Customer satisfaction can be a valuable tool for energy industry suppliers, as it provides providers and customers with both qualitative and quantitative insight.

Continue reading “Customer Ratings — Global Energy Industry Suppliers”M&A: Customer Friend or Foe? – Part 3

M&A: Customer Friend or Foe? – Part 1

Can Oilfield Suppliers Save Themselves?

Few sectors have ever fallen farther over an extended period than oilfield suppliers have since the current industry downturn began in June 2014. Relative to the broader market, the sector’s decline may be unprecedented.

Continue reading “Can Oilfield Suppliers Save Themselves?”Surviving the Promises of Technology

Over the years, technology has played a heralded role in the oil and gas industry. It still does today. Pick up any trade publication and chances are you’ll find at least one well-worn tribute to its importance.

Yet, the fixation on hi-tech hasn’t been without problems. It’s even been value-destroying at times. We’d argue the industry’s intractable struggle with financial returns is due, in part, to spending on technology that isn’t justified. Continue reading “Surviving the Promises of Technology”

Travelers on a Road to Nowhere

This post was updated on June 24, 2019.

For Oilfield Suppliers, It’s Adapt or Die

This post was updated on June 26, 2019.

Oil prices have rebounded from their 2014 collapse. Yet for upstream suppliers, it’s hard to tell.

It’s going to take more than crude in the $60s to rebalance the oilfield. The problem remains structural. In short, there are too many players chasing too little demand. Continue reading “For Oilfield Suppliers, It’s Adapt or Die”

Fulfilling the Promise of Weatherford

It is said what CEOs most enjoy is a challenge with outsize reward. If so, Mark McCollum should be ecstatic. As the incoming CEO of Weatherford International, he is tasked with resurrecting one of the more perennially promising, yet frustratingly underachieving, companies in the oil patch.

McCollum’s predecessor, long-time CEO Bernard Duroc-Danner, built an organization with a global presence and broad portfolio. However, the company found itself adrift in recent years as a string of financial losses and shifting strategies undermined employee morale and depleted investor confidence. Continue reading “Fulfilling the Promise of Weatherford”

Integrated Oilfield Suppliers Plot Divergent Paths

As the oil and gas sector stirs with a hopeful sense of purpose, several of its largest and most influential suppliers are pursuing distinctly different strategies. It’s not just about which products and services will propel the industry forward. To some extent, the balance of power between providers and customers is at stake.

On one end of the strategic spectrum sit Schlumberger and GE Oil & Gas. With the help of recent acquisitions, both companies hope to meld oilfield equipment and services into a new seamless network, one capable of generating and interpreting streams of data for use in improving performance across all phases of a well. If successful, the impact could be far-reaching. Continue reading “Integrated Oilfield Suppliers Plot Divergent Paths”

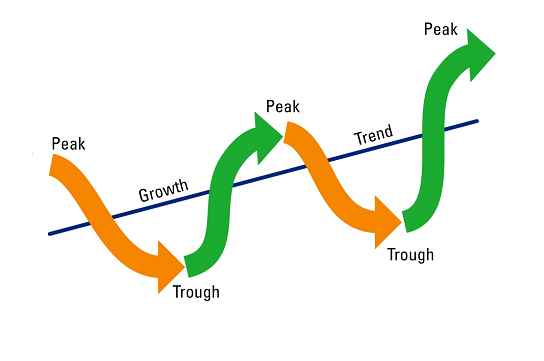

Succeeding in a Cyclical Industry

Achieving sustained performance in the oil and gas industry can, quite frankly, be a challenge. A primary reason is cyclicality. For suppliers, the task of continually scaling one’s organization to match market temperament can prove especially tricky.

Numerous factors lead to the swings in demand that define the oilfield. Mercurial commodity prices top the list. Fluctuating exchange rates, capital availability, seasonality and weather, government policy, and geopolitical events also play their part. Continue reading “Succeeding in a Cyclical Industry”