Late last week, Gardner Denver acknowledged it has engaged investment bankers at Goldman Sachs to help evaluate potential strategic alternatives, including sale of the company.

The company’s stock price jumped with the news. However, there’s reason to believe an eventual sale of Gardner Denver could be done at a price materially above current stock-price levels, especially since its shares seem to have been trading at a discount prior to the run-up.

We believe there will be considerable interest in Gardner Denver from strategic buyers, both from within and outside of the oil and gas sector. Private equity players should be in the mix as well.

Within the oilfield sector, we see potential suitors for all or portions of Garner Denver’s operations as including Cameron International, FMC Technologies, National Oilwell Varco, Weatherford International and possibly Aker Solutions.

Interested in us presenting to your organization?

Click here to find out more.

General Electric would seem a logical interested party given Gardner Denver’s mix of oil-and-gas and industrial-oriented products, as would Ingersoll-Rand and United Technologies. Should either of the latter two acquire the company, we’d expect the oil and gas product lines to be sold at attractive valuations, either directly or in secondary transaction(s), to one or more oilfield suppliers.

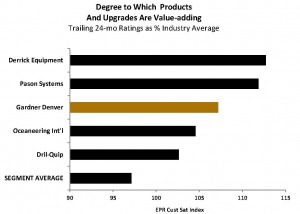

To be sure, Gardner Denver continues to rate very well with oil and gas customers in EnergyPoint’s independent surveys. Although the oil and gas segment only generates about a quarter of Gardner Denver’s revenues, it’s mud pumps and pressure-pumping equipment are some of the most recognized and well-regarded brands in the oilfield, a status not easily achieved in fickle oil and gas circles. The company’s products are particularly well regarded for their “value add”, an important consideration for purchasers (see chart below).

In summary, we see multiple companies potentially coveting Gardner Denver, or its petroleum assets, as an effective way to create or strengthen a position in the high-profile drilling and completions segment of the oil and gas sector. Accordingly, we would not be surprised to see Gardner Denver’s stock price bid up beyond current levels.