For many, the misfortune and missteps that have befallen Transocean in recent years have been painful to watch. The bludgeoning began with fallout from the company’s role in the Macondo disaster. Since then, the formerly top-rated offshore driller in EnergyPoint’s surveys has been waylaid by internal and external setbacks — poorly timed investments, credit downgrades, agitation from activist investors, low employee morale — leaving a battered operation to withstand the current downturn.

In an effort to right the ship, the company is aggressively scrapping older rigs and reducing expenses. Plans for future capex have been cut, as have dividends. Leadership changes have been made as well.

Pete Miller, an industry veteran and retired CEO of National Oilwell Varco, was added to the company’s board in 2014 (he is now Chairman). Soon thereafter, Jeremy Thigpen, a long-time protégé of Miller at NOV, was hired to replace Steven Newman, who took hits right along with the company as CEO beginning in 2010. And Mark Mey recently came over from Atwood Oceanics to be CFO.

Thigpen represents the latest in a series of newly named offshore drilling executives recruited from other segments of the industry. He appears to harbor no delusions concerning what Transocean needs to do in the near term to survive a market headed for acute oversupply. But charting a longer-term course — one plotted along with market realities that also makes capital of the organization’s abeyant strengths — will prove more difficult. It will also prove infinitely more consequential.

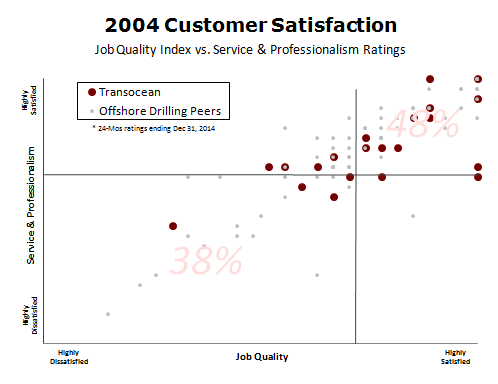

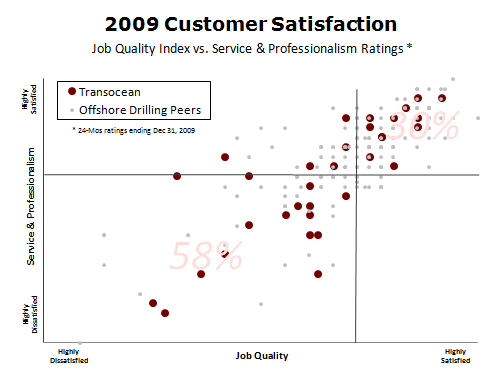

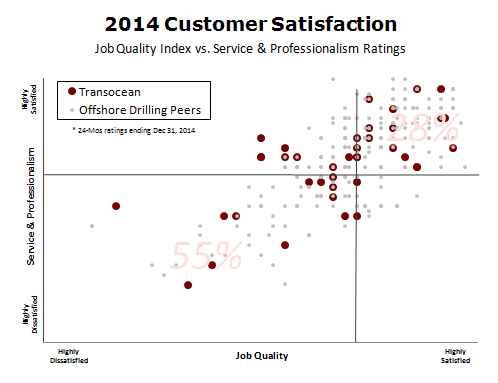

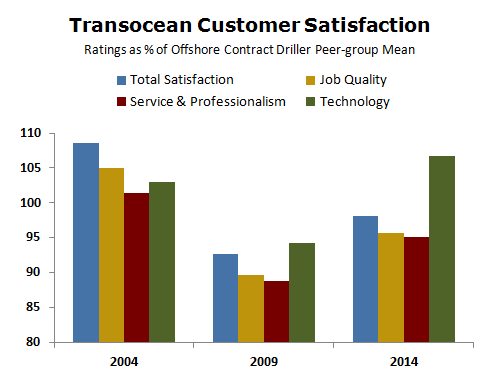

The ebb and flow of its customer satisfaction ratings offer some hints as to how the company might address its longer-term strategic challenges. Below are Transocean’s ratings at three milestones in the company’s recent narrative: 2004, the company’s ratings peak in EnergyPoint’s surveys; 2009, just prior to the Macondo incident; and 2014 , just prior to current leadership taking the helm.

A decade ago, Transocean enjoyed an enviable position with customers. Beginning in 2005, however, customer sentiment deteriorated even as ascending commodity prices spurred intense demand for its services. Arguably, seeking to meet too much of that demand stretched the company beyond its means. Follow that with an ill-advised 2007 merger with GlobalSantaFe. The result was a ratings nadir in 2009.

Since then, Transocean’s customer scores have rebounded, but only partially. Total satisfaction — the average of respondents’ overall satisfaction and willingness to recommend — is up. Ratings for technology and certain other categories have improved as well. Yes, the company’s customer marks still lag the industry average (100 on the charts) in many areas.

The challenge for Transocean — beyond its need to streamline its organization and high-grade its fleet — is to simultaneously improve field performance and its manner with customers. These attributes , in part, constitute service & professionalism and job quality, two of the most influential long-term drivers of customer satisfaction in the offshore drilling segment. Both consistently outrank more talked-about attributes like price and technology.

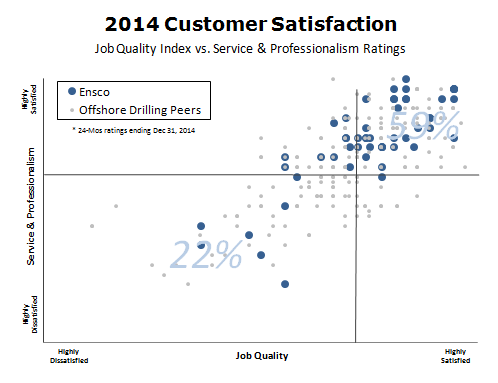

As the charts below show, plotting its service & professionalism and job quality ratings on opposing axes reveals Transocean’s lack of consistency. In 2014, only 28% of respondents rated the company above the peer-group mean in both service & professionalism and job quality. This is lower than the 30 % registered in 2009, and well short of the 48% recorded in 2004. The current top-rated offshore driller, Ensco, garnered marks above the peer group in both categories to the tune of 59% in 2014.

The smart next step for Transocean? Sharply focusing its leaner operation on improving performance in the field while retooling the way it interacts with customers. And if it can tap into the right muscle memory from days gone by, it might take that step sooner rather than later.