Conceptualizing, fabricating and installing the labyrinth of integrated systems and equipment required for today’s massive subsea projects are some of the most complex tasks in the oil and gas industry. Without question, the daunting challenges at these depths contribute to the historically low customer satisfaction ratings for subsea products we have observed in our surveys over the years.

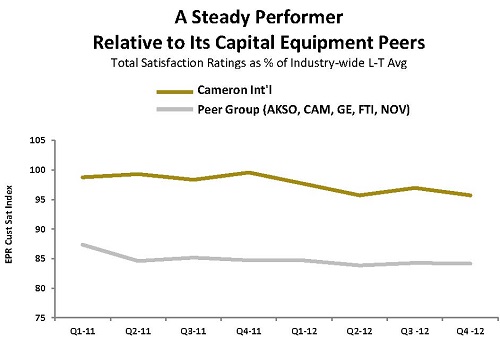

Although not the market-share leader in the space, Cameron International has recently been dynamic in its efforts related to increasing the profile of its subsea offerings, most notably advancing the depth and breadth of its capabilities via its OneSubsea joint venture with Schlumberger.

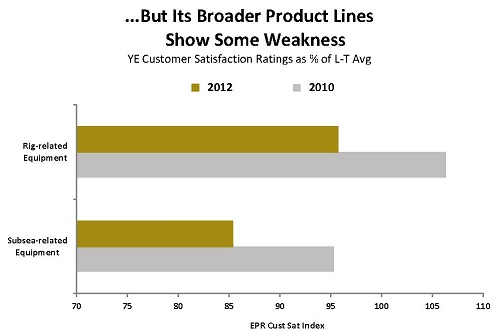

Listening to Cameron executives, they describe an ambitious organization growing both in its traditional areas of strength as well as at the fringes. A portion of growth has come through an initiative to sell a broader variety of its products to existing customers.

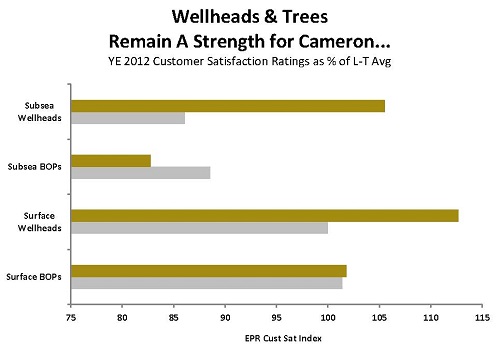

But, as we have discussed before, this approach is no panacea, as our studies show that suppliers run the risk of disappointing their customers when they try to do too much. Cameron is no exception, with its customer ratings falling along established lines by product segment.

The recent announcement by National Oilwell Varco to spin off its distribution business into a separate entity suggests at least one Cameron competitor might be coming to see less as more.

Cameron management also point to its record $10.5 billion backlog as an indicator of a sustainable expansion. Yet again, while customary backlogs can add to a company’s health to a point, they can also hinder the customer experience if clients too often find themselves too far back in the queue.

We also note that Cameron’s statements on its offshore capabilities increasingly center on OneSubsea. This is understandable as the roundly applauded joint venture affords the company the aggressive technology development and marketing muscle of Schlumberger.

When the JV was announced late last year, we projected the move meant a tighter focus on the part of all parties involved. Even with the recently captured $540 project for Chevron in the North Sea and other deals in the pipeline, it’s too early to tell how customers will size up the partnership.

Cameron CEO Jack Moore says despite its capabilities, the OneSubsea must pursue projects with “commercial discipline” and “focused execution.” He also maintains that subsea equipment and systems is a premium segment, and that pricing should reflect accordingly.

On the surface, customers in our surveys have historically taken little pleasure in either Cameron’s or Schlumberger’s pricing and terms. We suspect the same will hold for OneSubsea. That said, deeper analysis indicates pricing is not a major determining factor in customers’ eventual satisfaction. Rather, overall satisfaction tends to color feelings about pricing.

In short, Cameron right now is a tale of success and growth in its traditional offerings, with commensurate exposure in less familiar, but promising, areas. The company has never been one to garner market share through discounting. Nevertheless, the company’s subsea revenues are on the rise, no doubt in part due to its strong ratings and reputation for subsea wellheads and trees. One must assume Cameron’s primary competitors in the space — namely, Aker Solutions, FMC Technologies, GE Oil & Gas and NOV — are taking note.

According to Moore, the OneSubsea’s accomplishments so far show only a glimpse of its eventual promise. In the end, as a leader in blow-out prevention systems and land-based wellheads, with an intriguing set of drilling-rig and -system offerings in a time of relatively high demand, we sense Cameron may have earned valuable some wiggle room when it comes to pricing across its entire product line.