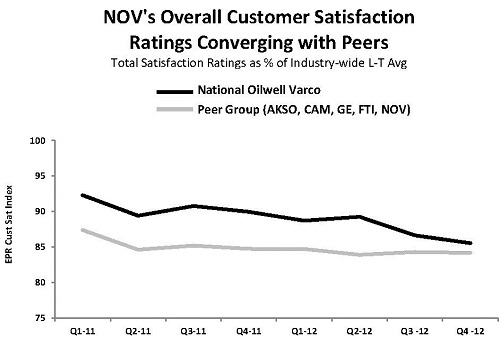

EnergyPoint’s most recent survey data suggest NOV’s customer satisfaction ratings, while certainly competitive within its peer group, have slowly trended down as the company logged lower scores in various segments. To be fair, ratings for manufacturers of capital drilling equipment remain below average industry-wide. However, NOV has been sliding from its previous perch.

Coinciding with the slip in customer satisfaction, the company has been in dynamic empire-building mode. It juiced up its oilfield distribution business with acquisitions of Wilson Supply in April of last year and CE Franklin a month later.

Those deals, along with this February’s acquisition of equipment maker Robbins & Myers, with its line of blowout preventers and other products, held the promise of increasing NOV’s scale and efficiency. As did its prior purchase of Grant Prideco. But that was then, and NOV now appears to be sharpening its focus.

Interested in EnergyPoint speaking to your organization?

Click here to find out more.

In a near about face, the company recently announced plans to spin off its now heftier oilfield distribution business. The new entity will include NOV’s legacy distribution assets as well as those of CE Franklin and Wilson Supply. Interestingly, NOV has undertaken this pruning even as customers like Transocean and Noble Corp have made efforts to slim down and focus their own organizations.

So, will this reversal in direction, however modest, help right the rudder? Possibly.

A svelter NOV should be able to concentrate its wherewithal on its strengths, such as rig technology. With so much drilling activity on the horizon, scopious companies like NOV stand to be right in the middle of things. Clay Williams, NOV’s recently named President and COO, sees the company positioning itself to grow as two-thirds of the world’s oceans are explored.

Some industry spinoffs have been motivated by the need to modernize rig fleets. So, opportunities do abound for equipment manufacturers. Nonetheless, regardless of how promising NOV’s latest redirect may be, it does not immediately make its products better. For NOV to maximize growth, customers will need to believe in the quality of their offerings.

As it stands, NOV and peers like Aker Solutions, Cameron Int’l, GE Oil & Gas and Forum Energy Technologies will need to produce more consistent customer experiences if they hope to take full advantage.

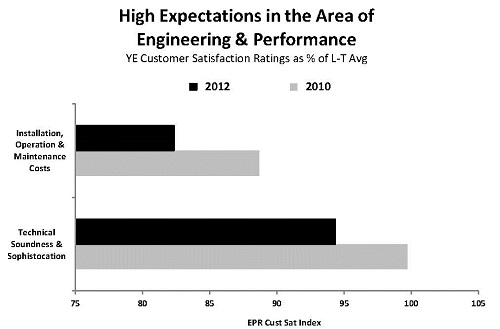

One area ripe for improvement surrounds the hitting of delivery schedules. NOV management has acknowledged that tighter schedules resulting from development methods and technologies shifting have led to some customer discontent and growing push back on pricing for deepwater-related equipment and systems. Our surveys suggest paltry levels of customer satisfaction with installation, operation and maintenance costs might be one culprit.

Finally, we remind our readers that, as many companies with acquisition hangovers often find, the closer one gets to becoming a one-stop-shop, the lower its customer satisfaction ratings tend to be. It’s this reality, in our opinion, that has in the past helped saddle NOV with lower margins in certain segments. Time will tell if the changes afoot at the company will serve as remedy.