Consisting mostly of publicly traded master limited partnerships (MLPs), oil and gas midstream suppliers, for better or worse, are beholden to a breed of investor as interested in the return of capital (i.e., distribution yield) as in the return on capital (i.e., unit-price appreciation and/or distribution growth).

With oil and gas prices currently weak, the attractiveness of MLPs as income and growth investments is waning. Midstream customers, made up mostly of upstream entities, are hunkered down. Drilling and development budgets have been slashed, and suppliers of all stripes are being asked to lower costs till it hurts.

As expected, the midstream sector has done what it can to adjust. It has cut overhead and reduced operating expenses, while also keeping a close watch on

counter-party risk. Some companies have even reduced their distributions, a step once considered verboten in the space. Investors have responded in kind, bidding down the Alerian MLP Index by a third over the last year.

To help navigate the troubled waters, midstream companies are also turning to arcane-sounding financial tactics: asset drop-downs, general partner consolidations, elimination of incentive distribution rights (IDRs), etc. Other more familiar moves, including mergers and acquisitions, are also on the table.

While we won’t quibble with the notion that such financial engineering can benefit investors, it’s clearly a strategy only investment bankers could love (and many do). It also obscures other more fundamental steps midstream suppliers can take to improve their circumstances.

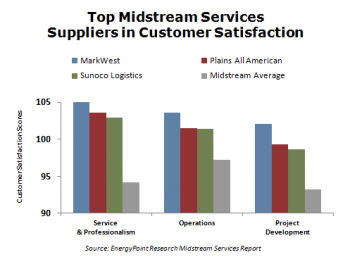

Based on analysis of a recently completed study conducted by EnergyPoint, we know customers of midstream suppliers prefer suppliers that excel in three areas: service and professionalism, operations and project development. We also know how a supplier performs in these areas can have considerable impact on its financial performance.

MarkWest Energy, Plains All American and Sunoco Logistics currently hold the top three survey spots in overall customer satisfaction. So, it’s not particularly surprising each also enjoys strong ratings in these key attributes.

Of course, performance like this doesn’t happen by chance. It requires organizations and leaders that emphasize the right things. For example, hiring and training practices and retention of key personnel are tied to service and professionalism. Operational excellence turns on productivity, efficiency and reliability (not on the newest assets or technologies). And project development is about being both aggressive and capable as a supplier.

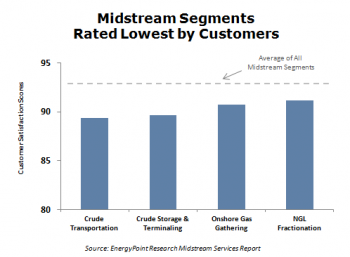

These aren’t the only areas of opportunity. There exist disparities in customer ratings across midstream service segments as well. The data suggest the suppliers best positioned in these low-rated areas include:

- Plains All American, Energy Transfer and Kinder Morgan in crude transportation and crude storage & terminaling;

- MarkWest, Kinder Morgan and Enable Midstream in onshore gas gathering, and;

- MarkWest , Enterprise Products and EnLink Midstream in NGL fractionation.

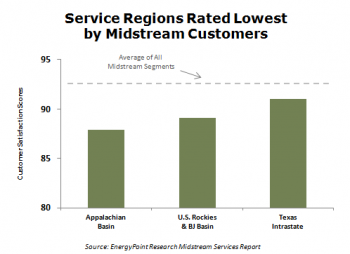

Various geographic regions also hold opportunity for suppliers, including:

- MarkWest and Sunoco Logistics in the Appalachian Basin & Marcellus region;

- Williams Midstream and Kinder Morgan in the U.S. Rockies & San Juan Basin, and;

- Sunoco Logistics, Energy Transfer and MarkWest in the Texas Intrastate region.

As it looks now, the slowdown in U.S. drilling and development will dampen midstream prospects though at least mid-2016. In the meantime, the hectic nature of the last few years has left opportunity in its wake. Higher-rated suppliers that leverage their rapport with customers (and lower-rated suppliers that change their ways) to help address these gaps stand to outperform.