We frequently receive questions about the effect of mergers and acquisitions on customer satisfaction. It’s an important issue—one that deserves a thoughtful response.

With apologies to those who earn their livings buying and selling businesses, or helping others do so, there’s a wealth of evidence to suggest that, on average, M&A destroys rather than creates value.

Mismatches in culture are a big reason. As management guru Peter Drucker famously noted, “Culture eats strategy for breakfast.”

Dutch management consultant Martin Roll concurs, pointing out that humans aren’t as straightforward as flow charts. People have emotions, habits, expectations, needs and opinions. If the cultures of two organizations aren’t good fits, an effort to combine them likely won’t work.

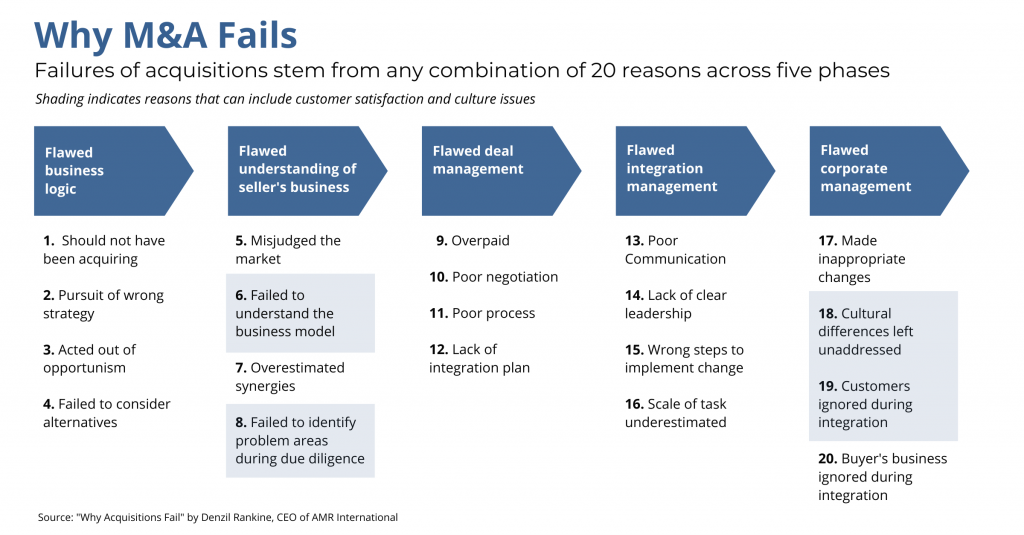

One particularly in-depth study of the effects of M&A was published by Denzil Rankine, executive chairman of consulting firm AMR International. In his book, Why Acquisitions Fail, Rankine identifies 20 reasons why acquisitions fall short of expectations.

Rankine’s research is instructive and well-supported. Among his direct findings is that ignoring customers during mergers is common. At least three other reasons on his list encompass aspects of customer satisfaction and culture as well.

Rankine is correct—nothing good comes from taking customers for granted. But it nonetheless happens.

Corporate ego is a big reason. Buyers typically do not view Sellers as being as well managed as themselves. That’s just a fact. Nor do they typically believe Sellers have better products or services, more talented employees, or better customer relationships.

Even when Buyers do acknowledge a Seller’s strengths, they rarely appreciate the factors that underpin them. And almost by definition, they believe they can do as much, or more, with a Seller’s assets—even as they plan to cut costs and headcount.

This often leads to Buyers paying significant premiums for companies; the greater the premium, the greater the expectation the Buyer will call the shots. After all, to the victor go the spoils.

With this overconfidence as a backdrop, when the integration phase of a merger begins, customers are often assured their needs are front and center, and that good things are in store.

Inured by past experience, however, many customers are skeptical of the promises. When performance falls short of expectations—or no unifying culture emerges, as is often the case—the skepticism turns to dissatisfaction.

At this point, some customers take their business elsewhere. In response, since deal projections rarely planned for customer attrition, Buyers may double down on cost cuts to hit their short-term financial targets. If quality and service deteriorate further, the downward spiral continues as competitors swoop in.

There are a host of reasons companies pursue mergers. They range from underperforming companies or CEOs seeking a change in luck, to the elimination of nettlesome rivals or overcapacity, to copycat mergers pushed by fee-hungry investment bankers.

Some deals are premised on cost synergies, others on revenue synergies. Still others hope to improve financial strength.

Whatever the reason, when two cultures come together, change is required—certainly at a Seller, but often at the Buyer as well. Caught in the middle are customers, who never asked for the change but must nonetheless adjust to new procedures, policies and people. Rarely do they feel like winners.

Part 2 of this series looks at the different types of M&A transactions and how they affect stakeholders, including customers.

This article was originally published on October 16, 2013. It was revised and republished on September 30, 2020.

Very interesting article!

Hi Kate –

So glad you found it of interest.

Doug