A family friend tells a funny story about when his recently engaged son asked what it was like to be married. In paraphrase, here’s what he told the young man:

Years ago, your mother gave me two neckties for Fathers Day. As I got ready to go to brunch later that morning, I put on one of the ties to show my appreciation for her thoughtfulness. When I walked over to show her how nice the tie looked, she burst into tears and ran out of the room. Concerned, I followed her to find out why she was crying. After gathering herself, she replied, “You don’t like the other tie, do you?.”

Here’s the takeaway: no matter how hard we try, we can never be fully certain how others will respond to efforts to satisfy them.

While serving the oil and gas industry can certainly be rewarding for those suppliers that crack the customer-satisfaction code, it can be frustrating and financially taxing for those that never develop an understanding of customers’ needs and drivers.

One way suppliers can help their cause is to better understand the motivations and concerns of the individuals they deal with at customer companies.

For example, think a drilling or completions manager is only interested in the price at which a supplier can offer services? Think again. They are equally interested in how the supplier’s performance will reflect upon them. There’s nothing worse than being taken to task for a supplier’s non-performance. “You should have known” is usually the refrain.

By nature, oilfield customers typically try to avoid risks in who they deal with, what they purchase and how they interact with suppliers. Even for suppliers that pass the “safe operator” test, it can take years to make “approved” lists. The smallest insights into what drives customer satisfaction can mean the difference between success and failure.

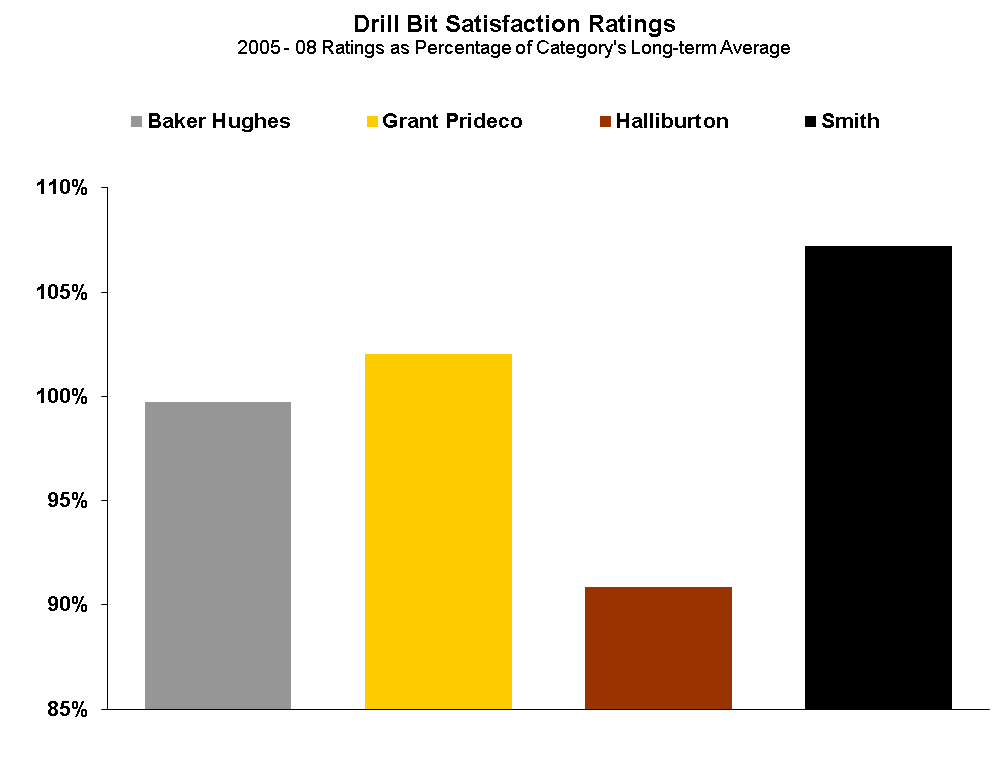

To learn more about what might be rattling around in the heads of oilfield customers, and how suppliers might be better able to meet their needs, contact us regarding our Ratings & Analysis Reports. Both you and your customers will be glad you did.