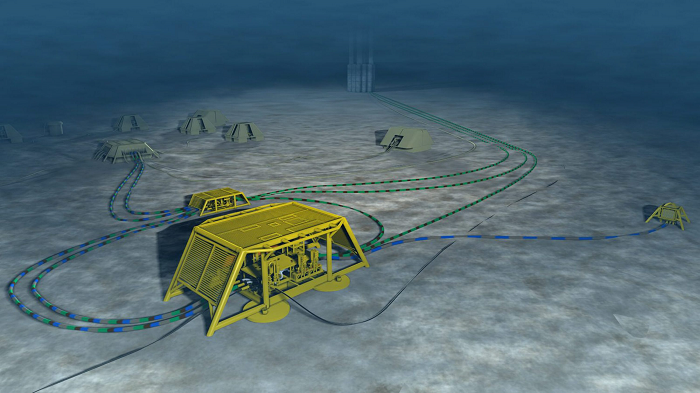

National Oilwell Varco (NOV) operates just about everywhere oil and gas is extracted, enjoying a hearty share of the market for integrated oilfield equipment. Yet global reach and a wide-ranging portfolio of products do not necessarily translate to a better customer experience—for NOV or its competitors.

EnergyPoint’s most recent survey data suggest NOV’s customer satisfaction ratings, while certainly competitive within its peer group, have slowly trended down as the company logged lower scores in various segments. To be fair, ratings for manufacturers of capital drilling equipment remain below average industry-wide. However, NOV has been sliding from its previous perch. Continue reading “NOV Closes the One-stop Shop”