In the 1980s and 1990s, the oilfield equipment sector, for all intents and purposes, neglected the customer. Since then, a select group of companies have successfully kept the focus of their efforts on satisfying customers with dependable products. They have coupled this with responsive service.

The results are impressive. In fact, they’ve played critical roles in advancing the industry’s capabilities. Horizontal wells are now drilled as adroitly as vertical wells. Offshore operations are carried out at previously unimaginable water depths. High temperatures and pressures are routinely brought to heel. Better bit designs save untold amounts of time and money. The list goes on.

So, what’s driving this performance?

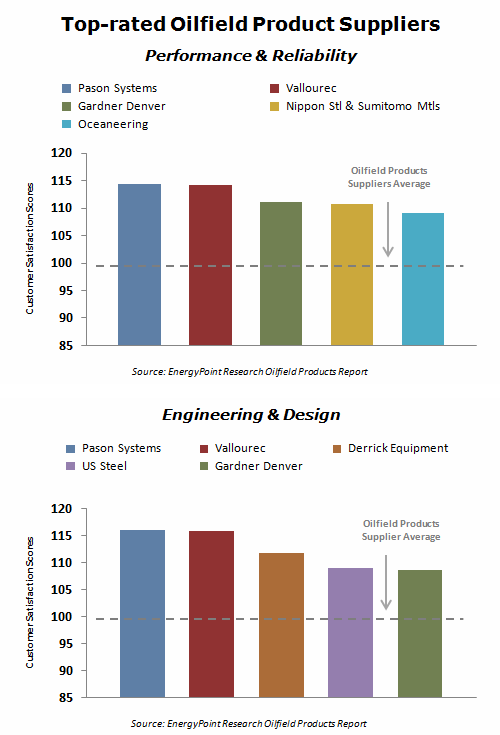

EnergyPoint’s surveys show customer satisfaction with oilfield products is heavily influenced by two factors. The first is performance and reliability, particularly durability and length of life. The second is engineering and design, with technical soundness and sophistication an important element.

Not surprisingly, high levels of overlap exist among suppliers rated highest in these influential areas and those suppliers rated highest overall. Specifically:

- Pason Systems, Vallourec, Gardner Denver, Nippon Steel & Sumitomo Metals and Oceaneering rank in the top five in performance & reliability, while;

- Pason Systems, Vallourec, Derrick Equipment, US Steel and Gardner Denver rate highest for engineering & design.

As leading suppliers seek to meet the needs and rising expectations of oilfield customers in today’s environment, their challenge is to not only remain true to the precepts that led to their past success, but to also close the gaps in areas needing improvement.

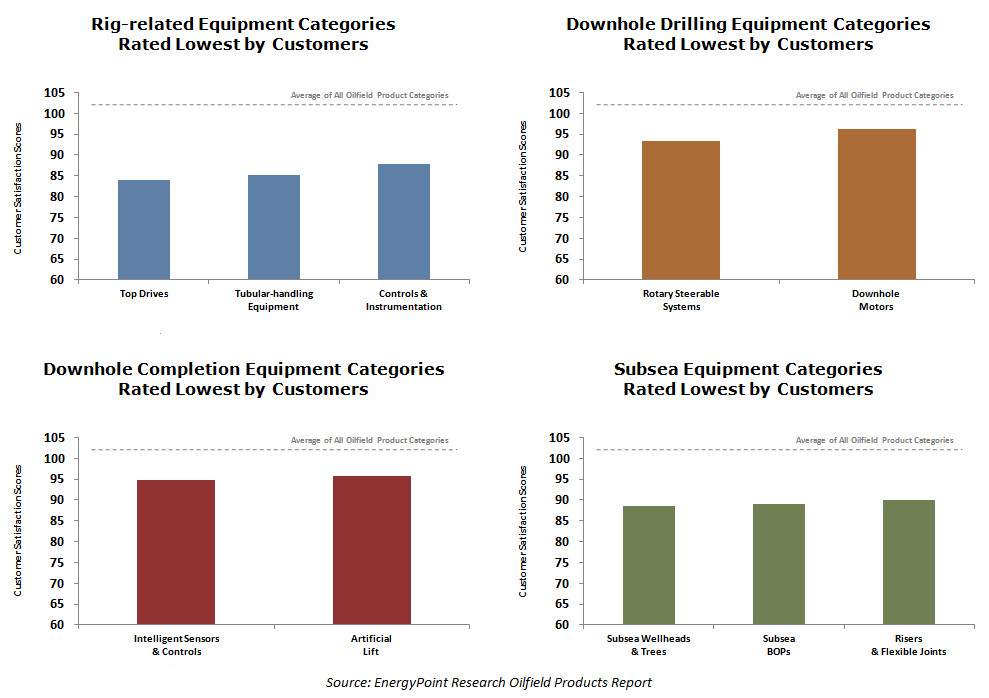

While some equipment categories like drill bits, drilling fluids, solids and waste control equipment, downhole cementing equipment and fishing tools continue to garner high praise from oilfield customers, several others still lag. These include rig-related products, downhole-drilling equipment, downhole-completion products and subsea equipment.

So, which suppliers are best positioned to close the gaps based on their ratings? In the category of rig-related equipment, the customer satisfaction data suggest it includes:

- Tesco Corp and National Oilwell Varco (NOV) in top drives;

- Weatherford, NOV and Frank’s International in tubular-handling equipment, and;

- Pason Systems and Omron IDM in rig controls & instrumentation

In downhole-drilling and -completion equipment, the opportunities lie with:

- Schlumberger in rotary steerable systems;

- Baker Hughes and NOV in downhole motors;

- Halliburton in intelligent sensors & controls, and;

- GE Oil & Gas, Baker Hughes and Schlumberger in artificial lift (ESPs)

The potential for gains in performance also lurks in the category of subsea equipment. These include:

- Dril-Quip, FMC Technologies and Cameron Int’l in subsea wellheads & trees, and;

- NOV in subsea BOPs

To be sure, the oil and gas industry is nothing if not resilient. While the current climate is as formidable as any seen over the last 25 years, it has been a hallmark of the industry’s leading suppliers to use these times of pause to invest in the development of new technologies, designs and processes to take the industry to even greater heights. To the degree companies focus on the products and categories outlined herein, the industry and its prospects should be particularly well-served.

Now let’s get to work.

Thanks for posting.

You bet. Hope you found it it of interest.

Doug