Schlumberger’s bid for Cameron Int’l is big news in a flinching industry. The vision behind the deal is ambitious — even a bit brash. It’s more than just the consolidation of two large oilfield suppliers. The technical aspects of the plan could unleash industry ripples for decades to come.

Cameron’s long-time focus has been on the “heavy iron” used in the oil patch. Schlumberger hopes to expand on that role by creating fully integrated drilling and production systems around its various products. The idea amounts to an operating system that efficiently manages processes from downhole to delivery.

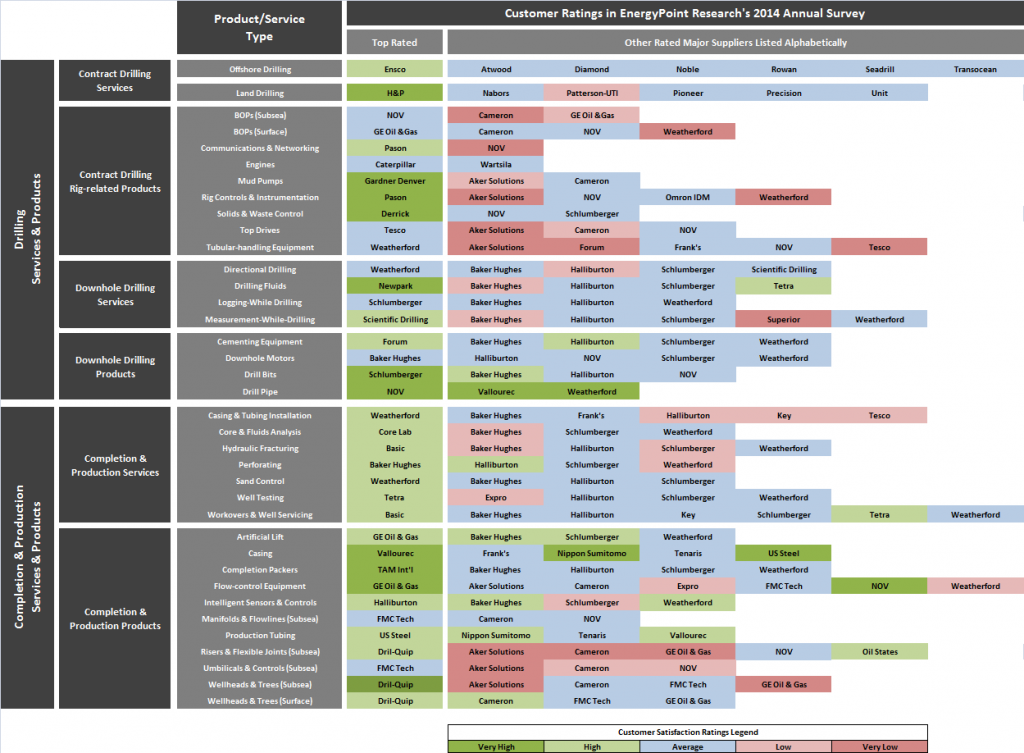

It’s an alluring concept, one that cuts across much of the upstream landscape. To better understand its moving parts, we laid out some of the segments and suppliers likely to be affected.

On a combined basis, Schlumberger-Cameron will participate in more than two-thirds of the 37 upstream segments listed in the chart. In theory, this positions the company to supply near-complete drilling and completion/production systems. By contrast, a Halliburton-Baker Hughes combination will have offerings in about half as many segments. The same goes for equipment giant National Oilwell Varco.

Obstacles to successfully executing the strategy loom, however. For example, many drilling contractors prefer to standardize equipment across their fleets. The practice helps lower costs and improve performance. While E&Ps might commit to Schlumberger for the full suite of downhole products and services for a given well, expecting drillers to do the same for more long-lived rig components could prove a stretch.

So far, Schlumberger has been hush about the specifics of the new platform. The company may not have all the answers yet. One glaring question is whether it will take an Android or iOS approach; that is, create an adaptable system for use by equipment and services from varied suppliers or clinch tightly to a proprietary model that syncs exclusively with Schlumberger-Cameron products.

There’s also the issue of preference. While Schlumberger enjoys large market share in many segments, EnergyPoint’s data suggest it’s often not the customer satisfaction leader. The same holds true for Cameron. For its grand strategy to work, many buyers will be asked to abandon more favored vendors for a hypothetical greater good. It’s not clear they will.

Winning over customers will depend a lot on whether Schlumberger can get the software right. It won’t be easy. The processes involved are varied and complex. If key oilfield products and services — including those of competitors — don’t integrate seamlessly, the system could hurt performance instead of improving it.

A little over a decade ago, the company was well positioned to tackle such an ambitious task. At the time, its SchlumbergerSEMA unit was knee-deep in the digital and communications space, with over 20,000 employees. Schlumberger management was fluent in everything from smart-cards to wireless metering technologies.

Schlumberger divested of SEMA in 2004 after the tech bubble burst. That leaves a company predominately focused on oilfield products and services to develop and maintain sophisticated software that could consist of millions of lines of code and take dozens of man-years to complete. From a distance, it seems like a less-than-perfect match.

Opening up the system’s architecture could help. Not only would it reduce the number of problems arising from disparate technical formats, users would be better able to assist in troubleshooting and maintaining the underlying software — making it more secure and stable. Open licensing would also reduce clients’ fears of being held hostage to a single vendor.

Yet, signs are Schlumberger will take a more proprietary approach. The lure of controlling the details around — and reaping the majority of profits from — such the platform is simply too great. After all, leading-edge technology sells awfully well, both in the oil patch and on Wall Street. And captive customers mean greater pricing power and higher margins. As a result, expect more iOS and less Android.

Competitors won’t idly stand by, however. Service suppliers like Halliburton and Weatherford will likely work with equipment manufacturers like NOV, GE Oil & Gas and Aker Solutions to offer alternatives. And systems specialists can be expected to come forward with their own, most likely open, software and operating solutions. If so, Schlumberger could find itself odd man out.

Schlumberger’s greatest challenge, however, might be overcoming customer skepticism. For years, integrated suppliers have argued that more is better. That bundling works best. That integration unlocks value. Yet customers seem unconvinced, especially as performance has all-too-often been dictated by the weak links in the chain.

To the extent Schlumberger can eliminate the weak links, it has a chance to achieve something special. To the extent it can’t, the strategy could end up as an empty-handed foray into a space better served by Silicon Valley.