Until recently, if one were to side-click their way to the website of onshore drilling contractor Helmerich & Payne (H&P), they could be forgiven for assuming the company was just another run-of-the-mill driller. Framed mostly in nondescript grey and blue, the site seemed an unfinished afterthought of a organization with better things to do.

In truth, that’s probably not too far off. H&P has traditionally avoided heavily marketing itself, leaving the trumpeting of its success to customers and industry analysts. Nonetheless, when you’ve earned the kind of respect the Tulsa-based company has over the years, taking pride in the presentation of your story is only natural. More on par with the company’s image, H&P’s website today has a decidedly more modern look and feel. But the site’s content still suggests an organization focused on one simple goal: continued domination of the onshore contract drilling market.

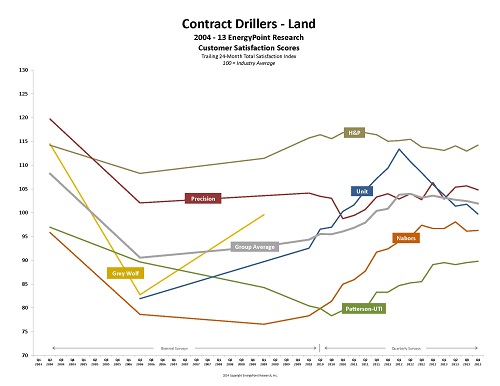

Click on chart to download and view as high-resolution PDF

When H&P introduced its third-generation FlexRig in 2002, it effectively ushered in a new operating model for the domestic onshore drilling market, one that would prove a perfect fit for the ascending shale revolution. With de novo AC-drive capabilities, high-tech controls and displays, and climate-controlled drillers cabins, the company set a course that forever changed the calculus behind drilling in North America.

Today, the configuration takes the main stage. FlexRig is one of the best-known brands in the oilfield, a highly respected series of rigs in an industry where equipment is often and dispassionately referred to simply as “heavy-iron”. H&P’s rigs are ones customers have come to not only trust, but to consistently prefer. In the first-half of the current fiscal year, H&P garnered 44 contracts for newbuild FlexRigs, all supported by long-term customer contracts. As the AC drive rig dial-up continues, additional orders will inevitability materialize.

In addition to being a fit-for-purpose engineering success, the FlexRig series offers added benefits from standardization, or what H&P management refers to as “uniformity.” Our take on the issue and its role in driving customer satisfaction is pretty straight forward: standardization of winning designs allows for more effective training of personnel, lower operating costs, tighter supply-chain management, reduced working capital investment and greater utilization of resources across the organization.

In turn, these factors all lead to more consistent performance where it matters most — in the field. In our opinion, it’s no coincidence that Ensco, the top-rated offshore contract driller in EnergyPoint’s surveys, also embraces standardization as a primary strategic tenet.

Interested in EnergyPoint speaking to your organization?

Click here to find out more.

So, after a decade of unprecedented growth and success, where does H&P go from here? Fortunately, the company is one of the few drillers that can say (with a straight face, anyway) that its best course of action is to simply keep doing what it’s been doing.

According to H&P management, approximately 40% of all active rigs in the U.S. are AC drive units (a statistic we have no reason to dispute). At the same time, places like the Permian Basin, previously thought to be one of the last bastions of the mechanical rig, continue to see AC rig usage rise. Both trends plausibly could pad FlexRig’s market share, and H&P’s related fortunes, for years to come.

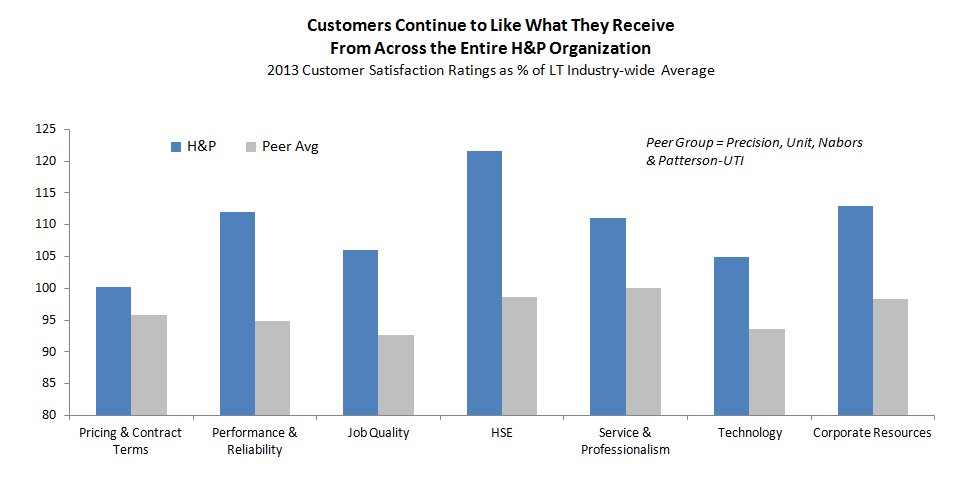

As reluctant as the company may be to bask in the glow of its success, H&P remains one of the oil and gas industry’s true rockstars. EnergyPoint’s latest annual survey results acutely suggest customers remain big fans of the company’s people, assets and services. Compared to the average ratings for its major peers — namely, Nabors, Patterson-UTI, Precision and Unit — H&P outperforms on all counts.

These strong customer satisfaction levels speak not only to the company’s performance in the field, but to its winning culture as well. And it’s the cultural part of H&P’s strategy that, in the end, might prove most difficult for competitors to replicate.