In retrospect, the recent announcement by National Oilwell Varco that it will acquire Robbins & Myers really shouldn’t come as much of a surprise. The surprise, rather, might be that the deal didn’t come any sooner than it did. Maybe NOV decided it would have been poor form to have moved earlier given that R&M only completed its transformational acquisition of T3 Energy Services a little more than 18 months ago.

Regardless of the factors behind the deal’s timing, NOV picks up in R&M a number of products and services that fit well with NOV’s already expansive set of offerings. But it’s R&M’s BOPs (and related pressure control products and services), along its artificial-lift/tubulars line up, that seem to us at the heart of the deal.

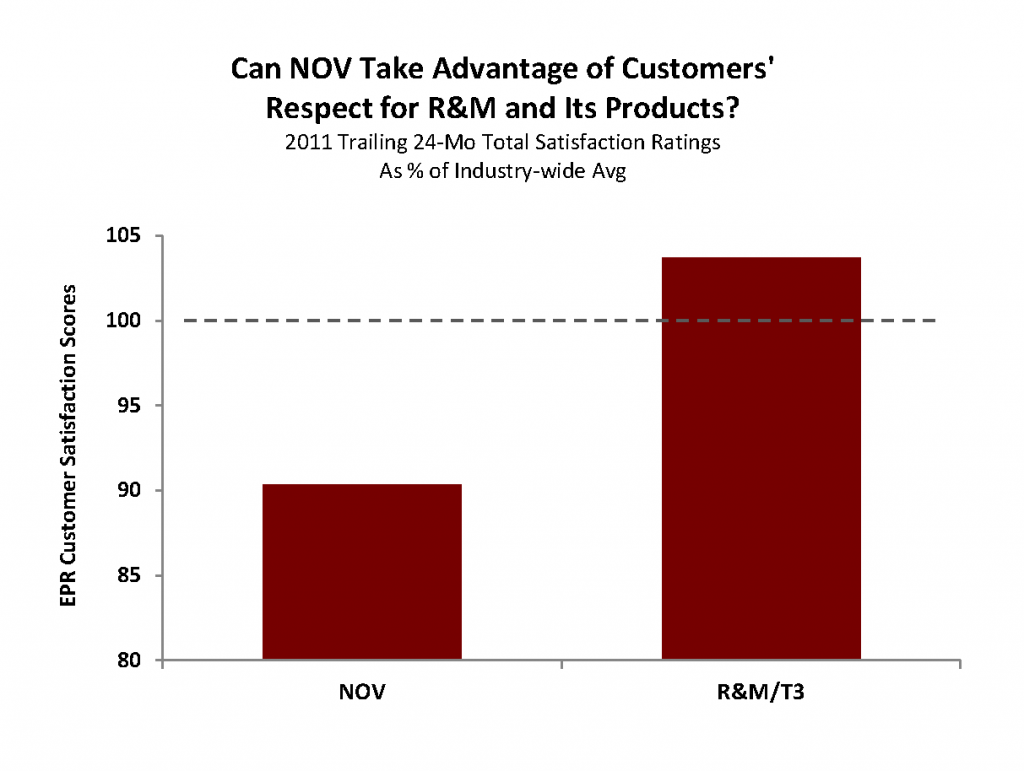

Despite Cameron International’s public-relations black eye from the role its equipment played in the Gulf of Mexico Macondo incident, the company’s BOPs continue to be the ratings leader in EnergyPoint’s customer satisfaction surveys. Its ratings certainly outpace NOV’s in the category. With scores that are much more competitive, R&M could provide NOV a boost in both customer perception and market share in the segment.

To the extent NOV’s management can bring itself to do so, it might even be smart to allow R&M’s management team to call the shots across its entire pressure control unit. If so, we could look back on the acquisition as a marking point in NOV’s emergence as a more substantive challenger to king-of-the-hill Cameron.

Interested in EnergyPoint presenting to your organization?

Click here to find out more.

We note that the R&M deal beefs up NOV’s BOP offerings and capabilities at a time when Cameron International is taking aim at NOV’s stranglehold on the integrated equipment market. Cameron recently completed acquisitions of Rowan’s LeTourneau Technologies and the energy unit of TTS Group, greatly expanding its rig and rig-related equipment offerings.

Regarding R&M’s other product lines, we suspect most will be impassively merged into NOV’s existing units. The primary intent will be to capture production and cost efficiencies. Pushing product through NOV’s vast distribution network, which now (unbelievably) includes both Wilson Supply and CE Franklin as a result of recent acquisitions, will be a key objective.

In short, the deal does seem to make strategic sense. The real question is whether customers a year from now will view it as a lasting upgrade to NOV’s product line and organization. If not, it’s just another market-share grab that offers little in the way of true romance.