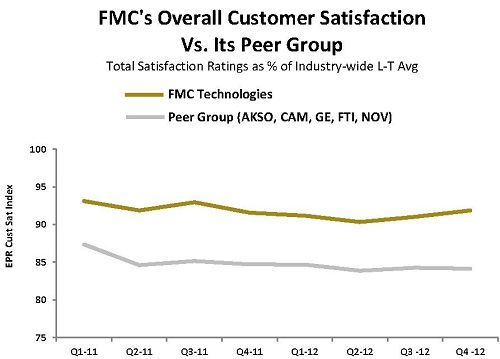

FMC Technologies, a leading oil equipment company, consistently outranks its peer-group average in EnergyPoint Research’s customer satisfaction surveys. The company has grown into a dominant player over the years partly on the strength of a vigorous research and development program that began bearing fruit in time for today’s exuberant revival of subsea drilling and development.

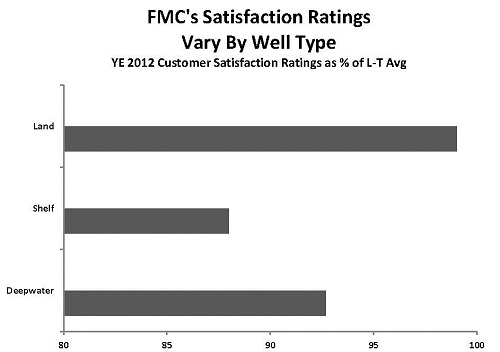

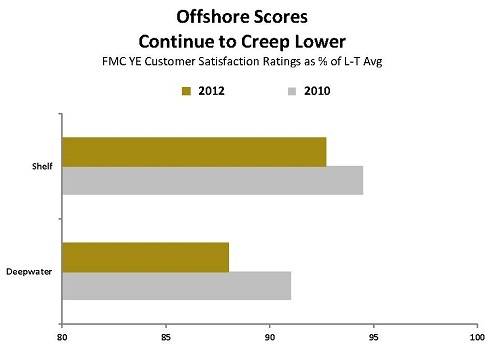

Not a pure customer satisfaction winner, though, FMC’s ratings fall more in line with its oil equipment company cohorts in the subsea segment. Like many of its peers, the company draws lower ratings from some customers for both organizational and equipment performance. And in what might come as a surprise to some, the company rates lower in shelf and deepwater wells, which account for about two-thirds of its business, than for onshore applications.

An Oil Equipment Company To Watch

Adding product lines through both development and acquisition has expanded the company’s footprint on turf. But it does nothing toward satisfying subsea customers, who arguably keep the enterprise afloat.

On the other hand, FMC has posted otherwise stable reviews from survey respondents given the fluidity of oil and gas sector on the whole. Rated Forbes’ 17th Most Innovative Company, FMC has more than kept pace with, and even led, the evermore complex and automated deepwater setting.

On the other hand, FMC has posted otherwise stable reviews from survey respondents given the fluidity of oil and gas sector on the whole. Rated Forbes’ 17th Most Innovative Company, FMC has more than kept pace with, and even led, the evermore complex and automated deepwater setting.

Interested in EnergyPoint speaking to your organization?

Click here to find out more.

Burgeoning opportunities offshore offer the promise of unseen growth for FMC and others such as GE Oil & Gas, National Oilwell Varco, Aker Solutions and OneSubsea, the promising JV between Cameron and Schlumberger. But if FMC’s products, no matter how innovative, fail to live up to their potential in the field, the company could forfeit any first-mover advantages innovation might otherwise enjoy.

FMC’s recent history as told through quarterly conference calls and industry reports seems to explain the company’s current rating’s plight, as well as potentially foreshadow some improvement. Early into the secular energy boom, FMC began aggressively hiring new technical grads. It beefed up its staff considerably each year, and added another 3,000 this year. These investments sent FMC expertise into the thrall just as subsea exploration took off.

The fresh hires were met with highly sophisticated processes in an environment swirling with regulatory, methodological and technological changes challenging to even the most experienced. FMC executives believe that inexperience contributed to critical mistakes at installations in Angola and the United Kingdom, which required costly rework.

Fortunately, bullish activity in global oceans continues to reset the game for FMC and its competitors. Any oil equipment company looking to establish a name for itself in customer satisfaction in subsea equipment has nothing but open field to run. They all share in the harried anticipation of record backlogs and massive new contracts for their products and services.

Leveraging Lessons Learned

FMC could eventually emerge as a true customer champion, just not on its current trajectory. And it could yet earn an outsize return on its talent and technology investment. One feather in its cap: many of its current employees cut their teeth in the new age of subsea exploration, ahead of the expected dearth of skilled oilfield workers.

The company also has begun redeploying experienced technical managers to its various global regions. There should be plenty to do, to be sure. Coming FMC innovations including subsea gear that greatly reduces personnel and equipment on the surface could limit human liability at the site.

So, in the end, what FMC has lacked in performance as oil equipment company might very well be made up for in valuable lessons learned.

Excellent insights, Doug. You are right on about FTI investing heavily in talent – they should be very well positioned to start reaping the payback of this investment as the deepwater cycle inflects from exploration to development over the next couple years.

We have found that the subsea environments in which the products of FMC and many of its peers must reliably perform are not the most conducive to attracting high customer satisfaction ratings. It’s clear the market place demands a high level of customization, sometimes entirely new and unique technologies. The combination of higher costs from a lack of standardization, harsh and demanding environments, and a constant push by customers to reduce costs is, to say the least, an interesting elixir of factors impacting the company’s business.

Very interesting post. One of the principal takeaways: “if FMC’s products, no matter how innovative, fail to live up to their potential in the field, the company could forfeit any first-mover advantages innovation might otherwise enjoy,” is both foreboding and pregnant with opportunity. It seems that FTI is in the nascent stages of shifting its strategy, as you point out.

FMC deserves a lot of credit for what it has accomplished in the subsea. It’s clearly a very difficult environment, and an even more difficult one in which to satisfy customers (when production falls short of expectations, it’s very easy to assume it because of the equipment that sits on the ocean floor). Personally, if FMC can move toward a set of more standardized offerings, I suspect the company would find itself well positioned for as offshore activity increasing moves more into an old-fashioned development phase.