Turn-of-the-century humorist Kin Hubbard once quipped, “The safest way to double your money is to fold it over once and put it in your pocket.” Simpler times, simpler rules.

Today, mergers are routinely struck using other people’s money, so decision-makers pay less of a direct price when deals go bad. As such, M&A activity has flourished in the decades since Hubbard’s witticism.

The reasons modern corporations now pursue mergers, and their promise, are as varied as they are persistent. Whatever the reasons, more deals are inevitable. Given this, here are some tips for companies hoping to reduce the risk to customers as they wade into M&A waters.

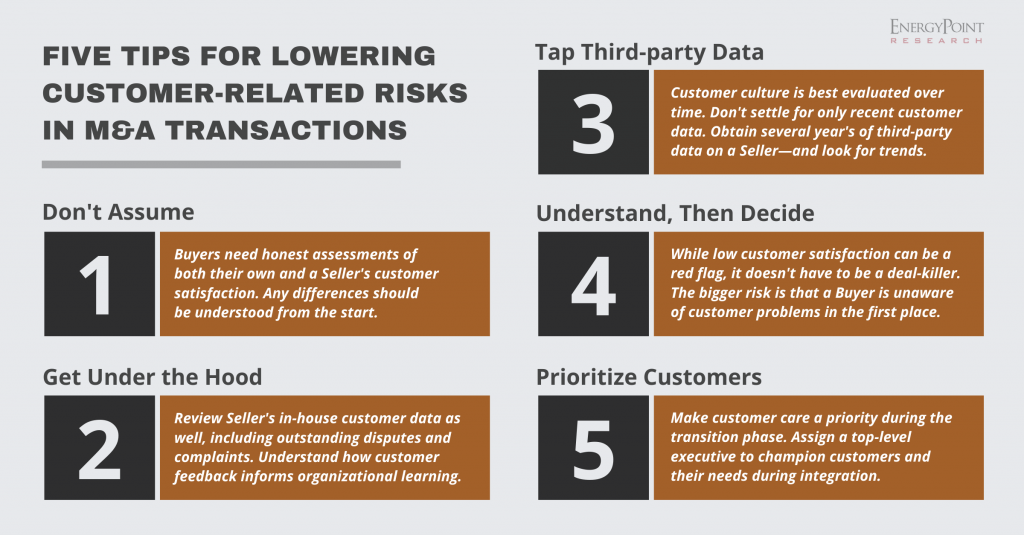

Tip 1: A Buyer should not assume its own customer satisfaction is higher than that of a Seller. It may not be.

Market share data is important for due diligence, but it’s not the only metric that matters. Buyers also need honest assessments of customer satisfaction and culture. As discussed in Part 2, a Seller’s satisfaction levels and culture may diverge significantly from that of a Buyer’s. Any differences need to be understood, and planned and accounted for, prior to inking a deal.

Tip 2: Delve into in-house customer satisfaction data.

Buyers should carefully examine a Seller’s in-house customer service, satisfaction and quality records going back at least three years. Review the data by product and service line, region, function, etc. Plot the data over time to understand trends. Also determine how customer feedback informs organizational learning.

Whether a Seller can provide this data in an organized and prompt manner can be an important indication of its customer culture. Treat with skepticism thin data or assurances that the Seller hasn’t the need to track customer satisfaction or feedback.

Tip 3: Utilize reputable customer data from independent third parties.

A wider lens always provides a more complete picture. Hence, third-party customer data on a Seller and its competitors is immensely valuable. If a Buyer has comparable data on itself, preferably from the same source, all the better.

As with in-house customer information, the point with third-party data is to understand both current satisfaction levels and trends. EnergyPoint’s database contains tens of thousands of independently collected customer evaluations on numerous companies going back several years. Other parties may have historical data as well.

Tip 4: Treat customer satisfaction as a barometer, not as a litmus test.

Low customer satisfaction at a Seller is a risk. The bigger risk, however, is missing or ignoring the factors responsible. If those issues go undetected during due diligence, or unaddressed in integration, trouble will typically follow.

However, with solid due diligence and thoughtful integration, Buyers can create value by improving a seller’s customer satisfaction and culture. It’s not easy, but it can be done.

Tip 5: Assign a customer champion.

If and when a deal is struck, place customer care front and center—from the beginning.

As Dan Kiely in the Harvard Business Review suggests, task a senior executive, possibly the COO, with ensuring customers’ needs are weighed during decision-making and execution phases. Whatever the plan, frequent and clear communication with customers should be a priority.

In short, there’s no getting around the fact that M&A can be a threat to stakeholders, including customers. Regardless of deal type, having the right data regarding customers improves the odds of success; it can provide the confidence to walk away when a Seller is not a good fit, or move forward when the opportunity is right.

Either way, Buyer’s should not take customers, or their loyalty, for granted.

Parts 1 and 2 of this series discussed the reasons stakeholders should view M&A with skepticism, including how customer dissatisfaction can sabotage outcomes.

This article was originally published on April 14, 2014. It was revised and republished on October 26, 2020.