Like many suppliers in the U.S. oilfield, Basic Energy Services has been badly beaten up. The culprit is a once-in-a-generation downturn that engulfed the entire industry, pushing Basic’s latest quarterly revenues down 70% compared to their peak just 18 months earlier.

It recently culminated in the company’s announcement that it will pursue a prepackaged bankruptcy and recapitalization plan.

To suggest Basic or others industry players (Key Energy Services made a similar announcement) should have seen the writing on the wall is probably disingenuous. Most downturns arrive like thieves in the night, providing little warning. This one was no different.

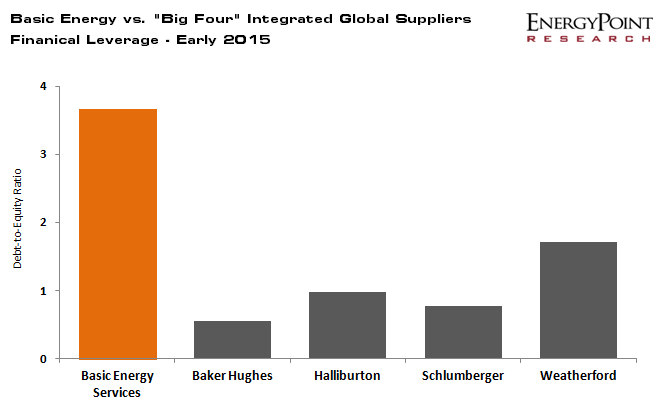

Basic’s challenges were, however, exacerbated by a thin capital structure. When the downturn began in late 2014, after a period of unprecedented industry growth and profitability, its debt levels were almost four times equity. This is leverage well beyond what the large-cap integrated service companies employed at the time.

To remedy, Basic is undertaking what it calls a “deleveraging transaction” with holders of its secured term notes and other lenders. Essentially, the deal swaps much of its debt for equity ownership of the company. Management is targeting the end of November for deal approval. It hopes to emerge from bankruptcy by year end.

The arrangement provides valuable breathing room. Most importantly, it allows the company to meet ongoing obligations to suppliers, customers, employees and others. From what we gather, it also includes (or will lead to) a working capital line of credit to finance expected growth.

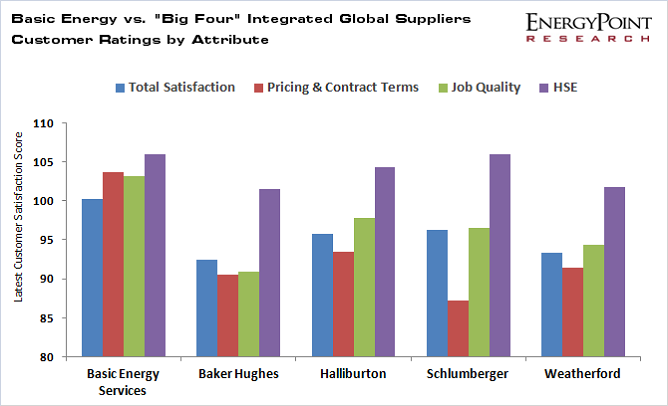

The industry needs suppliers like Basic, and EnergyPoint’s customer satisfaction data indicate the company should be positioned to compete. Because of its size, it tends to go up against smaller, less capable outfits. It fills a niche and its customer satisfaction ratings reflect this.

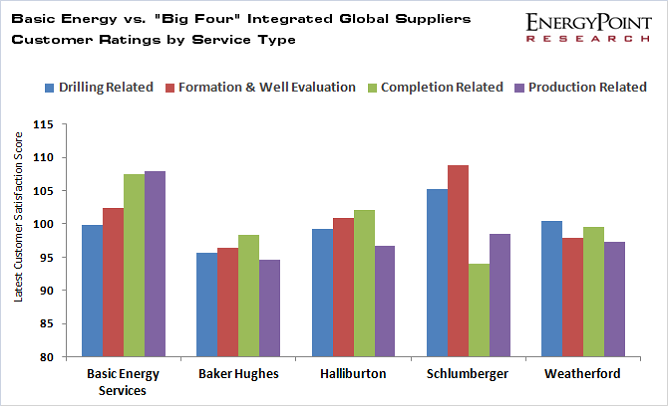

We expect the company will effectively exit certain businesses. This includes contract drilling, which was never a very good fit in our opinion. Drilling’s fundamentals now look too weak for all but the largest or most capable players.

Basic’s best opportunities lie with production-related services. With WTI expected to range between $45 and $55, workovers and well servicing (a company strength) will be in high demand. Its long-held presence in the Permian Basin — the most active play in the industry — is also reason for hope.

Of course, nothing is guaranteed in an oversupplied market where reactivation of marginal equipment could torpedo a nascent recovery. Nevertheless, it appears the storm is lifting just as Basic is set to regain its balance.

Solid analysis. Your points on potential divestitures to focus on the core strengths and Basic’s leverage to the production side of the business are particularly interesting. It’s also worth noting that Basic has long been a consolidator of smaller oil-patch players in the troughs and early recovery phases. I suppose we shouldn’t be looking for that kind of behavior for the time being…

It think you are right when it comes to the role the company might play in consolidating some of the smaller players in the industry. However, the hope would be that management would not look to finance such acquisitions with the same level of debt as in the past. Investment bankers like to trot out projections of how debt-fueled acquisitions juice EPS. What they seem to regularly leave out is the increased level of risk such transactions pose should the projections not materialize.

Anyhow, Godspeed to Basic and others like them. This has been a tough downturn.