Within the upstream oil and gas industry, there’s a limited number of oilfield suppliers possessing the size and scope to be considered fully integrated and/or global in nature. On the services side, the roll (listed alphabetically) includes Baker Hughes, Halliburton, Schlumberger and Weatherford International. For capital equipment, it’s Aker Solutions, Cameron International, FMC Technologies, GE Oil & Gas and National Oilwell Varco.

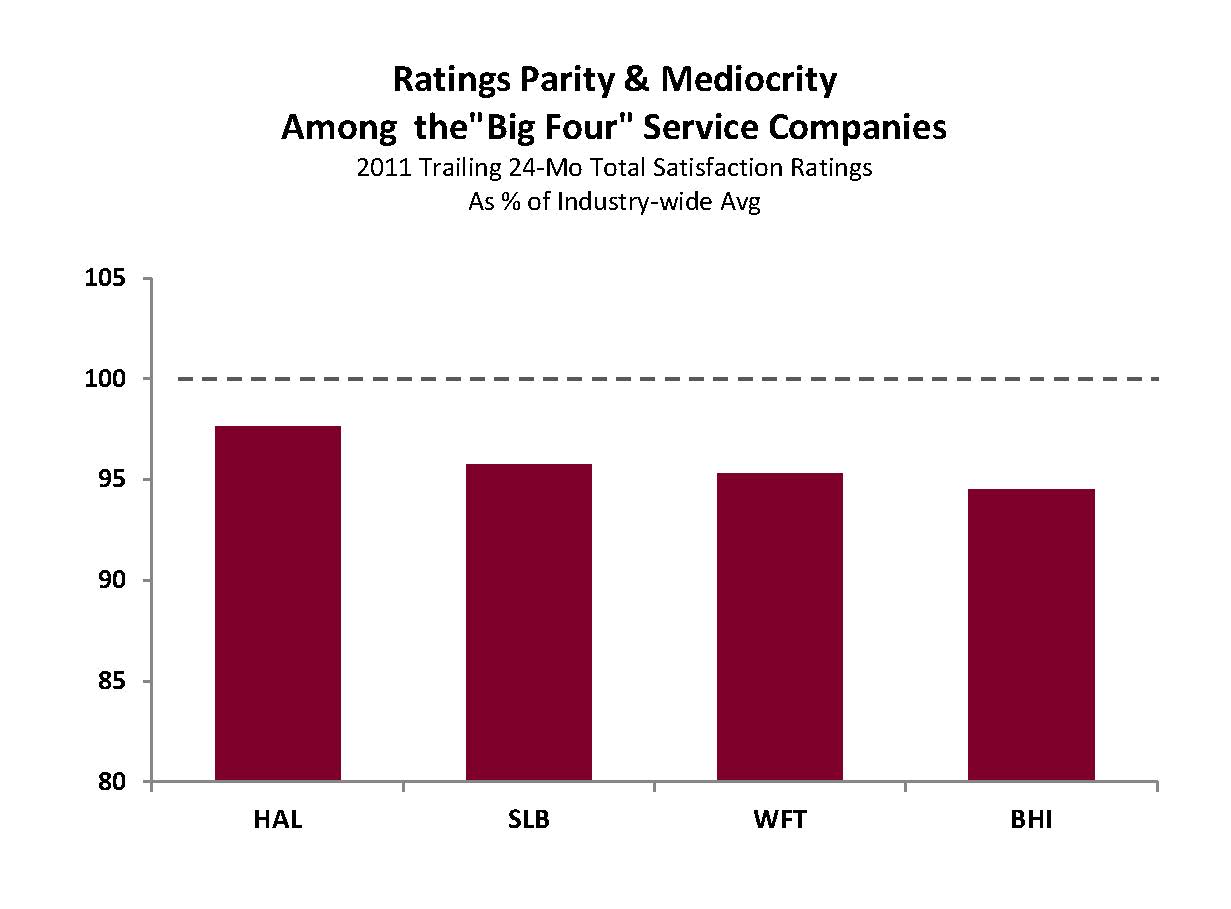

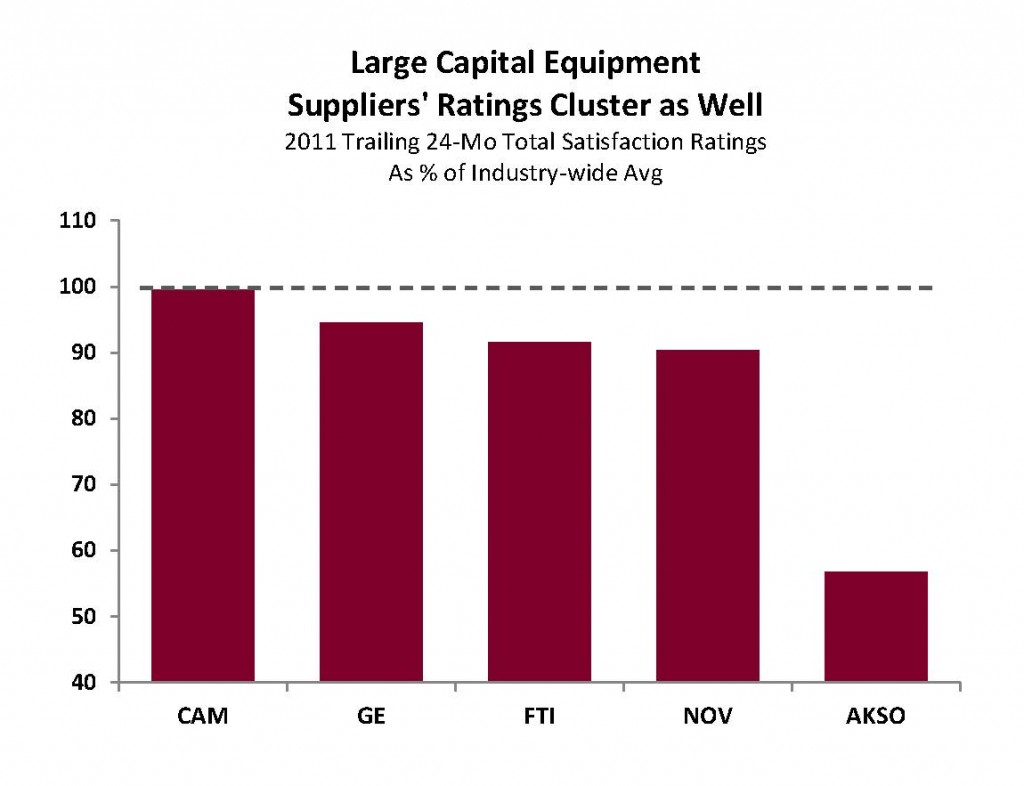

On a combined basis, these nine super suppliers (did we just coin a new term?) currently represent about a quarter of all supplier-segment sales to the global upstream. Yet, none of these companies currently enjoy above-average ratings in EnergyPoint Research’s independent customer satisfaction surveys. And the latest trends don’t suggest the situation will significantly change anytime soon.

Investors seem to sense something’s amiss as well. The eight pure-play oilfield supplier names (GE, as a cross-industry conglomerate, is excluded) have seen their stock prices rise just 29.4% in the 24 months ending June 30, 2012. This compares to a rise of 63.3% for the Philadelphia Oil Services Sector Index (OSX) over the same period.

Investors seem to sense something’s amiss as well. The eight pure-play oilfield supplier names (GE, as a cross-industry conglomerate, is excluded) have seen their stock prices rise just 29.4% in the 24 months ending June 30, 2012. This compares to a rise of 63.3% for the Philadelphia Oil Services Sector Index (OSX) over the same period.

The strategies, offerings and capabilities of these large suppliers are now so strikingly similar that their customer satisfaction ratings have effectively converged. This has made it even more of a challenge for customers to see much in the way of differentiation. Oilfield suppliers’ efforts to fit in have, in effect, made it substantially more difficult, maybe even impossible, for them to stand out. The result is that their customers are now able to more effectively push price as the final differentiator.

Interested in EnergyPoint presenting to your organization?

Click here to find out more.

Unfortunately, what both oilfield customers and suppliers appear to have missed in their march toward greater uniformity is the possibility that customers, in the end, might actually end up less satisfied with the products and services they receive from “do-it-all, be-everywhere” suppliers.

It shouldn’t come as a surprise that things have turned out this way. One need look no further than the problems the financial services industry heaped upon itself years ago when it decided bigger was better. The ability of large institutions to offer customers everything under the sun would spur innovation, competition and efficiency it was argued. It was, as they say, “the perfect dangle.” But in the end, the strategy backfired as individual banks ventured too far from their core competencies.

It shouldn’t come as a surprise that things have turned out this way. One need look no further than the problems the financial services industry heaped upon itself years ago when it decided bigger was better. The ability of large institutions to offer customers everything under the sun would spur innovation, competition and efficiency it was argued. It was, as they say, “the perfect dangle.” But in the end, the strategy backfired as individual banks ventured too far from their core competencies.

Lower customer satisfaction ratings for the largest suppliers do not necessarily reflect issues too deep to resolve. Rather, it’s the clustering of their customer ratings at such consistently mediocre levels that we see as the salient concern. Whether it be from a lack of differentiation stemming from a persistent group-think mentality, difficulties in running increasingly diverse and far-flung operations, or the inevitable “averaging down” of customer experiences as a result of bundling efforts, the deck seems stacked against today’s growth-through-diversification model for oilfield suppliers.

The first step in achieving better performance among the oil and gas industry’s largest suppliers may very well be in these companies, and their customers, recognizing that an organization’s real strengths lie not in its similarities with its competitors, but in its differences. That said, until a renewed focus emphasizing individual suppliers’ core competencies emerges within the oil and gas industry’s most influential circles, the customer satisfaction and performance levels of the largest oilfield suppliers will likely continue to languish.