A character in Oscar Wilde’s play Lady Windermere’s Fan famously defines a cynic as one who “knows the price of everything, and the value of nothing.” When it comes to shaping public opinion concerning the carbon economy, it’s fair to say climate fanaticism—and the bleak lens through which it views the future—has had an abiding impact.

Continue reading “Climate Fanaticism’s Distorted Lens”Yes, It Pays to Keep Customers Smiling

Yes, it pays to keep customers smiling—even in the midstream.

As midstream activity marches on in North America, customers show preferences for providers with strong operating and project-development skills. Professionalism also matters.

The need for solutions is diverse and widespread. Constraints in West Texas―ground zero of U.S. shale-oil production―crimp output. Natural gas in Appalachia seeks conditioning and outlets. Gulf Coast petrochemical and LNG facilities demand feedstock. Canadian producers beg for market access. Continue reading “Yes, It Pays to Keep Customers Smiling”

Opportunity Looms in the Midstream

Consisting mostly of publicly traded master limited partnerships (MLPs), oil and gas midstream suppliers, for better or worse, are beholden to a breed of investor as interested in the return of capital (i.e., distribution yield) as in the return on capital (i.e., unit-price appreciation and/or distribution growth).

With oil and gas prices currently weak, the attractiveness of MLPs as income and growth investments is waning. Midstream customers, made up mostly of upstream entities, are hunkered down. Drilling and development budgets have been slashed, and suppliers of all stripes are being asked to lower costs till it hurts. Continue reading “Opportunity Looms in the Midstream”

Global Shale: Potential Bonanza for Suppliers

Shale-oil and -gas production in the U.S. has been revered by some as the fuel, engine and vehicle driving the nation toward energy independence and economic solvency. Astronomical estimates of reserves, millions of high-paying new oilfield jobs, enhanced competitiveness for American industry, greater tax inflows for state and federal governments, and incremental export revenues certainly justify the volume of discussion.

Shale has at once become both disruptive and transformative. It’s also here to stay. IEA estimates the share of U.S. shale oil and gas production to double by 2035. Continue reading “Global Shale: Potential Bonanza for Suppliers”

MarkWest, Williams & Sunoco Logistics Garner Midstream Kudos

As customers in the hotly contested midstream services segment have demanded more reliable operations and deeper product-development capabilities from their suppliers, MarkWest Energy once again has emerged as best-in-class as it captured top honors in EnergyPoint Research’s 2013 Midstream Services Customer Satisfaction Survey.

The recently announced results cinches back-to-back customer satisfaction victories for MarkWest, which also took first-place overall in EnergyPoint’s midstream survey conducted in 2011. The biennial study, which dates back to 2006, is the leading independently conducted benchmark customer satisfaction study focusing on U.S. midstream service providers.

Continue reading “MarkWest, Williams & Sunoco Logistics Garner Midstream Kudos”

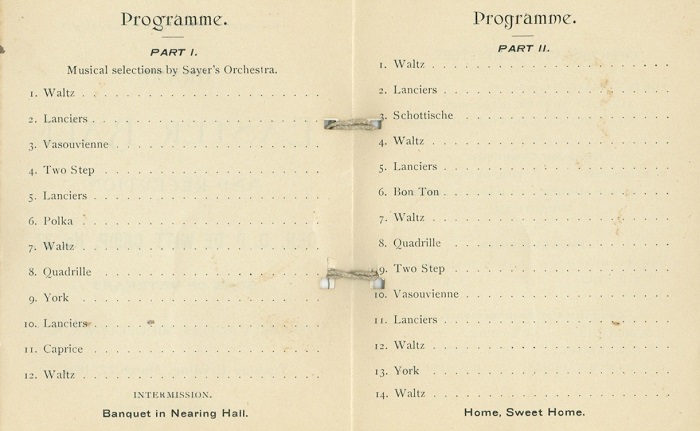

Gardner Denver’s Dance Card to Fill Up Fast

Late last week, Gardner Denver acknowledged it has engaged investment bankers at Goldman Sachs to help evaluate potential strategic alternatives, including sale of the company.

The company’s stock price jumped with the news. However, there’s reason to believe an eventual sale of Gardner Denver could be done at a price materially above current stock-price levels, especially since its shares seem to have been trading at a discount prior to the run-up. Continue reading “Gardner Denver’s Dance Card to Fill Up Fast”